What the Options Market Tells Us About Marathon Petroleum

What the Options Market Tells Us About Marathon Petroleum

Deep-pocketed investors have adopted a bearish approach towards Marathon Petroleum (NYSE:MPC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MPC usually suggests something big is about to happen.

对马拉松原油(NYSE:MPC)而言,深掌握资金的投资者们采取了看淡的态度,这是市场参与者不应忽视的事情。我们在Benzinga追踪的公共期权记录中揭示了今天的这一重大举动。这些投资者的身份仍然未知,但是在MPC方面发生如此大规模的举动通常意味着一些重大事件即将发生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Marathon Petroleum. This level of activity is out of the ordinary.

我们从今天Benzinga的期权扫描仪中观察到了这些信息,突出显示了马拉松原油的11个非同寻常的期权交易活动。这种活动水平是不寻常的。

The general mood among these heavyweight investors is divided, with 36% leaning bullish and 54% bearish. Among these notable options, 9 are puts, totaling $484,470, and 2 are calls, amounting to $91,160.

这些重量级投资者中的整体情绪存在分歧,有36%倾向看好,54%看淡。在这些显著的期权中,有9个看跌期权,总额为484,470美元,还有2个看涨期权,总额为91,160美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $155.0 for Marathon Petroleum over the recent three months.

根据交易活动来看,这些重要投资者在过去三个月中对马拉松原油的目标价格区间为155.0美元到155.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

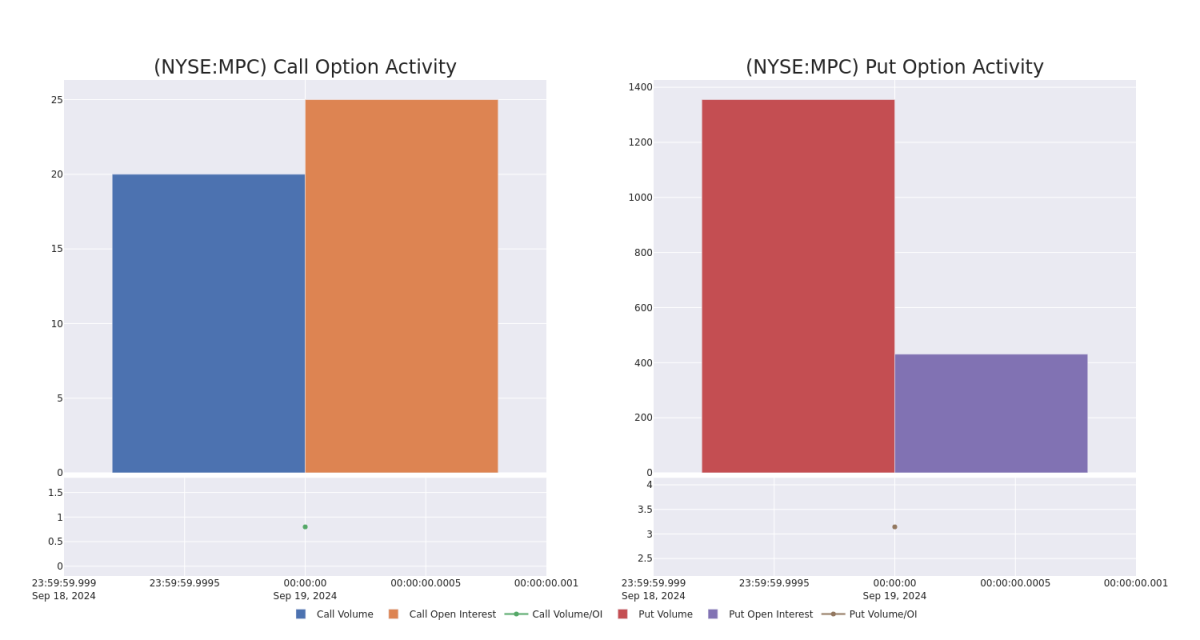

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marathon Petroleum's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marathon Petroleum's substantial trades, within a strike price spectrum from $155.0 to $155.0 over the preceding 30 days.

