Check Out What Whales Are Doing With CMCSA

Check Out What Whales Are Doing With CMCSA

Whales with a lot of money to spend have taken a noticeably bearish stance on Comcast.

拥有大量资金的鲸鱼对康卡斯特采取了明显的看淡态度。

Looking at options history for Comcast (NASDAQ:CMCSA) we detected 10 trades.

查看康卡斯特(纳斯达克:CMCSA)的期权历史,我们检测到10笔交易。

If we consider the specifics of each trade, it is accurate to state that 10% of the investors opened trades with bullish expectations and 70% with bearish.

如果我们考虑每笔交易的具体细节,可以准确地说有10%的投资者预计涨价,而70%的投资者则看跌。

From the overall spotted trades, 2 are puts, for a total amount of $63,354 and 8, calls, for a total amount of $606,337.

从总体上看到的交易中,有2个看跌期权,金额总计63354美元,8个看涨期权,金额总计606337美元。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $35.0 to $47.5 for Comcast during the past quarter.

分析这些合约的成交量和未平仓量,似乎大户一直在关注康卡斯特在过去一个季度内的价格区间从35.0到47.5美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

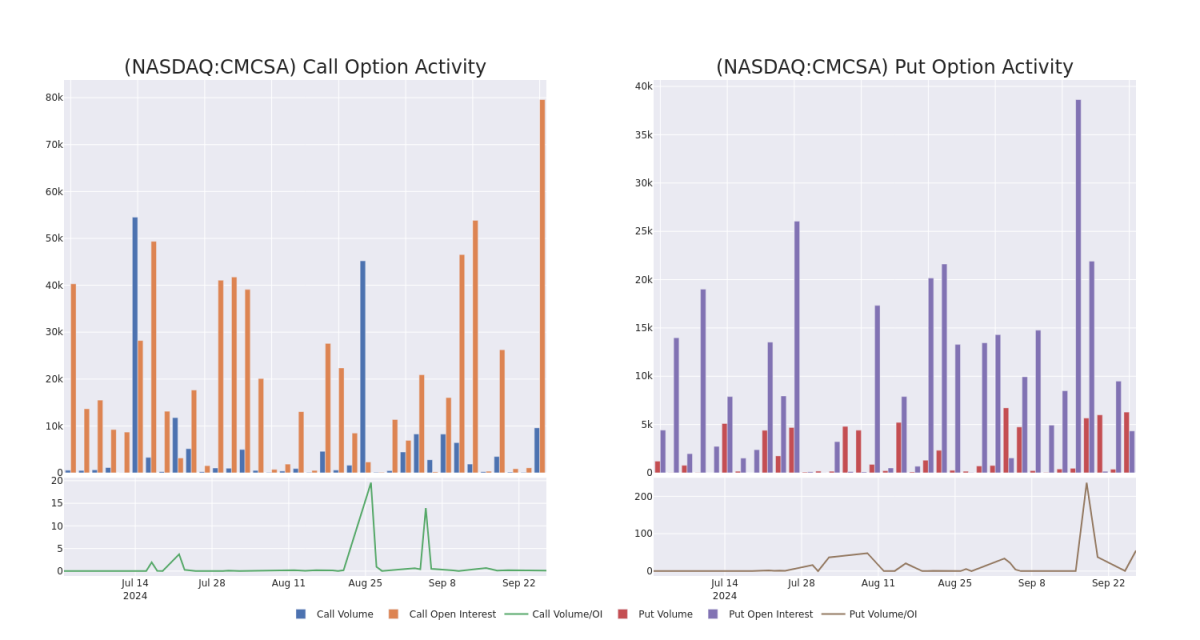

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Comcast's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Comcast's significant trades, within a strike price range of $35.0 to $47.5, over the past month.

