Markets Weekly Update (September 27)

Markets Weekly Update (September 27)

Macro Matters

宏观事项

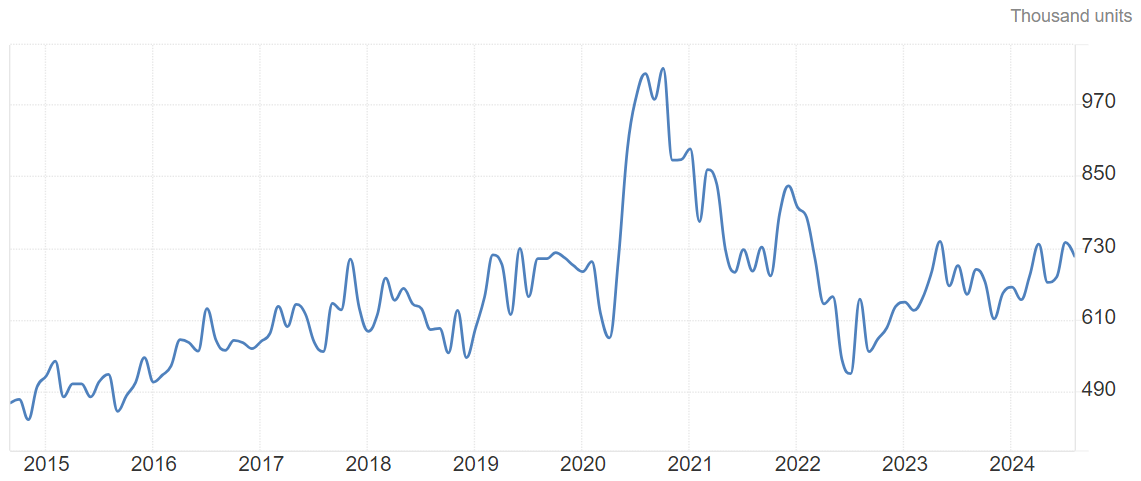

U.S. New Home Sales Drop Less Than Anticipated; Median House Price Decreases

美国新房销售下降幅度低于预期;中位房价下降

New home sales decreased 4.7% to a seasonally adjusted annual rate of 716,000 units last month, the Commerce Department's Census Bureau said.

上个月,经季节调整后的年化销售率下降了4.7%,至71.6万套,美国商务部普查局表示。

The median new house price decreased 4.6% to $420,600 in August from a year ago. Most of the houses sold last month were in the $300,000-$499,999 price range.

去年8月,新房的中位价格从前一年同期下降了4.6%,至42.06万美元。上个月销售的房屋大部分售价在30万至49.99万美元的价格区间内。

Source: Trading Economics

资料来源:Trading Economics

US Durable Goods Orders Hold Steady Defying Pessimistic Forecasts

美国耐用品订单保持稳定,蔑视悲观的预测

New orders for manufactured durable goods in the US were loosely unchanged from the prior month in August of 2024, compared to the revised 9.8% surge in July which was the highest in four years, and contrasting sharply with market expectations of a 2.6% drop. The result challenged the growing pessimism over manufacturing activity in the United States, suggesting the current slowdown may be temporary.

2024年8月,美国制造的耐用品新订单与前一个月基本持平,与7月修订后上涨了9.8%相比,这是四年来最高的涨幅,与市场预期的2.6%下降形成鲜明对比。这一结果挑战了对美国制造业活动日益增长的悲观情绪,暗示当前的减速可能是暂时的。

Excluding transportation, new orders rose by 0.5%, well above expectations of a 0.1% increase.

