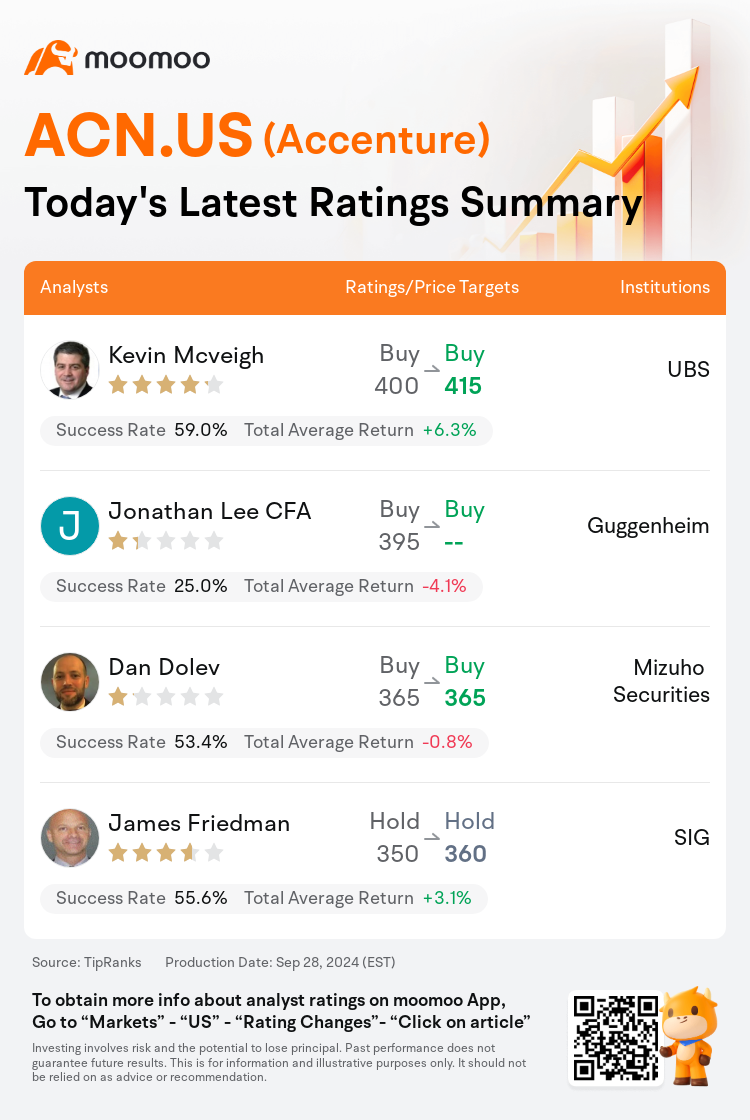

On Sep 28, major Wall Street analysts update their ratings for $Accenture (ACN.US)$, with price targets ranging from $360 to $415.

UBS analyst Kevin Mcveigh maintains with a buy rating, and adjusts the target price from $400 to $415.

Guggenheim analyst Jonathan Lee CFA maintains with a buy rating.

Mizuho Securities analyst Dan Dolev maintains with a buy rating, and maintains the target price at $365.

Mizuho Securities analyst Dan Dolev maintains with a buy rating, and maintains the target price at $365.

SIG analyst James Friedman maintains with a hold rating, and adjusts the target price from $350 to $360.

Furthermore, according to the comprehensive report, the opinions of $Accenture (ACN.US)$'s main analysts recently are as follows:

The stock is anticipated to experience an expansion in its multiple as General AI is expected to drive revenue growth in conjunction with sustained capital return.

The key insights from Accenture's earnings discussion indicated that the upper limit of their FY25 constant currency revenue growth forecast, ranging from 3% to 6%, does not rely on an uptick in discretionary spending. Conversely, the lower end of the guidance is designed to withstand potential declines. The conservative nature of this early FY25 projection is thought to resonate well with investors, bolstered by a greater quantity of significant transformational agreements in the current backlog compared to the previous year.

The ongoing momentum within the Health & Public Service sector has bolstered management's belief in achieving the upper spectrum of the company's annual constant currency organic growth projection, which ranges from 0-3%. This has resulted in commentary regarding the fiscal year 2025 organic growth that is more optimistic than initially anticipated.

Accenture's recent quarter showed satisfactory performance with a 24% increase in bookings, marking the most favorable comparison in several years. The company's forecast of 3%-6% growth is considered an appropriate initial estimate. Historically, Accenture has shown variability in achieving the mid-point of its guidance. It's suggested that the results may align with the forecasted range, with potential for higher outcomes.

Accenture's robust Q4 earnings surpassed expectations, bolstered by the recognition of revenue from larger projects initiated in prior periods. This has led to a significant quarter-over-quarter advancement, most notably within its Strategy & Consulting segment. Additionally, Accenture's FY24 gen-AI bookings have exceeded $3B with revenue reaching $900M, a sharp increase from $300M in bookings and $100M in revenue reported in FY23.

