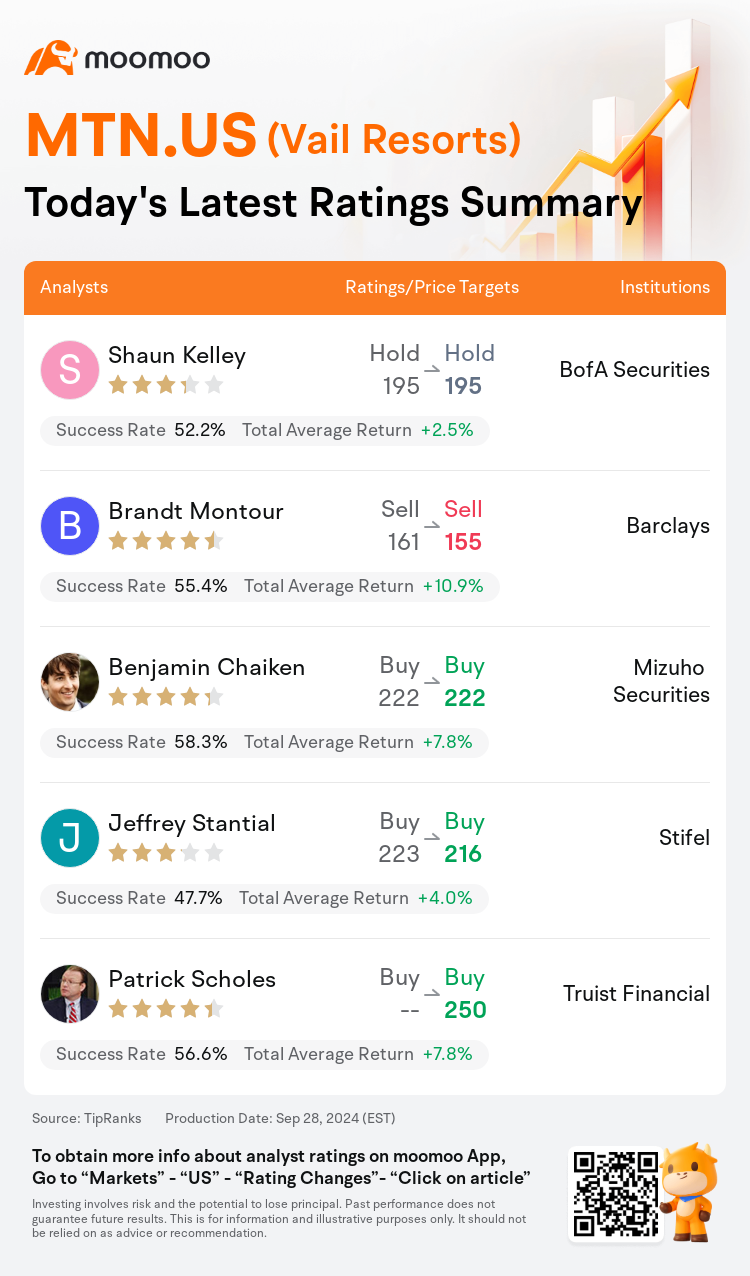

On Sep 28, major Wall Street analysts update their ratings for $Vail Resorts (MTN.US)$, with price targets ranging from $155 to $250.

BofA Securities analyst Shaun Kelley maintains with a hold rating, and maintains the target price at $195.

Barclays analyst Brandt Montour maintains with a sell rating, and adjusts the target price from $161 to $155.

Mizuho Securities analyst Benjamin Chaiken maintains with a buy rating, and maintains the target price at $222.

Mizuho Securities analyst Benjamin Chaiken maintains with a buy rating, and maintains the target price at $222.

Stifel analyst Jeffrey Stantial maintains with a buy rating, and adjusts the target price from $223 to $216.

Truist Financial analyst Patrick Scholes maintains with a buy rating, and sets the target price at $250.

Furthermore, according to the comprehensive report, the opinions of $Vail Resorts (MTN.US)$'s main analysts recently are as follows:

The initial fiscal 2025 guidance for Vail Resorts is construed as softer than anticipated, with potential for further downside risks should weather conditions be less favorable than usual. This outlook has reinforced the view that Vail Resorts faces inherent challenges to its organic growth.

Expectations are set for Vail Resorts' guidance for FY25 to fall short of the consensus, as estimations are adjusted to mirror the belief that the downward revisions seen over the past year stem more from a normalization in industry demand rather than adverse weather conditions. It's noted that the market may have already anticipated a lower guidance, but with stock seasonality and predictions of a La Nina weather pattern, there could be optimism influencing the stock following the earnings announcement.

Following Vail Resorts' announcement of a 'mixed' Q4 and the introduction of FY25 Resort adjusted EBITDA guidance slightly below consensus at the midpoint, the sentiment remains somewhat subdued. Despite the complexity of the guidance and the anticipation that it may not significantly affect the already low expectations, the attention is now turning towards the 2024/25 season. The key question is whether the company can meet the revised guidance and achieve a return to more normalized growth by FY26.

Here are the latest investment ratings and price targets for $Vail Resorts (MTN.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间9月28日,多家华尔街大行更新了$Vail Resorts (MTN.US)$的评级,目标价介于155美元至250美元。

美银证券分析师Shaun Kelley维持持有评级,维持目标价195美元。

巴克莱银行分析师Brandt Montour维持卖出评级,并将目标价从161美元下调至155美元。

瑞穗证券分析师Benjamin Chaiken维持买入评级,维持目标价222美元。

瑞穗证券分析师Benjamin Chaiken维持买入评级,维持目标价222美元。

斯迪富分析师Jeffrey Stantial维持买入评级,并将目标价从223美元下调至216美元。

储亿银行分析师Patrick Scholes维持买入评级,目标价250美元。

此外,综合报道,$Vail Resorts (MTN.US)$近期主要分析师观点如下:

据解释,Vail Resorts的2025财年初步指引比预期的要软一些,如果天气状况不如平时那么有进一步的下行风险。这种前景强化了这样的观点,即韦尔度假村的有机增长面临着固有的挑战。

预计Vail Resorts对25财年的指导将无法达到共识,因为对估值进行了调整,以反映这样的观点,即过去一年的向下修正更多地源于行业需求的正常化,而不是不利的天气状况。值得注意的是,市场可能已经预计会有更低的预期,但鉴于股票季节性和对拉尼娜天气模式的预测,财报公布后,可能会出现乐观情绪影响该股。

在韦尔度假村宣布第四季度 “喜忧参半”,并推出25财年度假村调整后的息税折旧摊销前利润指引中点略低于市场预期水平之后,市场情绪仍然有些低迷。尽管该指导方针很复杂,而且预计它可能不会对本已很低的预期产生重大影响,但现在的注意力正转向2024/25赛季。关键问题是该公司能否满足修订后的指导方针,并在26财年之前恢复更为正常的增长。

以下为今日5位分析师对$Vail Resorts (MTN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞穗证券分析师Benjamin Chaiken维持买入评级,维持目标价222美元。

瑞穗证券分析师Benjamin Chaiken维持买入评级,维持目标价222美元。

Mizuho Securities analyst Benjamin Chaiken maintains with a buy rating, and maintains the target price at $222.

Mizuho Securities analyst Benjamin Chaiken maintains with a buy rating, and maintains the target price at $222.