Here's Why Inter Parfums (NASDAQ:IPAR) Can Manage Its Debt Responsibly

Here's Why Inter Parfums (NASDAQ:IPAR) Can Manage Its Debt Responsibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Inter Parfums, Inc. (NASDAQ:IPAR) does carry debt. But is this debt a concern to shareholders?

霍华德·马克斯很好地表达了这一点,他说,与其担心股价波动,'我担心的是永久性损失的可能性……我所知道的每位实践投资者都担心这一点。' 当您审查公司的风险时,考虑到债务往往涉及业务崩溃时,考虑一家公司的资产负债表是很自然的。重要的是,依特香水股份有限公司(纳斯达克: IPAR)确实存在债务。但这笔债务是否会让股东担忧?

When Is Debt A Problem?

什么时候负债才是一个问题?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

一般而言,只有当公司无法轻松偿还债务时,债务才会成为真正的问题,或者说,无法通过发行股票或利用自己的现金流偿还债务。如果情况变得非常糟糕,那么债权人可以接管业务。但更常见(但同样昂贵)的情况是,公司必须以低廉的股票价格稀释股东以控制债务。当然,债务可以是企业中重要的工具,尤其是在资本密集型企业中。考虑公司的债务水平时的第一步是将其现金和债务一起考虑。

What Is Inter Parfums's Debt?

依特香水的债务状况是什么?

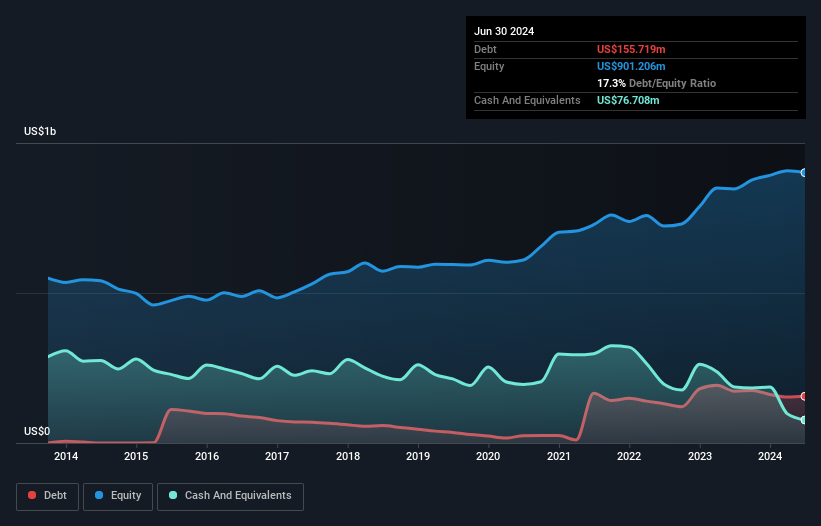

The image below, which you can click on for greater detail, shows that Inter Parfums had debt of US$155.7m at the end of June 2024, a reduction from US$172.6m over a year. On the flip side, it has US$76.7m in cash leading to net debt of about US$79.0m.

下面的图片显示,您可以点击查看更详细的信息,显示依特香水在2024年6月底的债务为15570万美元,比一年前的17260万美元有所减少。 相反,它有7670万美元的现金,导致净负债约为7900万美元。

How Healthy Is Inter Parfums' Balance Sheet?

依特香水的资产负债表有多健康?

We can see from the most recent balance sheet that Inter Parfums had liabilities of US$332.4m falling due within a year, and liabilities of US$130.4m due beyond that. On the other hand, it had cash of US$76.7m and US$323.3m worth of receivables due within a year. So its liabilities total US$62.7m more than the combination of its cash and short-term receivables.

我们可以从最近的资产负债表看出,依特香水有1年内到期的负债为3.324亿元美元,以及超过1年到期的负债为1.304亿元美元。另一方面,它手头现金为0.767亿元美元,并且1年内到期的应收账款为3.233亿元美元。因此,它的负债总额比现金和短期应收账款的总和多6.27亿元美元。

Having regard to Inter Parfums' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$3.87b company is short on cash, but still worth keeping an eye on the balance sheet.

考虑到依特香水的规模,其流动资产似乎与总负债相当平衡。因此,这家市值为38.7亿美元的公司极不可能缺现金,但仍值得关注其资产负债表。

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

通过查看公司的净债务与利息、税、折旧、摊销前利润(EBITDA)之比以及它的利息费用(利息覆盖率)可以衡量一个公司的债务负担与收益能力。因此,我们考虑将债务与有无计算折旧和摊销费用的收益相对比。

Inter Parfums has a low net debt to EBITDA ratio of only 0.30. And its EBIT covers its interest expense a whopping 47.3 times over. So we're pretty relaxed about its super-conservative use of debt. Inter Parfums's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Inter Parfums can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

依特香水的净债务与息税折旧摊销前利润(EBITDA)比率仅为0.30。其EBIT覆盖利息支出的倍数高达47.3倍。因此,我们对其极为保守地使用债务感到放心。依特香水的EBIT在过去一年中基本保持平稳,但由于其没有太多债务,这不应该成为问题。在分析债务水平时,资产负债表是显而易见的起点。但最终,业务未来的盈利能力将决定依特香水能否随着时间加强其资产负债表。因此,如果您想知道专业人士的看法,您可能会发现分析师盈利预测的免费报告很有趣。

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Inter Parfums reported free cash flow worth 10% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

但我们最后考虑的也很重要,因为公司不能用纸面利润支付债务;它需要现金。所以值得检查多少EBIT是由自由现金流支持的。在过去三年中,依特香水报告的自由现金流相当于其EBIT的10%,这实际上相当低。这种疲软的现金转换水平削弱了其管理和偿还债务的能力。

Our View

我们的观点

Inter Parfums's interest cover was a real positive on this analysis, as was its net debt to EBITDA. Having said that, its conversion of EBIT to free cash flow somewhat sensitizes us to potential future risks to the balance sheet. Considering this range of data points, we think Inter Parfums is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Inter Parfums is showing 1 warning sign in our investment analysis , you should know about...

依特香水的利息覆盖率在这项分析中确实表现不错,其净负债与EBITDA之比也是如此。 话虽如此,其EBIt转为自由现金流的能力稍微敏感,可能会给资产负债表带来潜在风险。考虑到这些数据点的范围,我们认为依特香水具备管理其债务水平的良好基础。话虽如此,负担相当沉重,我们建议任何股东都要密切关注。 在分析债务时,资产负债表明显是要重点关注的领域。然而,并非所有的投资风险都在资产负债表之内,相反,应该注意到依特香水在我们的投资分析中显示了1个警示信号,你应该知道...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

如果在所有这些之后,您更感兴趣的是具有坚实资产负债表的快速增长公司,那么不要拖延,查看我们的净现金增长股票列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

We can see from the most recent balance sheet that Inter Parfums had liabilities of US$332.4m falling due within a year, and liabilities of US$130.4m due beyond that. On the other hand, it had cash of US$76.7m and US$323.3m worth of receivables due within a year. So its liabilities total US$62.7m more than the combination of its cash and short-term receivables.

We can see from the most recent balance sheet that Inter Parfums had liabilities of US$332.4m falling due within a year, and liabilities of US$130.4m due beyond that. On the other hand, it had cash of US$76.7m and US$323.3m worth of receivables due within a year. So its liabilities total US$62.7m more than the combination of its cash and short-term receivables.