Here are the latest investment ratings and price targets for $Accenture (ACN.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

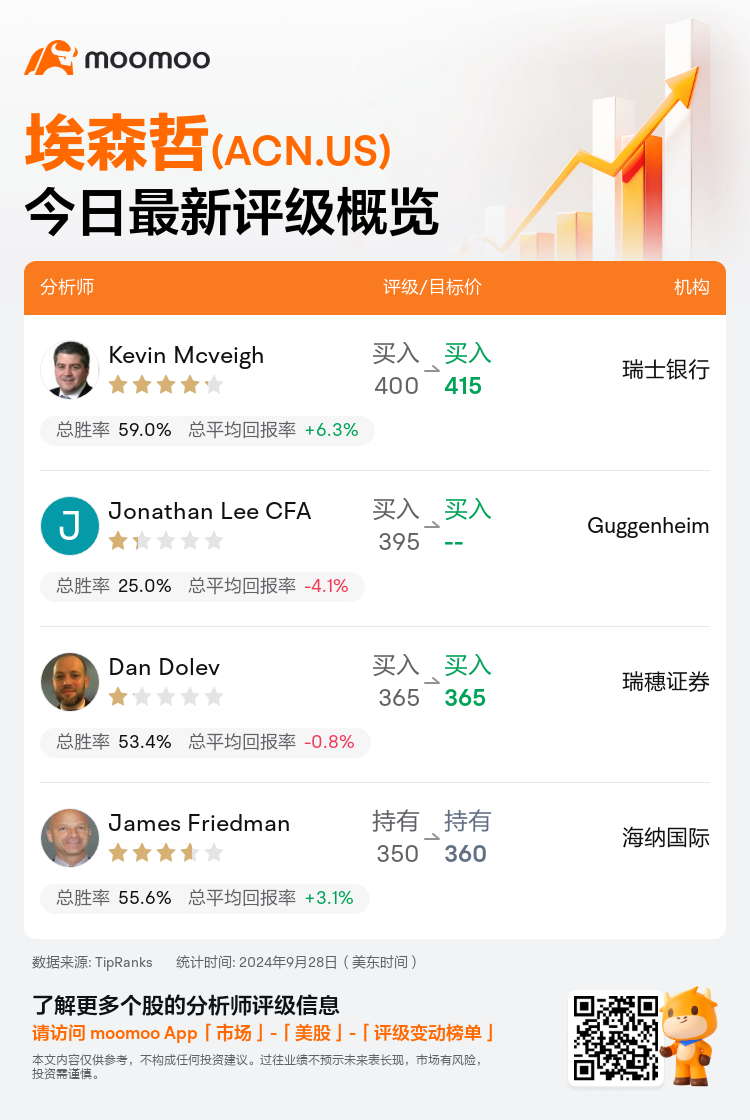

美东时间9月28日,多家华尔街大行更新了$埃森哲 (ACN.US)$的评级,目标价介于360美元至415美元。

瑞士银行分析师Kevin Mcveigh维持买入评级,并将目标价从400美元上调至415美元。

Guggenheim分析师Jonathan Lee CFA维持买入评级。

瑞穗证券分析师Dan Dolev维持买入评级,维持目标价365美元。

瑞穗证券分析师Dan Dolev维持买入评级,维持目标价365美元。

海纳国际分析师James Friedman维持持有评级,并将目标价从350美元上调至360美元。

此外,综合报道,$埃森哲 (ACN.US)$近期主要分析师观点如下:

由于预计通用人工智能将推动收入增长以及持续的资本回报,该股的倍数预计将扩大。

埃森哲财报讨论中的关键见解表明,其25财年固定货币收入增长预测的上限,从3%到6%不等,并不依赖于全权支出的增加。相反,该指引的下限旨在承受潜在的下跌。据认为,25财年早期预测的保守性质引起了投资者的共鸣,这得益于当前积压的重大转型协议与去年相比数量的增加。

健康与公共服务领域的持续势头增强了管理层的信念,即实现公司年度固定货币有机增长预测的上限,范围为0-3%。这导致对2025财年有机增长的评论比最初的预期更加乐观。

埃森哲最近一个季度的表现令人满意,预订量增长了24%,这是几年来最有利的比较。该公司对3%-6%的增长的预测被认为是适当的初步估计。从历史上看,埃森哲在实现其指导目标的中点方面表现出可变性。有人认为,结果可能与预测区间一致,有可能产生更高的结果。

埃森哲第四季度强劲的收益超出了预期,这得益于对前期启动的大型项目的收入的确认。这带来了显著的季度同比增长,最值得注意的是其战略与咨询板块。此外,埃森哲24财年的Gen-AI预订量已超过30亿美元,收入达到9亿美元,较23财年公布的3亿美元预订量和1亿美元收入大幅增加。

以下为今日4位分析师对$埃森哲 (ACN.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

瑞穗证券分析师Dan Dolev维持买入评级,维持目标价365美元。

瑞穗证券分析师Dan Dolev维持买入评级,维持目标价365美元。

Mizuho Securities analyst Dan Dolev maintains with a buy rating, and maintains the target price at $365.

Mizuho Securities analyst Dan Dolev maintains with a buy rating, and maintains the target price at $365.