不计算运输业务,新订单增长了0.5%,远远超出了0.1%的预期增长。

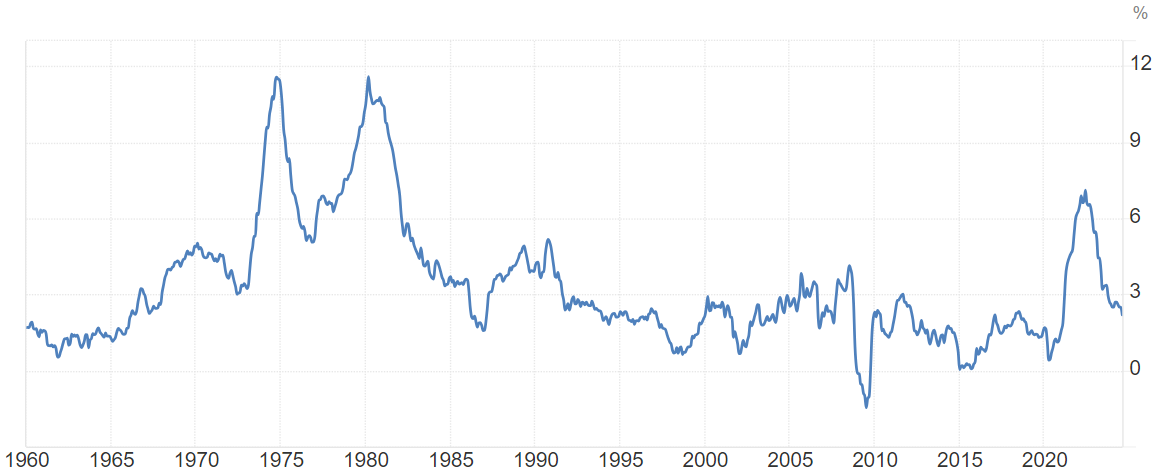

Key Federal Inflation Gauge Registers 2.2% in August, Below Expectations

关键联邦通货膨胀指标在8月份达到2.2%,低于预期

The PCE price index in the US increased 2.2% year-on-year in August 2024, the lowest since February 2021, compared to 2.5% in July and below forecasts of 2.3%.

美国的PCE价格指数在2024年8月同比增长2.2%,为自2021年2月以来最低,低于预期的2.3%和7月的2.5%

The annual increase in the core PCE price index, the Federal Reserve’s preferred gauge, edged higher to 2.7% in August of 2024 from 2.6% in the previous month.

核心PCE价格指数的年度增长率,即美联储首选的衡量指标,从2024年8月的2.6%上升到2.7%,高于上个月的水平。

Chart: Headline PCE Inflation, Trading Economics

图表:头条PCE通胀,交易经济学

Smart Money Flow

智能资金流

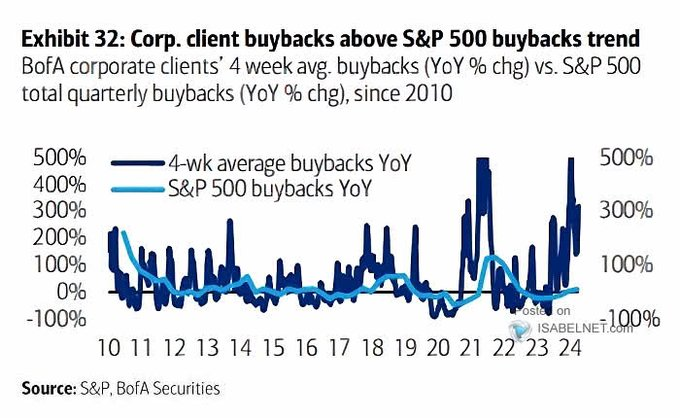

Stock buybacks by BofA's corporate clients, which surpass the overall trend of S&P 500 buybacks, suggest a positive outlook for investors, defying recession fears while showcasing confidence in future growth potential.

美国银行的企业客户进行的股票回购超过了标普500的回购总量,这表明投资者对未来增长潜力充满信心,蔑视衰退担忧,展示积极的前景。

S&P 500 Gains Are Becoming Less Dependent on Nvidia

标普500指数涨幅不再那么依赖英伟达

David Tepper's Big Bet After the Fed Rate Cut Was to Buy 'Everything' Related to China

大卫·特帕在联邦大幅降息后,押注买入与中国相关的‘一切’股票板块

Billionaire hedge fund founder David Tepper said his big bet after the Federal Reserve’s rate cut was to buy Chinese stocks.

