Li Auto's Options: A Look at What the Big Money Is Thinking

Li Auto's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Li Auto.

有大量资金的鲸鱼对理想汽车采取明显的看好态度。

Looking at options history for Li Auto (NASDAQ:LI) we detected 47 trades.

查看理想汽车(纳斯达克:LI)的期权历史,我们发现了47笔交易。

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 31% with bearish.

如果考虑每笔交易的具体细节,可以准确地说,55%的投资者持有看好期权,31%持有看淡期权。

From the overall spotted trades, 3 are puts, for a total amount of $170,482 and 44, calls, for a total amount of $4,376,920.

从所有发现的交易中,有3个看跌期权,交易金额共$170,482,有44个看涨期权,交易金额共$4,376,920。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $20.0 to $40.0 for Li Auto during the past quarter.

分析这些合同的成交量和未平仓合约后,似乎大户一直留意理想汽车在过去一个季度的价格区间从$20.0至$40.0。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

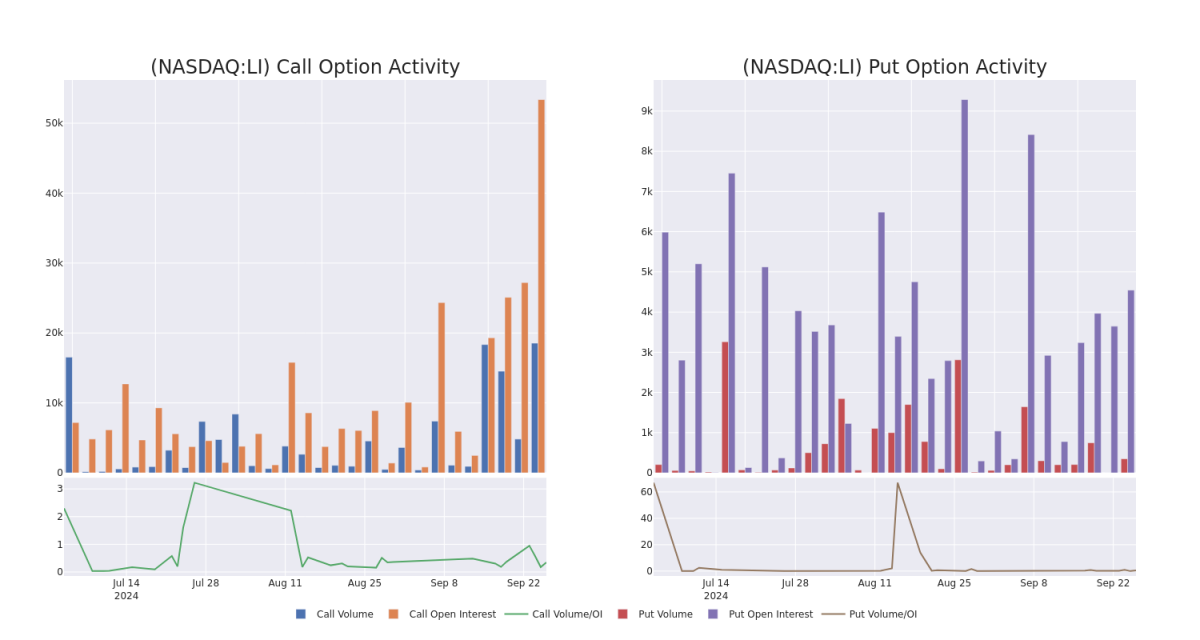

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Li Auto's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Li Auto's substantial trades, within a strike price spectrum from $20.0 to $40.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的战略步骤。这些指标揭示了在指定行权价格下,投资者对理想汽车期权的流动性和兴趣。接下来的数据展示了过去30天中与理想汽车的重大交易相关的成交量和未平仓合约的波动,涵盖了从$20.0至$40.0的行权价格范围。

Li Auto Option Volume And Open Interest Over Last 30 Days

理想汽车期权成交量和未平仓合约在过去30天内

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LI | CALL | SWEEP | BEARISH | 12/20/24 | $3.7 | $3.65 | $3.7 | $25.00 | $427.5K | 5.1K | 149 |

| LI | CALL | TRADE | BEARISH | 11/15/24 | $5.85 | $5.7 | $5.71 | $21.00 | $411.1K | 4.0K | 1.3K |

| LI | CALL | TRADE | BULLISH | 10/04/24 | $5.4 | $5.4 | $5.4 | $21.00 | $356.4K | 841 | 660 |

| LI | CALL | SWEEP | BEARISH | 11/15/24 | $5.8 | $5.65 | $5.66 | $21.00 | $282.4K | 4.0K | 1.3K |

| LI | CALL | TRADE | BULLISH | 10/18/24 | $3.0 | $2.86 | $3.0 | $24.00 | $264.6K | 2.0K | 892 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 理想汽车 | 看涨 | SWEEP | 看淡 | 12/20/24 | $3.7 | $3.65 | $3.7 | $25.00 | $427.5千 | 5.1K | 149 |

| 理想汽车 | 看涨 | 交易 | 看淡 | 11/15/24 | $5.85 | $5.7 | $5.71 | 21.00美元 | $411.1K | 4.0K | 1.3K |

| 理想汽车 | 看涨 | 交易 | 看好 | 10/04/24 | $5.4 | $5.4 | $5.4 | 21.00美元 | 356.4千美元 | 841 | 660 |

| 理想汽车 | 看涨 | SWEEP | 看淡 | 11/15/24 | $5.8 | $5.65 | 5.66美元 | 21.00美元 | $282.4K | 4.0K | 1.3K |

| 理想汽车 | 看涨 | 交易 | 看好 | 10/18/24 | $3.0 | $2.86 | $3.0 | 24.00美元 | 264.6K | 2.0K | 892 |

About Li Auto

关于理想汽车

Li Auto is a leading Chinese NEV manufacturer that designs, develops, manufactures, and sells premium smart NEVs. The company started volume production of its first model Li One in November 2019. The model is a six-seater, large, premium plug-in electric SUV equipped with a range extension system and advanced smart vehicle solutions. It sold over 376,000 NEVs in 2023, accounting for about 4% of China's passenger new energy vehicle market. Beyond Li One, the company expands its product line, including both BEVs and PHEVs, to target a broader consumer base.

理想汽车是一家领先的中国新能源汽车制造商,设计、开发、制造和销售高端智能新能源汽车。该公司于2019年11月开始量产其首款车型理想ONE。该车型是一款六座、大型、高端的插电式混合动力SUV,配备了续航系统和先进的智能车辆解决方案。2023年,它销售了超过37.6万辆新能源汽车,占中国乘用车新能源市场约4%。除了理想ONE外,公司正在扩大其产品线,包括纯电动汽车和插电式混合动力汽车,以面向更广泛的消费群体。

In light of the recent options history for Li Auto, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于理想汽车最近的期权历史,现在适合关注公司本身。我们的目标是探讨其当前的表现。

Present Market Standing of Li Auto

理想汽车的现市场地位

- Currently trading with a volume of 16,448,202, the LI's price is up by 6.48%, now at $25.31.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 42 days.

- 当前成交量为16,448,202,LI的价格上涨了6.48%,目前为25.31美元。

- RSI读数表明股票目前可能超买。

- 预计发布收益的时间为42天后。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 3 are puts, for a total amount of $170,482 and 44, calls, for a total amount of $4,376,920.

From the overall spotted trades, 3 are puts, for a total amount of $170,482 and 44, calls, for a total amount of $4,376,920.