Here's Why It's Unlikely That Asia Cassava Resources Holdings Limited's (HKG:841) CEO Will See A Pay Rise This Year

Here's Why It's Unlikely That Asia Cassava Resources Holdings Limited's (HKG:841) CEO Will See A Pay Rise This Year

Key Insights

主要见解

- Asia Cassava Resources Holdings will host its Annual General Meeting on 30th of September

- Total pay for CEO Ming Chuan Chu includes HK$1.50m salary

- The total compensation is similar to the average for the industry

- Asia Cassava Resources Holdings' EPS declined by 89% over the past three years while total shareholder loss over the past three years was 69%

- 亚洲木薯资源控股将于9月30日举行年度股东大会

- 董事总经理Ming Chuan Chu的总薪酬包括150万港元的薪水

- 总的薪酬与行业平均水平相似。

- 亚洲木薯资源控股的每股收益在过去三年下降了89%,而过去三年股东的总损失为69%

The results at Asia Cassava Resources Holdings Limited (HKG:841) have been quite disappointing recently and CEO Ming Chuan Chu bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 30th of September. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

亚洲木薯资源控股有限公司(HKG:841)最近的业绩表现令人失望,CEO朱明川对此负有一定责任。股东们可以趁着下次于9月30日举行的股东大会来对董事会和管理层负责任的不佳表现提出质疑。这也是股东通过对公司决议的投票来影响管理层,比如执行薪酬等,可能会对公司产生重要影响的机会。我们提出了为何认为CEO薪酬与公司业绩脱节的情况。

How Does Total Compensation For Ming Chuan Chu Compare With Other Companies In The Industry?

明川朱的总薪酬与行业其他公司相比如何?

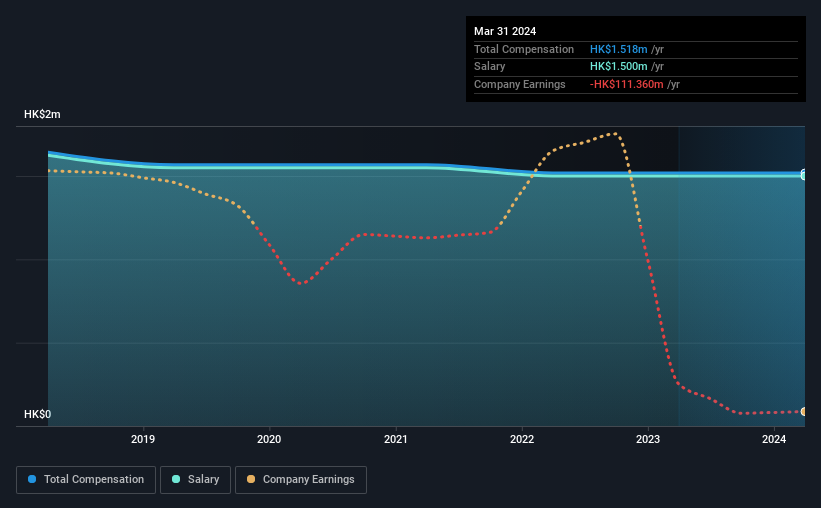

According to our data, Asia Cassava Resources Holdings Limited has a market capitalization of HK$50m, and paid its CEO total annual compensation worth HK$1.5m over the year to March 2024. This was the same as last year. Notably, the salary which is HK$1.50m, represents most of the total compensation being paid.

根据我们的数据,亚洲木薯资源控股有限公司的市值为5000万港元,截至2024年3月,该公司的CEO总年薪达到150万港元。这与去年相同。值得注意的是,150万港元的薪水占到了总薪酬的大部分。

In comparison with other companies in the Hong Kong Food industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.9m. From this we gather that Ming Chuan Chu is paid around the median for CEOs in the industry. Furthermore, Ming Chuan Chu directly owns HK$31m worth of shares in the company, implying that they are deeply invested in the company's success.

与香港食品行业市值低于16亿港元的其他公司相比,报道的中位数CEO总薪酬为190万港元。从中我们了解到明川朱的薪酬水平大致处于行业CEO中位数水平。此外,明川朱直接持有公司价值3100万港元的股份,这意味着他们对公司的成功投入了极大的利益。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$1.5m | HK$1.5m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$1.5m | HK$1.5m | 100% |

| 组成部分 | 2024 | 2023 | 比例(2024年) |

| 薪资 | 150万港元 | 150万港元 | 99% |

| 其他 | HK$18k | HK$18k | 1% |

| 总补偿 | 150万港元 | 150万港元 | 100% |

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. Asia Cassava Resources Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

从行业方面来看,薪水在我们分析的所有公司中约占总报酬的73%,而其他报酬则占27%。 亚洲木薯资源控股支付高薪水,更加关注报酬的这一方面,与非薪水支付相比更加集中。 如果薪水占据主导地位,则表明CEO的薪酬倾向于较少依赖于通常与绩效挂钩的变量组成部分。

A Look at Asia Cassava Resources Holdings Limited's Growth Numbers

查看亚洲木薯资源控股有限公司的增长数据

Over the last three years, Asia Cassava Resources Holdings Limited has shrunk its earnings per share by 89% per year. In the last year, its revenue is down 70%.

在过去三年里,亚洲木薯资源控股有限公司的每股收益年均下降了89%。在过去一年中,其营业收入下降了70%。

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

很少股东会高兴地发现每股收益下降。而且,当考虑到营业收入同比下降时,情况更糟。很难说公司处处表现出色,因此股东可能不愿意看到高额CEO薪酬。虽然我们没有该公司的分析师预测,股东可能想要查看这份涵盖了收益、营业收入和现金流量的详细历史数据图。

Has Asia Cassava Resources Holdings Limited Been A Good Investment?

亚洲木薯资源控股有限公司是一个好的投资吗?

Few Asia Cassava Resources Holdings Limited shareholders would feel satisfied with the return of -69% over three years. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

在过去三年里,很少亚洲木薯资源控股有限公司的股东会对-69%的回报感到满意。因此,如果CEO薪酬较高,可能会令股东感到沮丧。

In Summary...

总之……

Asia Cassava Resources Holdings pays its CEO a majority of compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

亚洲木薯资源控股通过薪水向其首席执行官支付大部分补偿。与业务表现不佳相结合,股东在投资上遭受股价回报差,表明他们几乎没有机会支持首席执行官加薪。在即将到来的股东大会上,董事会将有机会解释他们计划采取的措施以提高业务绩效。

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 3 which shouldn't be ignored) in Asia Cassava Resources Holdings we think you should know about.

首席执行官的薪酬仅是在审查业务绩效时需要考虑的许多因素之一。我们进行了研究,并在亚洲木薯资源控股中确定了4个警示信号(以及3个不容忽视的),我们认为您应该了解。

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

当然,你可能会通过观察其他股票的不同涨跌幅来找到一笔不错的投资。所以,可以看一下这个有趣的公司的免费列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. Asia Cassava Resources Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Talking in terms of the industry, salary represented approximately 73% of total compensation out of all the companies we analyzed, while other remuneration made up 27% of the pie. Asia Cassava Resources Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.