Gold Reaches New Record As Investors Eye Further Rate Cuts

Gold Reaches New Record As Investors Eye Further Rate Cuts

By RoboForex Analytical Department

作者:RoboForex 分析部门

Gold prices soared to a new all-time high, with the troy ounce surpassing 2614 USD. This surge is primarily driven by expectations of additional interest rate cuts and ongoing geopolitical tensions, which enhance gold's appeal as a safe-haven asset.

黄金价格飙升至历史新高,金衡盎司超过2614美元。这种飙升主要是由对进一步降息的预期和持续的地缘政治紧张局势推动的,这增强了黄金作为避险资产的吸引力。

Following the US Federal Reserve's decision last week to reduce its interest rate by 50 basis points – the first such cut in four years – the market expects an equivalent reduction by the year's end. This week, attention is focused on upcoming US macroeconomic releases, including the Core PCE report and personal income and expenditures data. These indicators will provide insights into the potential direction of future Fed rate adjustments.

继美联储上周决定将利率下调50个基点——这是四年来的首次降息——之后,市场预计到年底将降息同等水平。本周,注意力集中在即将发布的美国宏观经济数据上,包括核心个人消费支出报告和个人收支数据。这些指标将为未来美联储利率调整的潜在方向提供见解。

Gold becomes increasingly attractive as an investment during periods of lower lending costs, which typically lead to reduced yields on government bonds and a lower Dollar Index (DXY). Unlike other assets, gold does not generate coupon income, making it more appealing when other yields decline.

在贷款成本较低的时期,黄金作为一种投资变得越来越有吸引力,这通常会导致政府债券收益率下降和美元指数(DXY)下降。与其他资产不同,黄金不产生票面收入,因此在其他收益率下降时更具吸引力。

Additionally, the escalation of hostilities between Israel and Gaza has further boosted demand for gold. In times of heightened global uncertainty and conflict, gold traditionally performs well as a defensive investment.

此外,以色列和加沙之间敌对行动的升级进一步提振了对黄金的需求。在全球不确定性和冲突加剧的时期,黄金作为防御性投资的表现传统上表现良好。

Despite some strengthening of the US dollar, this has not significantly impacted the upward trajectory of gold prices.

尽管美元有所走强,但这并未对金价的上涨趋势产生重大影响。

Technical Analysis Of Gold

黄金的技术分析

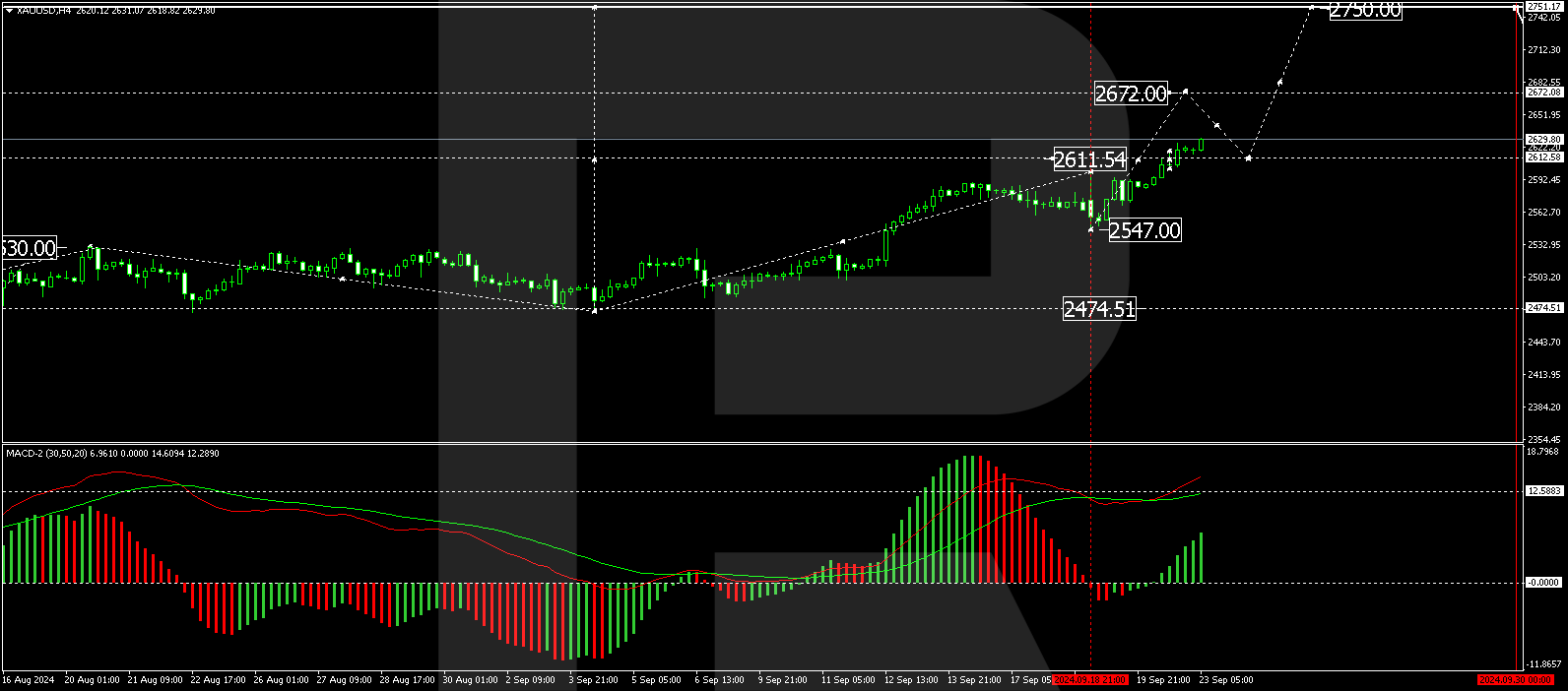

Gold has broken through the resistance at 2611.00 USD and is now targeting 2672.00 USD. Upon reaching this level, a corrective movement back to 2611.00 USD may occur, followed by another growth phase targeting 2750.00 USD. The MACD indicator supports this bullish outlook, with the signal line well above zero and ascending sharply.

