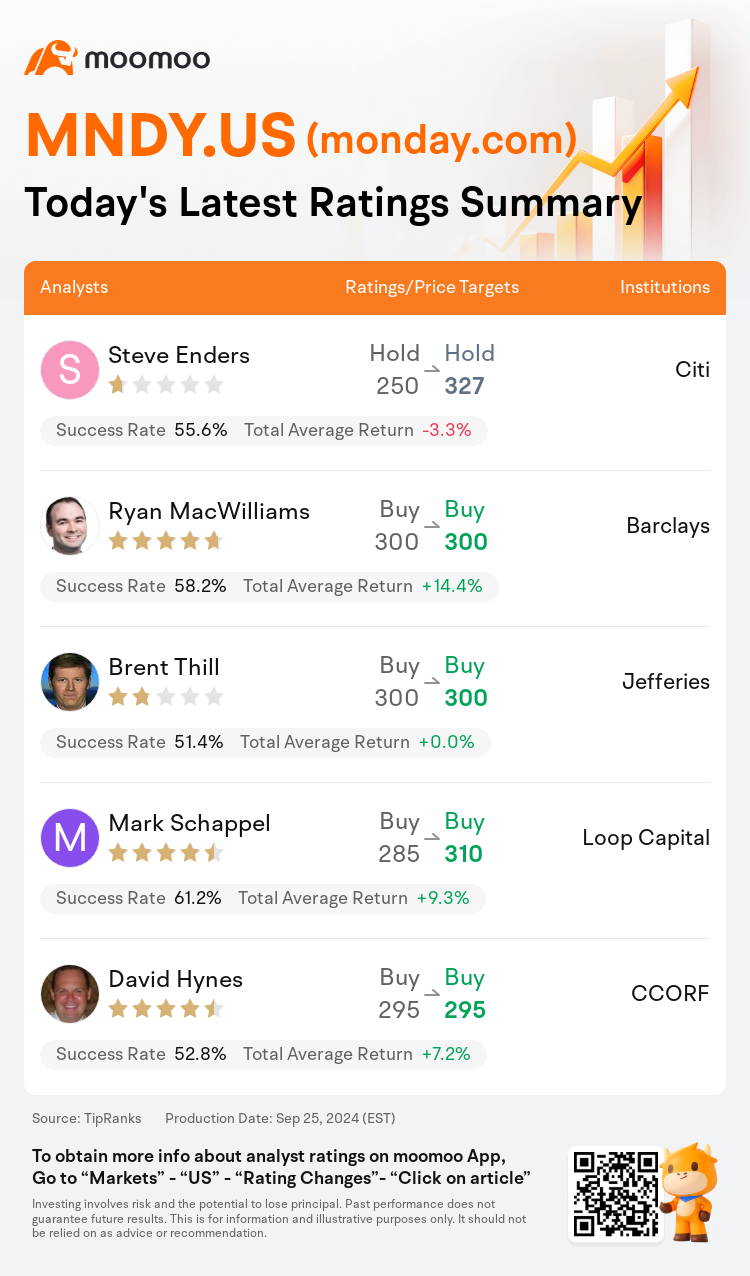

On Sep 25, major Wall Street analysts update their ratings for $monday.com (MNDY.US)$, with price targets ranging from $295 to $327.

Citi analyst Steve Enders maintains with a hold rating, and adjusts the target price from $250 to $327.

Barclays analyst Ryan MacWilliams maintains with a buy rating, and maintains the target price at $300.

Jefferies analyst Brent Thill maintains with a buy rating, and maintains the target price at $300.

Jefferies analyst Brent Thill maintains with a buy rating, and maintains the target price at $300.

Loop Capital analyst Mark Schappel maintains with a buy rating, and adjusts the target price from $285 to $310.

CCORF analyst David Hynes maintains with a buy rating, and maintains the target price at $295.

Furthermore, according to the comprehensive report, the opinions of $monday.com (MNDY.US)$'s main analysts recently are as follows:

The revised valuation for Monday.com is attributed to updated models and preferences within the back office software sector following Q2 outcomes. There is a perception of potential for small to mid-cap software companies to adjust their valuations favorably during a cycle more accepting of risk, coupled with stable IT budget expenditures and the emergence of AI opportunities. Preference has shifted towards certain companies in the software sector, with an emphasis on a well-known large-cap company as a top pick.

Following Monday.com's Elevate user conference, the company's development into a multi-product platform was reinforced by management's presentation. It highlighted the successful expansion from its traditional work management tools to new, adjacent use cases. The company's focus on innovation is evident and appears to be well-received by its customer base. Additionally, the strategic acquisition of a competitor is seen as a tactical move that could enhance Monday.com's market presence and attract more investor attention.

