Micron Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Micron Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Micron Technology, Inc. (NASDAQ:MU) will release earnings results for its fourth quarter, after the closing bell on Wednesday, Sept. 25.

纳斯达克股票MU公司将于9月25日星期三收盘后发布第四季度盈利结果。

Analysts expect the Boise, Idaho-based company to report quarterly earnings at $1.13 per share, versus a year-ago loss of $1.07 per share. Micron is projected to post quarterly revenue of $7.64 billion, up from $4.01 billion a year earlier, according to data from Benzinga Pro.

分析师预计总部位于爱达荷州博伊西的该公司将以每股1.13美元的季度盈利报告,而去年同期每股亏损1.07美元。根据彭博专业版的数据,预计Micron将发布76.4亿美元的季度营业收入,高于去年的40.1亿美元。

On Sept. 17, Micron announced the availability of the Crucial P310 2280 Gen4 NVMe solid-state drive (SSD) which expands Micron's P310 portfolio to address PCs, laptops and PlayStation 5. The company said a version with a heatsink will be released in the coming months, suited for use with PlayStation 5 and desktop gaming PCs.

9月17日,Micron宣布推出Crucial P310 2280 Gen4 NVMe固态硬盘(SSD),将Micron的P310系列扩展到PC、笔记本电脑和PlayStation 5。该公司表示,将在未来几个月推出带散热器的版本,适用于PlayStation 5和台式电脑。

Micron shares gained 2.9% to close at $93.57 on Monday.

Micron股价周一上涨2.9%,收于93.57美元。

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Benzinga的读者可以在分析师股票评级页面上获取最新的分析师评级。读者可以按股票代号、公司名称、分析师公司、评级变化或其他变量排序。

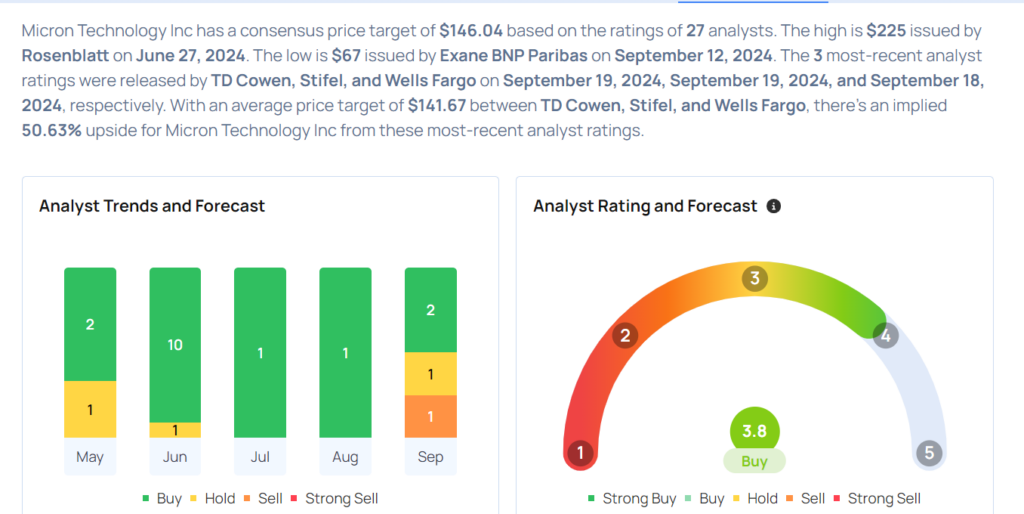

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

让我们来看看Benzinga最准确的分析师是如何评价公司的。

- Stifel analyst Brian Chin maintained a Buy rating and cut the price target from $165 to $135 on Sept. 19. This analyst has an accuracy rate of 70%.

- Wells Fargo analyst Aaron Rakers maintained an Overweight rating and cut the price target from $190 to $175 on Sept. 18. This analyst has an accuracy rate of 85%.

- UBS analyst Timothy Arcuri maintained a Buy rating and slashed the price target from $153 to $135 on Sept. 17. This analyst has an accuracy rate of 78%.

- Citigroup analyst Christopher Danely maintained a Buy rating and cut the price target from $175 to $150 on Sept. 17. This analyst has an accuracy rate of 79%.

- Morgan Stanley analyst Joseph Moore maintained an Equal-Weight rating and decreased the price target from $140 to $100 on Sept. 16. This analyst has an accuracy rate of 71%.

- Stifel分析师Brian Chin维持买入评级,将价格目标从165万亿美元下调至135美元,时间为9月19日。该分析师的准确率为70%。

- 富国银行分析师Aaron Rakers维持增持评级,将价格目标从190万亿美元下调至175美元,时间为9月18日。该分析师的准确率为85%。

- UBS分析师Timothy Arcuri维持买入评级,将价格目标从$153亿降至$135亿,9月17日。该分析师的准确率为78%。

- 花旗集团分析师Christopher Danely维持买入评级,将价格目标从$175亿降至$150亿,9月17日。该分析师的准确率为79%。

- 摩根士丹利分析师Joseph Moore维持等权评级,将价格目标从$140亿降至$100亿,9月16日。该分析师的准确率为71%。

Considering buying MU stock? Here's what analysts think:

考虑买入MU股票?以下是分析师的看法:

Read This Next:

阅读以下内容:

- Top 3 Financials Stocks That May Plunge In September

- 可能在九月份暴跌的前三家金融股

Micron shares gained 2.9% to close at $93.57 on Monday.

Micron shares gained 2.9% to close at $93.57 on Monday.