Optimistic Investors Push Shanghai New Huang Pu Industrial Group Co., Ltd. (SHSE:600638) Shares Up 27% But Growth Is Lacking

Optimistic Investors Push Shanghai New Huang Pu Industrial Group Co., Ltd. (SHSE:600638) Shares Up 27% But Growth Is Lacking

The Shanghai New Huang Pu Industrial Group Co., Ltd. (SHSE:600638) share price has done very well over the last month, posting an excellent gain of 27%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

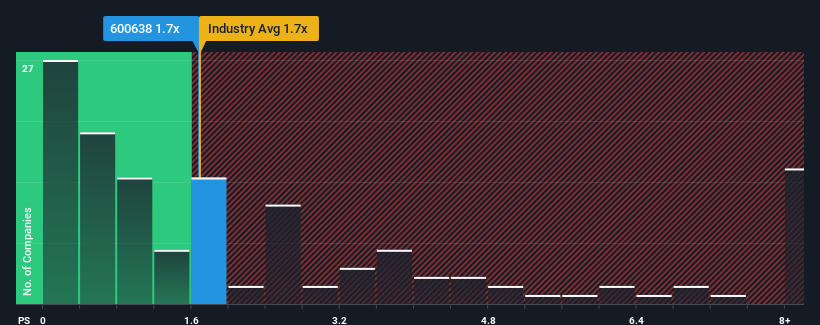

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Shanghai New Huang Pu Industrial Group's P/S ratio of 1.7x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in China is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does Shanghai New Huang Pu Industrial Group's Recent Performance Look Like?

For instance, Shanghai New Huang Pu Industrial Group's receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Shanghai New Huang Pu Industrial Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Shanghai New Huang Pu Industrial Group?

The only time you'd be comfortable seeing a P/S like Shanghai New Huang Pu Industrial Group's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Shanghai New Huang Pu Industrial Group's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 64%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 11% shows it's noticeably less attractive.

With this information, we find it interesting that Shanghai New Huang Pu Industrial Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Shanghai New Huang Pu Industrial Group's P/S

Shanghai New Huang Pu Industrial Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Shanghai New Huang Pu Industrial Group's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

You should always think about risks. Case in point, we've spotted 3 warning signs for Shanghai New Huang Pu Industrial Group you should be aware of.

If these risks are making you reconsider your opinion on Shanghai New Huang Pu Industrial Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.