黄金已经突破了2611.00美元的阻力位,目前的目标是2672.00美元。达到该水平后,可能会出现回落至2611.00美元的修正走势,随后是目标为2750.00美元的又一个增长阶段。MACD指标支持这种看涨前景,信号线远高于零并急剧上升。

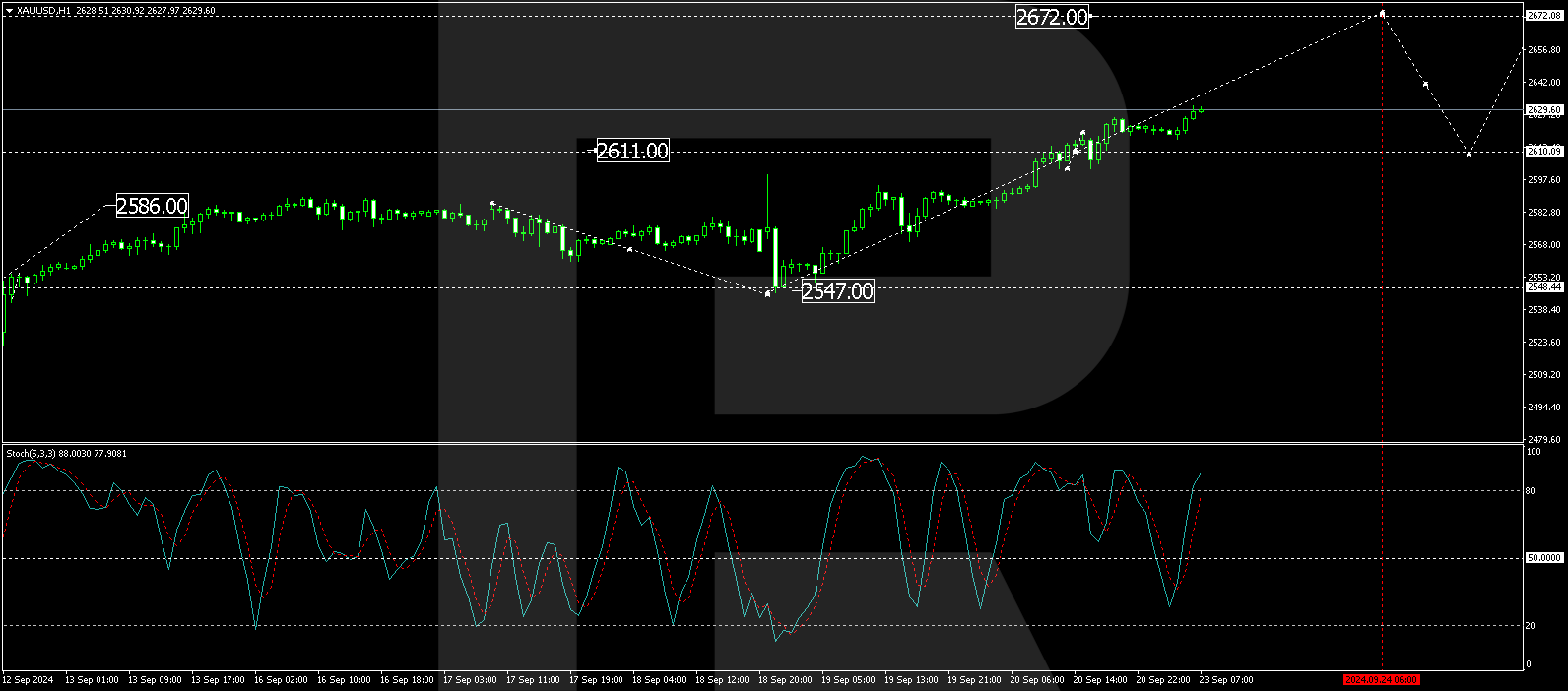

The H1 chart shows that gold has reached 2611.00 USD and is now consolidating around this level. The consolidation range is defined between 2603.00 USD and 2625.25 USD. A breakout above 2625.25 USD would likely lead to a continuation of the upward momentum towards 2672.00 USD, confirming the ongoing bullish trend. This scenario is corroborated by the Stochastic oscillator, with its signal line progressing towards 80, indicating sustained upward momentum.

H1图表显示,黄金已达到2611.00美元,目前正在该水平附近盘整。盘整区间定义在2603.00美元和2625.25美元之间。突破2625.25美元可能会使上涨势头延续至2672.00美元,从而证实持续的看涨趋势。随机振荡器证实了这种情况,其信号线向80前进,表明持续的上升势头。

Disclaimer

免责声明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

此处包含的任何预测均基于作者的特定观点。此分析可能不被视为交易建议。RoboForex对基于此处包含的交易建议和评论的交易结果不承担任何责任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文来自一位未付费的外部撰稿人。它不代表 Benzinga 的举报,也未就内容或准确性进行过编辑。

Gold becomes increasingly attractive as an investment during periods of lower lending costs, which typically lead to reduced yields on government bonds and a lower Dollar Index (DXY). Unlike other assets, gold does not generate coupon income, making it more appealing when other yields decline.

Gold becomes increasingly attractive as an investment during periods of lower lending costs, which typically lead to reduced yields on government bonds and a lower Dollar Index (DXY). Unlike other assets, gold does not generate coupon income, making it more appealing when other yields decline.