亿万富豪、对冲基金创始人大卫·特帕(David Tepper)表示,在美联储降息后,他的大笔赌注是买入中国股票。

“I thought that what the Fed did last week would lead to China easing, and I didn’t know that they were going to bring out the big guns like they did,” Tepper told CNBC’s “Squawk Box” on Thursday. “And I think there’s a whole shift.”

“我认为上周美联储的举措可能会导致中国采取宽松政策,但我不知道他们会像现在这样竭尽全力,”特帕周四在CNBC的“摇旗桥”节目中说。“我认为形势有了整体改变。”

Tepper also noted the Chinese market is cheaper than U.S. equities. “You’re sitting there with single multiple P/Es with double-digit growth rates for the big stocks that trade over here,” Tepper said. “That’s kind of versus what, you know, the 20-plus on the S&P.”

特帕还指出,中国市场的估值比美国股票便宜。“你看这里的大型股票,单一倍数市盈率配上两位数增长率,”特帕说。“这与标准普尔指数上的20多倍相比。”

Recent upside breakouts in S&P 500 cumulative net up volume, along with other bullish indicators, suggest that the S&P 500 may continue to reach new highs, indicating a robust market environment.

最近标准普尔500指数累积净成交量上行突破,加上其他看好的指标,表明标准普尔500指数可能继续达到新高,表明市场环境良好。

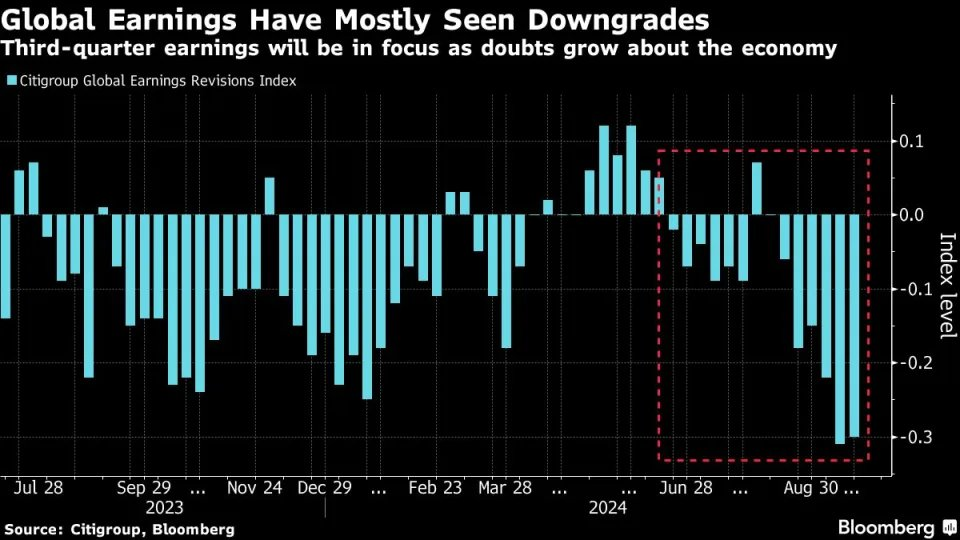

Global earnings have mostly seen downgrades, per Citi

根据花旗银行,全球收益主要受到下调影响。

Top Corporate News

头条公司新闻

Micron Revenues Surge 93% Driven by AI Demand

因人工智能需求推动,美光(Micron)营业收入激增93%。

AI-driven server memory, particularly GPU high-bandwidth memory (HBM), and SSD demand sent Micron revenues in its final FY 2024 quarter to $7.75 billion, 93 percent higher year-on-year.