评估成交量和持仓量是期权交易的战略步骤。这些指标揭示了在指定行权价区间内马拉松原油期权的流动性和投资者的兴趣。即将发布的数据可视化了过去30天内马拉松原油重要交易的成交量和持仓量的波动,涵盖了从155.0美元到155.0美元的行权价范围。

Marathon Petroleum Option Volume And Open Interest Over Last 30 Days

马拉松石油近30天期权交易成交量和持仓量

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $21.6 | $20.85 | $21.6 | $155.00 | $105.8K | 431 | 200 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $22.25 | $20.8 | $21.8 | $155.00 | $95.9K | 431 | 144 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $21.9 | $20.6 | $21.9 | $155.00 | $61.3K | 431 | 48 |

| MPC | PUT | TRADE | BEARISH | 12/18/26 | $22.4 | $20.6 | $21.9 | $155.00 | $52.5K | 431 | 72 |

| MPC | CALL | TRADE | BULLISH | 06/20/25 | $24.8 | $24.25 | $24.8 | $155.00 | $49.6K | 4 | 20 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 马拉松原油 | 看跌 | 交易 | 看淡 | 12/18/26 | $21.6 | $20.85 | $21.6 | $155.00 | 105.8千美元 | 431 | 200 |

| 马拉松原油 | 看跌 | 交易 | 看淡 | 12/18/26 | $22.25 | $20.8 | $21.8美元 | $155.00 | $95.9K | 431 | 144 |

| 马拉松原油 | 看跌 | 交易 | 看淡 | 12/18/26 | $21.9 | 20.6美元 | $21.9 | $155.00 | $61.3K | 431 | 48 |

| 马拉松原油 | 看跌 | 交易 | 看淡 | 12/18/26 | $22.4 | 20.6美元 | $21.9 | $155.00 | $52.5K | 431 | 72 |

| 马拉松原油 | 看涨 | 交易 | 看好 | 06/20/25 | $24.8 | $24.25 | $24.8 | $155.00 | 49.6K美元 | 4 | 20 |

About Marathon Petroleum

关于马拉松原油

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

马拉松原油是一家独立的炼油商,在美国中西部、西海岸和墨西哥湾拥有13座炼油厂,总吞吐能力达到300万桶/日。它位于北达科他州迪金森的工厂年产1.84亿加仑可再生柴油。它位于加利福尼亚州马丁尼兹的工厂一旦改造完成,将有能力每年生产7.3亿加仑可再生柴油。该公司还主要通过其上市的主管限制合伙企业MPLX拥有和经营中游资产。

Where Is Marathon Petroleum Standing Right Now?

马拉松原油目前处于何种位置?

- With a trading volume of 2,110,663, the price of MPC is up by 1.02%, reaching $166.35.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 47 days from now.

- 成交量为2,110,663,MPC的价格上涨了1.02%,达到166.35美元。

- 目前的RSI值表明该股票目前处于超买和超卖之间的中立状态。

- 下一季度财报将在47天后公布。

What The Experts Say On Marathon Petroleum

有关马拉松原油的专家观点

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $187.5.

在过去一个月中,有2位行业分析师分享了他们对该股票的见解,建议设定一个平均目标价为187.5美元。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Marathon Petroleum, targeting a price of $182. * Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Marathon Petroleum, targeting a price of $193.

Benzinga Edge的期权异动板块能在市场大动之前发现潜在的市场推动者。查看大资金在您最喜欢的股票上的持仓。点击这里进行访问。* 保持立场,摩根士丹利的一位分析师继续持有马拉松原油的超配评级,并设定目标价为182美元。* 保持立场,瑞穗的一位分析师继续持有马拉松原油的中立评级,并设定目标价为193美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $155.0 for Marathon Petroleum over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $155.0 for Marathon Petroleum over the recent three months.