检查成交量和未平仓量对股票研究提供了关键见解。这些信息对于衡量康卡斯特特定行权价的期权的流动性和兴趣水平至关重要。以下是我们对康卡斯特的重要交易在35.0到47.5美元行权价范围内看涨期权和看跌期权的成交量和未平仓量趋势的快照,覆盖过去一个月。

Comcast Call and Put Volume: 30-Day Overview

康卡斯特看涨和看跌成交量:30天概览

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMCSA | CALL | SWEEP | BEARISH | 09/19/25 | $8.35 | $8.25 | $8.25 | $35.00 | $171.6K | 4 | 223 |

| CMCSA | CALL | SWEEP | NEUTRAL | 10/18/24 | $2.0 | $1.91 | $1.98 | $40.00 | $103.5K | 7.2K | 2.8K |

| CMCSA | CALL | SWEEP | BEARISH | 01/17/25 | $1.96 | $1.92 | $1.94 | $42.50 | $101.4K | 28.3K | 2.8K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.14 | $1.16 | $47.50 | $58.0K | 1.0K | 1.0K |

| CMCSA | CALL | TRADE | BEARISH | 04/17/25 | $1.24 | $1.15 | $1.16 | $47.50 | $58.0K | 1.0K | 501 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMCSA | 看涨 | SWEEP | 看淡 | 09/19/25 | $8.35 | $8.25 | $8.25 | 35.00美元 | $171.6K | 4 | 223 |

| CMCSA | 看涨 | SWEEP | 中立 | 10/18/24 | $2.0 | $1.91 | $1.98 | $40.00 | $103.5千美元 | 7,200 | 2.8K |

| CMCSA | 看涨 | SWEEP | 看淡 | 01/17/25 | 1.96美元 | $1.92 | $1.94每股 | $42.50 | $101.4K | 28.3千 | 2.8K |

| CMCSA | 看涨 | 交易 | 看淡 | 04/17/25 | $1.24 | $1.14 | $1.16 | $47.50 | $58.0K | 1.0K | 1.0K |

| CMCSA | 看涨 | 交易 | 看淡 | 04/17/25 | $1.24 | $1.15 | $1.16 | $47.50 | $58.0K | 1.0K | 501 |

About Comcast

关于康卡斯特

Comcast is made up of three parts. The core cable business owns networks capable of providing television, internet access, and phone services to 63 million US homes and businesses, or nearly half of the country. About 50% of the locations in this territory subscribe to at least one Comcast service. Comcast acquired NBCUniversal from General Electric in 2011. NBCU owns several cable networks, including CNBC, MSNBC, and USA, the NBC network, the Peacock streaming platform, several local NBC affiliates, Universal Studios, and several theme parks. Sky, acquired in 2018, is a large television provider in the UK and has invested heavily in proprietary content to build this position. Sky is also a large pay-television provider in Italy and has a presence in Germany and Austria.

康卡斯特由三部分组成。核心有线电视业务拥有能提供电视、互联网接入和电话服务的网络,覆盖美国6300万家庭和企业,几乎占据全国近一半的市场份额。该地区约50%的地点订阅至少一种康卡斯特服务。康卡斯特于2011年从通用电气收购了NBC环球公司。NBCU拥有包括CNBC、MSNBC和美国在内的多个有线网络,NBC电视台,孔雀流媒体平台,几家地方NBC分支机构,环球影城和几家主题公园。2018年收购的Sky是英国的一家大型电视服务提供商,并大力投资于自有内容以建立这一地位。Sky还是意大利的一家大型付费电视服务提供商,并在德国和奥地利设有业务。

Where Is Comcast Standing Right Now?

康卡斯特现在处于什么位置?

- Currently trading with a volume of 6,485,734, the CMCSA's price is up by 2.0%, now at $41.84.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

- CMCSA目前成交量为6,485,734,价格上涨2.0%,目前为$41.84。

- RSI读数表明该股目前可能接近超买水平。

- 预计发布收益报告还有34天。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Comcast options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断学习,调整策略,监控多个因子,并紧密关注市场走势来管理这些风险。通过Benzinga Pro实时提醒了解最新的康卡斯特期权交易。

From the overall spotted trades, 2 are puts, for a total amount of $63,354 and 8, calls, for a total amount of $606,337.

From the overall spotted trades, 2 are puts, for a total amount of $63,354 and 8, calls, for a total amount of $606,337.