人工智能驱动的服务器内存,尤其是gpu高带宽内存(HBM)和SSD需求推动了美光在2024财年第四季度的营业收入达到77.5亿美元,同比增长93%。

It made a net profit of $887 million in the quarter ended August 29, contrasting with the $1.4 billion loss a year ago. Full FY 2024 revenue was $25.1 billion, 62 percent higher year-over-year, with a $778 million net profit, versus FY 2023’s $5.83 billion loss.

在截至8月29日的季度中,其净利润为88700万美元,与一年前的14亿美元亏损形成鲜明对比。2024财年整年营业收入为251亿美元,同比增长62%,净利润为77800万美元,而2023财年为583亿美元的亏损。

Costco's Earnings Beat Estimates Despite Slower Sales Growth

好市多的收益超出预期,尽管销售增长放缓

Costco Wholesale (COST) delivered fiscal fourth-quarter earnings that exceeded analysts’ forecasts, although revenue fell slightly short due to decelerating growth. The company reported a 7% increase in net income from the previous year, reaching $2.35 billion or $5.29 per share, which surpassed expectations from analysts surveyed by Visible Alpha. However, revenue growth was modest, rising just 1% year-over-year to $79.7 billion, missing the projected figures.

好市多批发公司(COST)发布了财政第四季度的收益超出分析师的预测,尽管收入因增长放缓稍有不足。该公司报告称,与上一年相比,净利润增加了7%,达到235亿美元,或每股5.29美元,超过Visible Alpha受访分析师的预期。然而,营业收入增长不显著,仅比去年增加1%,达到797亿美元,低于预期数字。

Accenture Earnings Top Estimates Amid Strong Bookings

埃森哲的收益超出预期,预订强劲

Accenture earnings for the quarter ended Aug. 31 rose 3% to 2.79 per share on an adjusted basis, said the Dublin-based consulting firm. Including acquisitions, revenue increased 3% to $16.4 billion, Accenture said.

根据总部位于都柏林的咨询公司的说法,截至8月31日的季度,埃森哲的收益在调整基础上增长了3%,达到每股2.79美元。包括收购在内,营业收入增长了3%,达到164亿美元,埃森哲表示。

Analysts expected Accenture earnings of $2.78 a share on sales of $16.36 billion. Bookings rose 21% to $20.1 billion, including $1 billion in artificial intelligence-related bookings.

分析师预期埃森哲的每股收益为2.78美元,销售额为163.6亿美元。预订额增长21%,达到201亿美元,包括10亿美元的人工智能相关预订。

Super Micro shares tumble 12% after DOJ reportedly opens probe into company

超微电脑股价下跌12%,据报道司法部对公司展开调查

Super Micro Computer shares closed down 12% on Thursday after the Justice Department reportedly opened a probe into the company, which has been a major beneficiary of the artificial intelligence boom.

据称司法部对超微电脑公司展开调查后,超微电脑股价周四下跌了12%,该公司一直是人工智能热潮的主要受益者。

The probe is in its early days, according to a report from The Wall Street Journal, and it comes after Hindenburg Research disclosed a short position in the company in late August.

根据《华尔街日报》的报道,该调查仍处于早期阶段,此前在8月下旬,Hindenburg研究披露了对该公司的空头头寸。

Upcoming Economic Data

免责声明:本演示仅供信息和教育目的;不是任何特定投资或投资策略的建议或认可。在此提供的投资信息具有一般性质,仅供说明目的,并可能不适合所有投资者。它是在没有考虑个人投资者的财务知识水平、财务状况、投资目标、投资时间范围或风险承受能力的情况下提供的。在做出任何投资决策之前,您应考虑此信息是否适合您的相关个人情况。过去的投资业绩并不表明或保证未来的成功。收益将有所不同,所有投资都存在风险,包括本金损失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易应用程序,在美国,Moomoo Financial Inc 为投资者提供投资产品和服务,为 FINRA/SIPC 的成员。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的金融信息和交易应用程序。在美国,Moomoo的投资产品和服务由Moomoo Financial Inc.提供,成为FINRA/SIPC成员。

Source: Trading Economics

Source: Trading Economics