Here are the latest investment ratings and price targets for $monday.com (MNDY.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

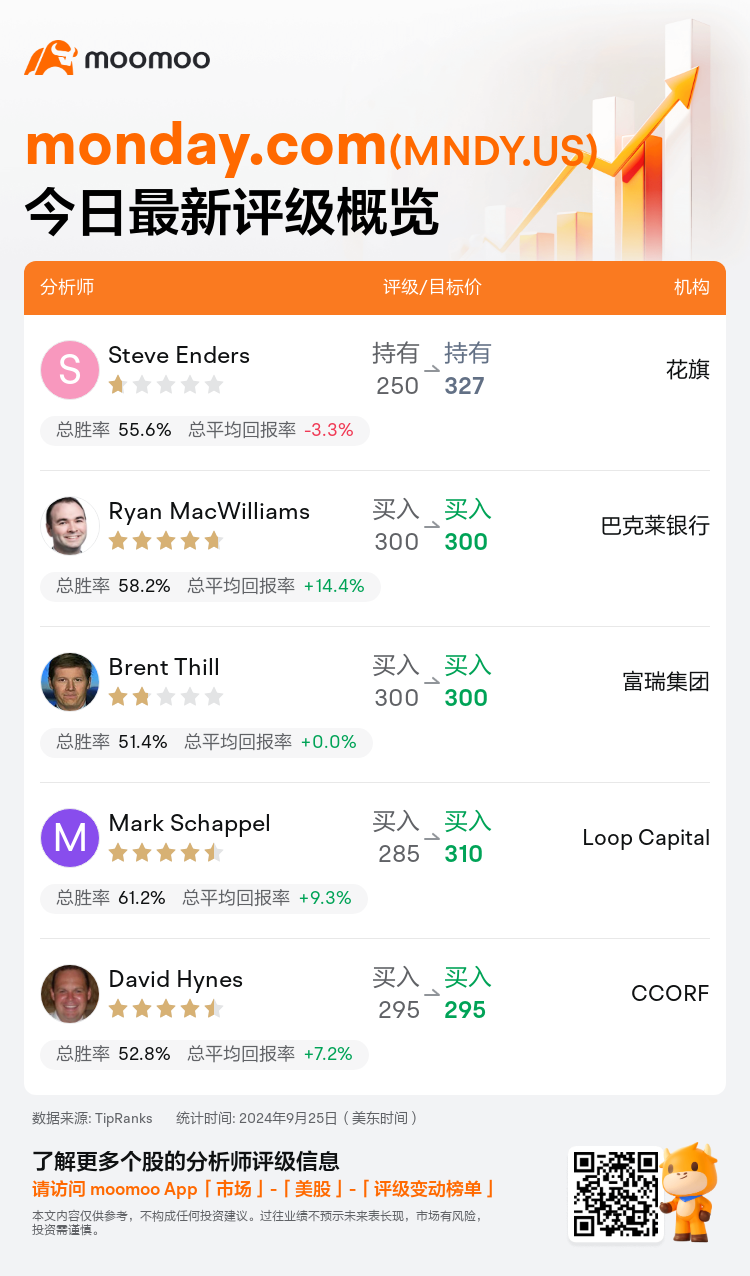

美东时间9月25日,多家华尔街大行更新了$monday.com (MNDY.US)$的评级,目标价介于295美元至327美元。

花旗分析师Steve Enders维持持有评级,并将目标价从250美元上调至327美元。

巴克莱银行分析师Ryan MacWilliams维持买入评级,维持目标价300美元。

富瑞集团分析师Brent Thill维持买入评级,维持目标价300美元。

富瑞集团分析师Brent Thill维持买入评级,维持目标价300美元。

Loop Capital分析师Mark Schappel维持买入评级,并将目标价从285美元上调至310美元。

CCORF分析师David Hynes维持买入评级,维持目标价295美元。

此外,综合报道,$monday.com (MNDY.US)$近期主要分析师观点如下:

周一软件的修订估值归因于更新的模型和偏好,在Q2业绩后的后勤软件板块。在一个更容忍风险的周期内,有人认为,中小市值软件公司有潜力调整他们的估值,结合稳定的IT预算支出和人工智能机遇的出现。偏好已转向软件板块的某些公司,重点放在一家知名的大市值公司作为首选。

在周一软件的Elevate用户大会之后,公司发展成为一个多产品平台得到管理层演示的再次强化。它突显了成功从传统的工作管理工具扩展到新的、相邻的用例。公司对创新的关注是显而易见的,并且似乎受到客户群体的好评。此外,对竞争对手的战略收购被视为一项战术举措,可以增强周一软件的市场存在并吸引更多投资者的关注。

以下为今日5位分析师对$monday.com (MNDY.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富瑞集团分析师Brent Thill维持买入评级,维持目标价300美元。

富瑞集团分析师Brent Thill维持买入评级,维持目标价300美元。

Jefferies analyst Brent Thill maintains with a buy rating, and maintains the target price at $300.

Jefferies analyst Brent Thill maintains with a buy rating, and maintains the target price at $300.