Tradepulse Power Inflow Alert: Autozone Inc. Climbs Over 100 Points After Signal

Tradepulse Power Inflow Alert: Autozone Inc. Climbs Over 100 Points After Signal

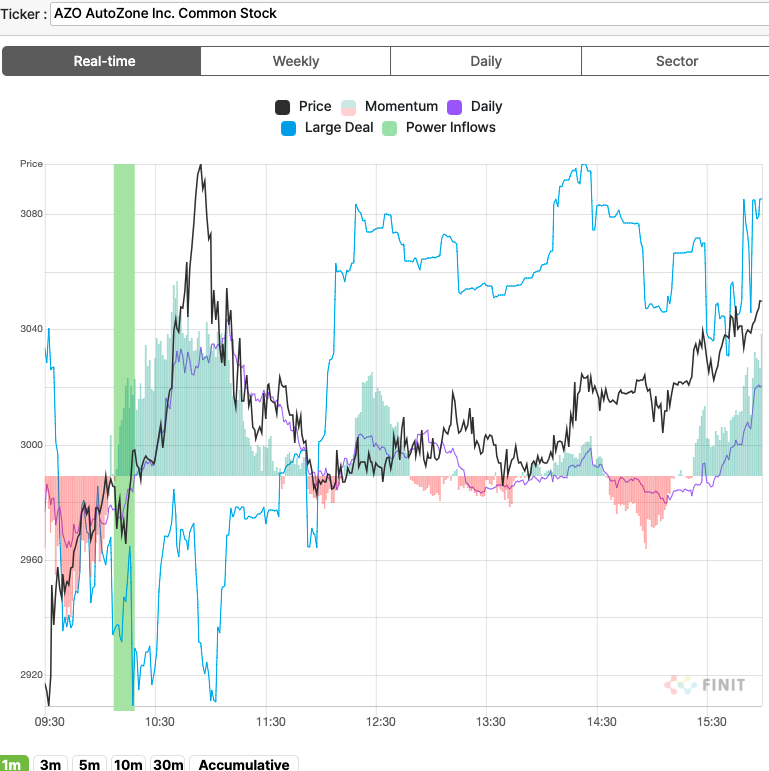

STOCK RISES QUICKLY AFTER THE SIGNAL AT 10:17 AM AND HITS THE HIGH OF THE DAY AT 10:55 AM EDT

股票在上午10:17收到信号后迅速上涨,并在上午10:55达到当天最高点

Today, TradePulse's latest Power Inflow alert indicated institutional volume is coming into AutoZone Inc. (NYSE:AZO), signaling a shift from net selling to buying. This shift is a key indicator of rising investor confidence and the potential for an uptrend in AZO's stock.

今天,TradePulse最新的Power Inflow警报表明机构成交量正在流入AutoZone Inc. (纽交所:AZO),标志着由纯卖盘转为买盘。这种转变是投资者信心上升和AZO股票上涨可能性的重要因子。

At 10:17 AM ET on SEPTEMBER 24th, AZO registered a Power Inflow at a price of $2987.80. Following this signal, the stock reached its high point at 10:55 AM EDT, climbing over 100 points ($3097.42) during the day, translating to an approximate increase of 3.7%. This alert is crucial for investors relying on order flow analytics, suggesting the beginning of an uptrend and presenting a valuable opportunity for those anticipating higher prices. Observers are now closely monitoring AZO for sustained positive momentum, viewing this as a bullish sign.

在9月24日上午10:17,AZO以2987.80美元的价格录得大宗资金流入。在此信号之后,股票在上午10:55达到高点,当天上涨超过100点(3097.42美元),涨幅约为3.7%。对于依赖订单流分析的投资者来说,这个警报至关重要,预示着一股上升趋势的开始,并为那些预期价格上涨的人提供了宝贵的机会。观察者现在正在密切关注AZO是否能持续正面势头,将这视为一个看好的迹象。

Understanding Power Inflow:

理解Power Inflow:

A Power Inflow is identified by a surge in buy orders over sell orders, typically occurring within the first one or two hours after the market opens. This phenomenon is observed in ten to twenty stocks daily, reflecting the initial strategies and reactions of large institutional investors. Analyzing the size, timing, and price of these transactions helps signal shifts in market sentiment and potential price changes. For those interested in monitoring more stocks exhibiting Power Inflows, visiting the TradePulse website provides comprehensive insights and updates on daily occurrences.

Power Inflow是指买单激增超过卖单,通常发生在市场开盘后的一两个小时内。每天大约有十到二十支股票出现这种现象,反映了大型机构投资者的初始策略和反应。分析这些交易的规模、时间和价格有助于识别市场情绪的转变和潜在的价格变动。对于那些对更多展现Power Inflow的股票感兴趣的人,访问TradePulse网站可以提供关于每日事件的全面洞察和更新。

Importance of Power Inflow:

Power Inflow的重要性:

Power Inflows are crucial as they offer early indications of potential uptrends, enabling traders to act even before the market fully adjusts. Such a change is commonly viewed as a sign of larger inflows than retail is capable of producing, indicating institutional interest and a short-term uptrend in the stock. Although not always marking the lowest point, stocks tend to rise following a Power Inflow. This makes these signals especially valuable for identifying strategic entry points and planning short-term investments, as they provide an opportunity to capitalize on upward momentum ahead of wider market recognition.

Power Inflows至关重要,因为它们提供了潜在上涨趋势的早期指标,使交易者甚至在市场完全调整之前就能采取行动。这种变化通常被视为比零售投资能力更强的资金流入的迹象,表明机构的兴趣和股票的短期上涨趋势。虽然并不总是标志着最低点,但股票往往会在Power Inflow之后上涨。这使得这些信号对于确定战略入场点和规划短期投资特别有价值,因为它们提供了在更广泛市场认可之前利用上行动力的机会。

Strategic Actions Following a Power Inflow:

权力流入后的战略行动:

After detecting a Power Inflow, traders should view it as a potential entry buying point but also confirm the trend with TradePulse's additional indicators such as Momentum, Daily, and Large Deal flows to ensure its strength and viability. Prompt action, combined with strategic stop-loss settings, can maximize returns and minimize risks. This comprehensive approach allows traders to make more informed decisions, optimizing their trading strategies in alignment with real-time market dynamics.

在检测到权力流入后,交易员应将其视为潜在的入场买点,但也应通过TradePulse的额外指标如动量、日常和大单流量来确认趋势,以确保其强度和可行性。及时采取行动,结合战略止损设置,可以最大化收益和最小化风险。这种全面的方法使交易员能够做出更明智的决策,优化其交易策略以与实时市场动态保持一致。

After Market Close UPDATE:

收盘后更新:

The price at the time of the Power Inflow was $2987.80. The returns on the High price ($3097.42) and Close price ($3049.98) after the Power Inflow were respectively 3.7% and 2.0%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite.

动力流入时的价格为$2987.80。动力流入后,高价($3097.42)和收盘价($3049.98)的回报率分别为3.7%和2.0%。这就是为什么拥有包括反映您风险偏好的盈利目标和止损在内的交易计划非常重要。

Past Performance is Not Indicative of Future Results

过往表现并不代表未来结果