Decoding Meta Platforms's Options Activity: What's the Big Picture?

Decoding Meta Platforms's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Meta Platforms (NASDAQ:META).

有很多资金可以使用的投资者对Meta Platforms(纳斯达克:META)持看淡态度。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.

无论这些人是机构还是富人,我们都不知道。但是当meta发生这样的大事时,往往意味着有人知道即将发生的事情。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 32 uncommon options trades for Meta Platforms.

今天,Benzinga的期权扫描器发现了32笔meta platforms的非常规期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 40% bullish and 43%, bearish.

这些大额交易者的整体情绪在40%看好和43%看淡之间分歧。

Out of all of the special options we uncovered, 18 are puts, for a total amount of $1,009,170, and 14 are calls, for a total amount of $872,582.

在我们发现的所有特殊期权中,有18个看跌期权,总金额达到$1,009,170,有14个看涨期权,总金额为$872,582。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $420.0 and $810.0 for Meta Platforms, spanning the last three months.

通过评估交易量和未平仓合约量,显而易见主要市场推动者的重点在meta platforms的价格区间集中在$420.0到$810.0之间,跨过过去三个月。

Insights into Volume & Open Interest

成交量和持仓量分析

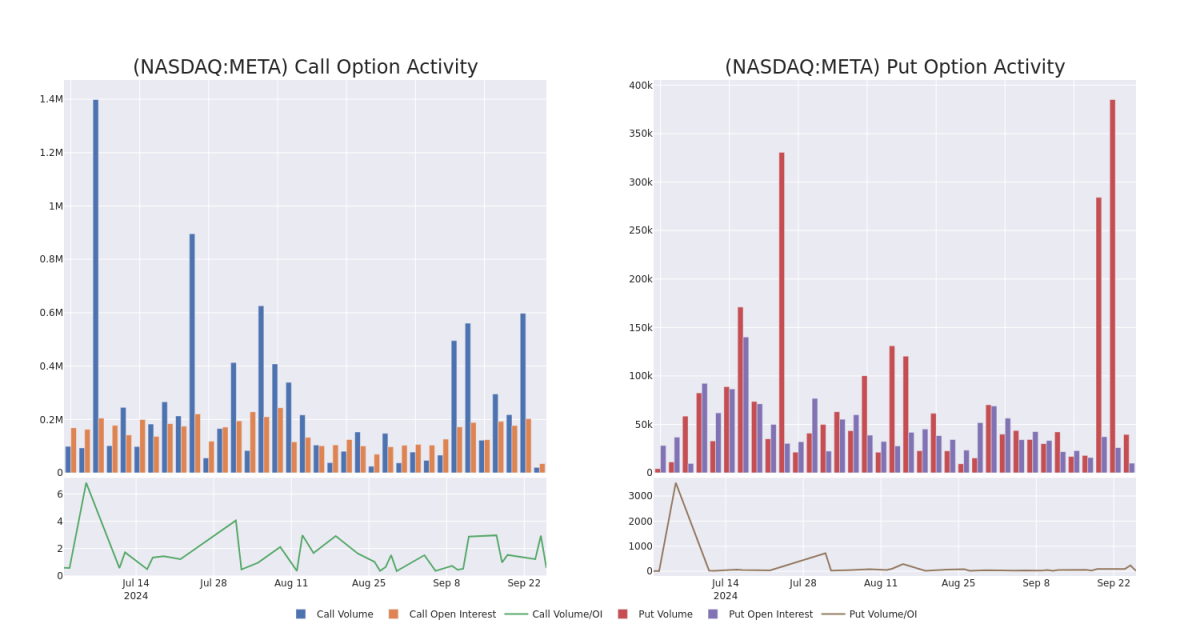

In today's trading context, the average open interest for options of Meta Platforms stands at 3169.86, with a total volume reaching 59,884.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Meta Platforms, situated within the strike price corridor from $420.0 to $810.0, throughout the last 30 days.

