China's Stimulus Sparks Optimism: 3 Large-Cap Stocks With Analyst Buy Ratings

China's Stimulus Sparks Optimism: 3 Large-Cap Stocks With Analyst Buy Ratings

China's latest economic stimulus is making waves across global markets. Following a bold series of moves by the People's Bank of China (PBoC), which included:

中国最新的经济刺激措施正在全球市场掀起波澜。继中国人民银行(PBoC)采取了一系列大胆举措之后,其中包括:

- Slashing the reserve requirement ratio (RRR) for banks

- Reducing key repo rates

- 削减银行的存款准备金率(RRR)

- 降低密钥回购率

Accordingly, an influx of liquidity is expected to hit the country's financial system. The goal? Inject approximately $140 billion into the economy and encourage more lending to boost growth.

因此,预计流动性的涌入将打击该国的金融体系。目标?向经济注入约1400亿美元,并鼓励更多贷款以促进增长。

While there's been some volatility following this news, certain U.S.-listed Chinese stocks remain hot picks for analysts. Here's a closer look at three large-cap stocks with strong upside potential, alk are currently rated a Buy by analysts.

尽管这一消息出现了一些波动,但某些在美国上市的中国股票仍然是分析师的热门选择。以下是三只具有强大上行潜力的大盘股的仔细观察,分析师目前将所有股票评为买入。

Trip.com: Ready To Soar 42% As China's Travel Boom Takes Off

Trip.com:随着中国旅游热潮的兴起,准备飙升42%

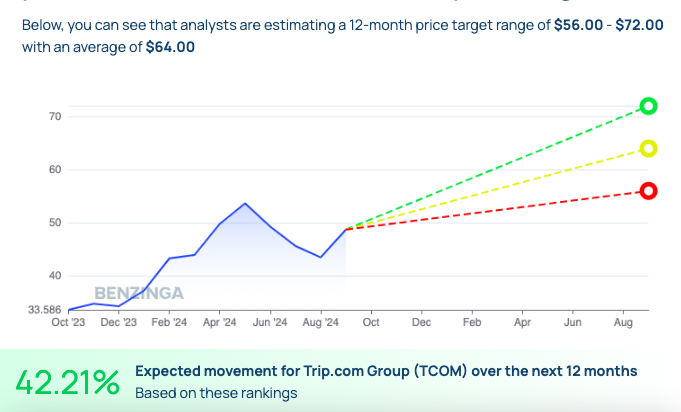

Source: Benzinga Stock Report – TCOM

资料来源:Benzinga股票报告— TCOM

First on the list is Trip.com Group (NASDAQ:TCOM), China's largest online travel agency. The stock has soared over 43% in the past year, with a remarkable 44% year-to-date gain.

排在第一位的是中国最大的在线旅行社Trip.com集团(纳斯达克股票代码:TCOM)。该股在过去一年中飙升了43%以上,今年迄今为止涨幅为44%。

Analysts are particularly optimistic about Trip.com's potential as China's travel sector rebounds, with passport penetration still low in the country. With international travel ramping up, Trip.com is expected to see higher-margin growth.

随着中国旅游业的反弹,分析师对Trip.com的潜力特别乐观,该国的护照普及率仍然很低。随着国际旅行的增加,预计Trip.com将实现更高的利润率增长。

Analysts predict the stock could rise between $56 and $72 over the next 12 months, with an average target of $64 — representing an impressive 42.21% upside.

分析师预测,该股在未来12个月内可能上涨56美元至72美元,平均目标为64美元,相当于令人印象深刻的42.21%的上涨空间。

JD.com: Delivering A 37% Upside With E-Commerce Dominance

京东:凭借电子商务的主导地位,实现37%的上涨空间

Source: Benzinga Stock Report – JD

资料来源:Benzinga股票报告—京东

Next up is JD.com (NASDAQ:JD), one of China's leading e-commerce platforms.

接下来是京东(纳斯达克股票代码:JD),这是中国领先的电子商务平台之一。

JD.com's strength lies in its extensive logistics and fulfillment infrastructure, which has driven its 22% gain so far this year.

京东的优势在于其广泛的物流和配送基础设施,这推动了其今年迄今为止22%的增长。

Analysts are bullish on JD's future, estimating a price range of $28 to $47, with an average target of $37.50. This suggests the stock could see a potential 36.97% upside over the next year, positioning it as another strong pick in the sector.

分析师看好京东的未来,估计价格区间为28美元至47美元,平均目标为37.50美元。这表明该股明年可能上涨36.97%,使其成为该行业的又一个强劲选择。

Read Also: Alibaba Partners With Nvidia To Advance AI, Autonomous Driving, Chart Indicates Positive Momentum

另请阅读:阿里巴巴与英伟达合作推进人工智能和自动驾驶,图表显示出积极势头

Alibaba: The Commerce Giant Poised For A 30% Leap

阿里巴巴:这家商业巨头有望实现30%的飞跃

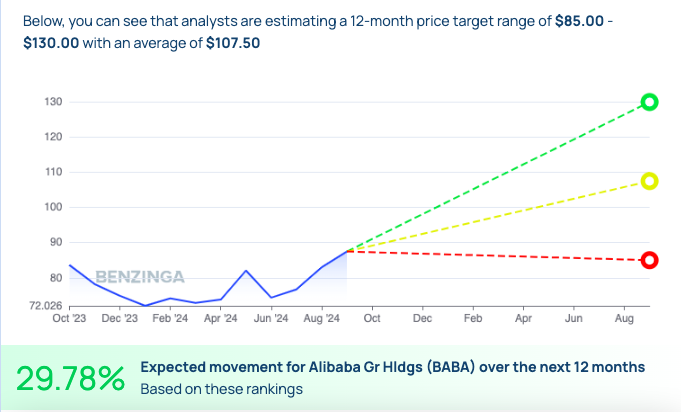

Source: Benzinga Stock Report – BABA

资料来源:Benzinga股票报告— BABA

Rounding out the list is Alibaba Group (NYSE:BABA) (NYSE:BABAF), a titan in the global e-commerce space.

排在榜单上的是全球电子商务领域的巨头阿里巴巴集团(纽约证券交易所代码:BABA)(纽约证券交易所代码:BABAF)。

While Alibaba has faced challenges in recent years, its diverse business operations — from online marketplaces to cloud computing — continue to attract analyst interest. The stock is up 21% year-to-date and analysts are forecasting a 12-month price target range of $85 to $130, averaging at $107.50. This implies an upside of 29.78%, making Alibaba a solid long-term bet.

尽管阿里巴巴近年来面临挑战,但其多样化的业务运营——从在线市场到云计算——继续吸引分析师的兴趣。该股今年迄今已上涨21%,分析师预计12个月的目标股价区间为85美元至130美元,平均为107.50美元。这意味着上涨29.78%,使阿里巴巴成为一个可靠的长期赌注。

As China's economic engine shifts into high gear with the latest stimulus package, these three large-cap stocks — Trip.com, JD.com and Alibaba — are positioned to capitalize on the country's recovery and growth.

随着最新的刺激计划推动中国经济引擎进入高速运转,这三只大盘股——Trip.com、京东和阿里巴巴——有望利用该国的复苏和增长。

- Tech Stocks Rise, Materials Sector Rallies On China's Stimulus, Nvidia Surges: What's Driving Markets?

- 科技股上涨,材料板块因中国的刺激措施而上涨,英伟达股价飙升:是什么推动了市场?

Photo: Shutterstock

照片:Shutterstock