CrowdStrike Holdings Options Trading: A Deep Dive Into Market Sentiment

CrowdStrike Holdings Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings (NASDAQ:CRWD) revealed 9 unusual trades.

金融巨头在CrowdStrike Holdings上做出了明显的看淡举动。我们对CrowdStrike Holdings(纳斯达克:CRWD)的期权历史进行分析,发现了9笔飞凡交易。

Delving into the details, we found 33% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $68,034, and 7 were calls, valued at $333,137.

深入细节后,我们发现33%的交易者看好,而44%表现出看淡倾向。在我们发现的所有交易中,有2笔看跌期权,价值为$68,034,有7笔看涨期权,价值为$333,137。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $240.0 to $330.0 for CrowdStrike Holdings during the past quarter.

分析这些合约的成交量和持仓量,看起来大户们在过去一个季度一直在关注CrowdStrike Holdings股价区间在$240.0至$330.0之间。

Insights into Volume & Open Interest

成交量和持仓量分析

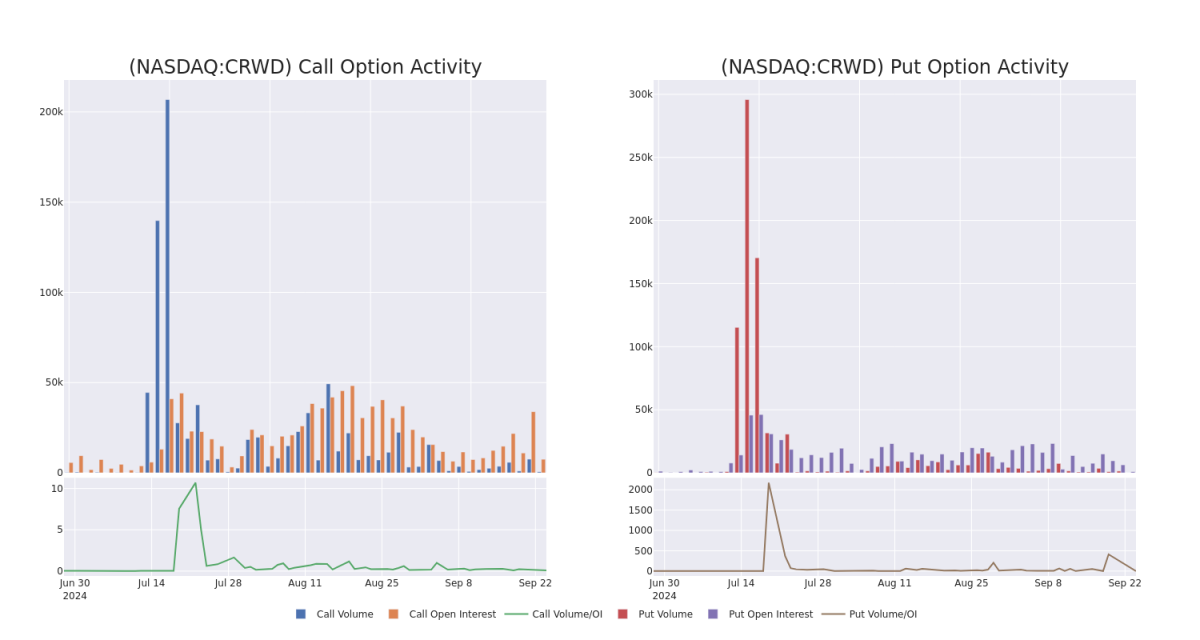

In terms of liquidity and interest, the mean open interest for CrowdStrike Holdings options trades today is 1052.12 with a total volume of 571.00.

就流动性和利益而言,今天CrowdStrike Holdings期权交易的平均持仓量为1052.12,总成交量为571.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for CrowdStrike Holdings's big money trades within a strike price range of $240.0 to $330.0 over the last 30 days.

在下图中,我们能够跟踪过去30天内CrowdStrike Holdings大额交易看涨和看跌期权的成交量和持仓量的发展,其行使价格范围为$240.0至$330.0。

CrowdStrike Holdings 30-Day Option Volume & Interest Snapshot

CrowdStrike Holdings 30天期权成交量和未平仓合约快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | SWEEP | BULLISH | 10/18/24 | $4.05 | $3.9 | $4.04 | $310.00 | $62.6K | 3.3K | 341 |

| CRWD | CALL | TRADE | BEARISH | 01/15/27 | $102.85 | $100.8 | $100.8 | $260.00 | $60.4K | 22 | 11 |

| CRWD | CALL | TRADE | BEARISH | 09/27/24 | $11.95 | $11.05 | $11.4 | $280.00 | $57.0K | 706 | 59 |

| CRWD | CALL | SWEEP | NEUTRAL | 10/11/24 | $17.05 | $13.55 | $15.62 | $285.00 | $46.5K | 134 | 31 |

| CRWD | CALL | SWEEP | BEARISH | 01/17/25 | $28.0 | $27.0 | $27.0 | $300.00 | $45.9K | 2.7K | 68 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | 看涨 | SWEEP | 看好 | 10/18/24 | $4.05 | $3.9 | $4.04 | $ 310.00 | $62.6K | 3.3K | 341 |

| CRWD | 看涨 | 交易 | 看淡 | 01/15/27 | $102.85 | $100.8 | $100.8 | $260.00 | $60.4千 | 22 | 11 |

| CRWD | 看涨 | 交易 | 看淡 | 09/27/24 | 11.95美元 | $11.05 | $11.4 | $280.00 | $57.0K | 706 | 59 |

| CRWD | 看涨 | SWEEP | 中立 | 10/11/24 | $17.05 | $13.55 | $15.62 | $285.00 | $46.5K | 134 | 31 |

| CRWD | 看涨 | SWEEP | 看淡 | 01/17/25 | $28.0 | $27.0 | $27.0 | $ 300.00 | $45.9K | 2.7K | 68 |

About CrowdStrike Holdings

关于CrowdStrike控股公司

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike是一家基于云的网络安全公司,专门提供下一代安全垂直领域,如端点、云工作负载、身份和安全运营。CrowdStrike的主要产品是其Falcon平台,为企业提供一种类似单一的视图,以便检测和响应攻击其IT基础设施的安全威胁。这家总部位于德克萨斯州的公司成立于2011年,并于2019年上市。

Current Position of CrowdStrike Holdings

CrowdStrike Holdings的当前持仓

- Currently trading with a volume of 445,062, the CRWD's price is down by -0.75%, now at $290.95.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 63 days.

- 以445,062的成交量交易,CRWD的价格下跌了-0.75%,目前为$290.95。

- RSI读数表明该股目前可能接近超买水平。

- 预计发布收益报告还有63天。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

期权交易具有更高的风险和潜在回报。精明的交易员通过持续教育自己,调整策略,监控多种因子,并密切关注市场走势来管理这些风险。通过Benzinga Pro即时提醒了解最新的CrowdStrike Holdings期权交易动态。

In terms of liquidity and interest, the mean open interest for CrowdStrike Holdings options trades today is 1052.12 with a total volume of 571.00.

In terms of liquidity and interest, the mean open interest for CrowdStrike Holdings options trades today is 1052.12 with a total volume of 571.00.