在今天的交易环境下,meta platforms的期权平均未平仓合约量为3169.86,总成交量达到59,884.00。附图展示了在过去30天内,位于$420.0至$810.0行权价格走廊内meta platforms高价值交易的看涨和看跌期权成交量和未平仓合约量的进展。

Meta Platforms 30-Day Option Volume & Interest Snapshot

Meta平台30天期权成交量和持仓快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| META | CALL | TRADE | BEARISH | 06/20/25 | $35.0 | $34.0 | $34.01 | $700.00 | $231.2K | 10.4K | 93 |

| META | PUT | SWEEP | BEARISH | 12/20/24 | $5.75 | $5.7 | $5.75 | $460.00 | $153.4K | 1.6K | 432 |

| META | PUT | SWEEP | BULLISH | 09/27/24 | $3.6 | $3.5 | $3.5 | $570.00 | $96.6K | 2.9K | 3.8K |

| META | CALL | SWEEP | BULLISH | 06/20/25 | $34.0 | $33.7 | $34.0 | $700.00 | $85.0K | 10.4K | 93 |

| META | PUT | SWEEP | BEARISH | 09/27/24 | $3.45 | $3.35 | $3.35 | $570.00 | $84.9K | 2.9K | 4.2K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| meta platforms | 看涨 | 交易 | 看淡 | 06/20/25 | $35.0 | 34.0美元 | $34.01 | $700.00 | 231.2K美元 | 10.4K | 93 |

| meta platforms | 看跌 | SWEEP | 看淡 | 12/20/24 | $5.75 | $5.7 | $5.75 | $460.00 | $153.4K | 1.6K | 432 |

| meta platforms | 看跌 | SWEEP | 看好 | 09/27/24 | $3.6 | $3.5 | $3.5 | $570.00 | $96.6K | 2.9K | 3.8K |

| meta platforms | 看涨 | SWEEP | 看好 | 06/20/25 | 34.0美元 | $33.7 | 34.0美元 | $700.00 | $85.0K | 10.4K | 93 |

| meta platforms | 看跌 | SWEEP | 看淡 | 09/27/24 | $3.45 | $3.35 | $3.35 | $570.00 | $84.9K | 2.9K | 4.2千 |

About Meta Platforms

关于meta平台

Meta is the largest social media company in the world, boasting close to 4 billion monthly active users worldwide. The firm's "Family of Apps," its core business, consists of Facebook, Instagram, Messenger, and WhatsApp. End users can leverage these applications for a variety of different purposes, from keeping in touch with friends to following celebrities and running digital businesses for free. Meta packages customer data, gleaned from its application ecosystem and sells ads to digital advertisers. While the firm has been investing heavily in its Reality Labs business, it remains a very small part of Meta's overall sales.

Meta是全球最大的社交媒体公司,拥有近40亿月活跃用户。该公司的“应用家族”,即其核心业务,包括Facebook、Instagram、Messenger和WhatsApp。最终用户可以利用这些应用程序进行各种不同的用途,从与朋友保持联系到关注名人和免费运行数字业务。Meta打包客户数据,从其应用生态系统中收集数据并向数字广告商出售广告。虽然该公司一直在大量投资其Reality Labs业务,但这仍然是Meta整体销售额中的一小部分。

Where Is Meta Platforms Standing Right Now?

Meta Platforms目前的状况怎么样?

- Currently trading with a volume of 663,266, the META's price is up by 0.95%, now at $573.72.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 27 days.

- 目前成交量为663,266,META的价格上涨了0.95%,目前为573.72美元。

- RSI读数表明股票目前可能超买。

- 预期的盈利发布还有27天。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Meta Platforms options trades with real-time alerts from Benzinga Pro.

期权交易具有较高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种因子以及密切关注市场动向来管理这些风险。通过Benzinga Pro的实时提醒,了解最新的Meta Platforms期权交易动态。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with META, it often means somebody knows something is about to happen.