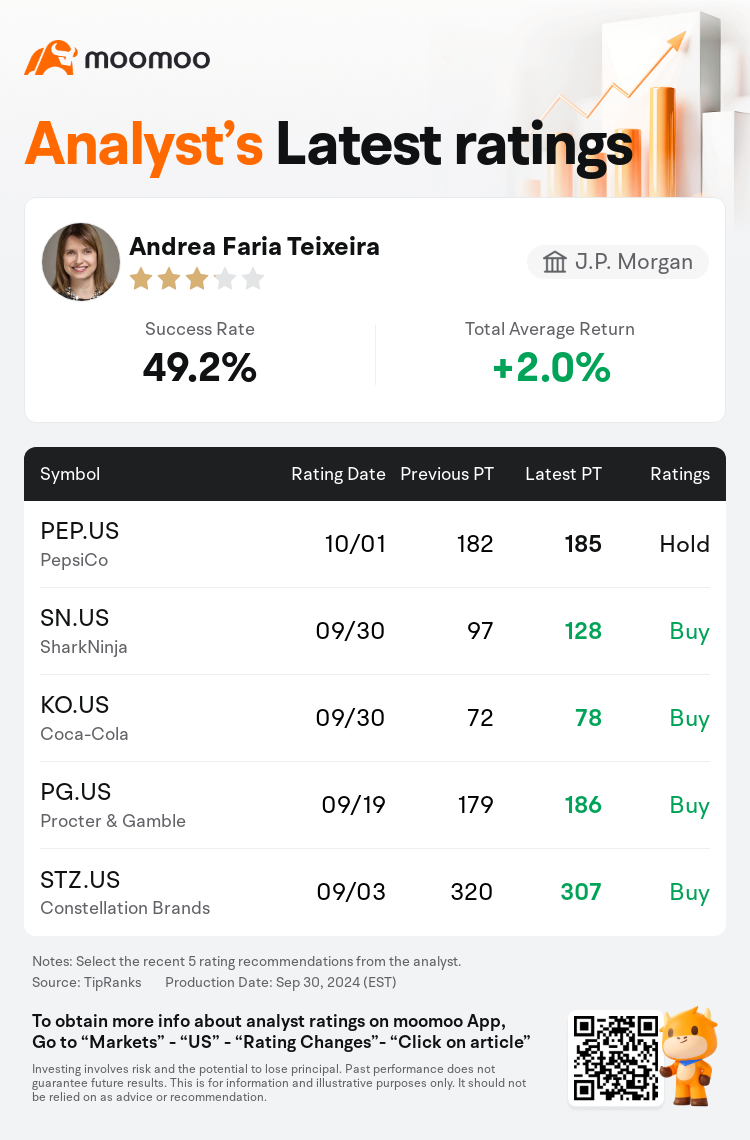

J.P. Morgan analyst Andrea Faria Teixeira maintains $SharkNinja (SN.US)$ with a buy rating, and adjusts the target price from $97 to $128.

According to TipRanks data, the analyst has a success rate of 49.2% and a total average return of 2.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $SharkNinja (SN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $SharkNinja (SN.US)$'s main analysts recently are as follows:

Most investors gained a greater understanding of the durability of SharkNinja's rapid sales expansion following an investor meeting with the company's management. This growth is attributed to continuous innovation and three primary growth drivers: increasing market share in current categories, branching into new categories, and expanding geographically. There is a heightened confidence in the potential for surpassing near-term estimates, with management conveying a positive outlook on their ability to achieve sustained growth.

SharkNinja has been recognized for its exceptional performance, consistently surpassing expectations in recent quarters despite a challenging U.S. consumer durables landscape. Looking ahead, the company's prominent brand collection, history of significant innovation, and distinctive marketing initiatives are anticipated to drive further market share increases. Ongoing retail analysis has revealed an expanded presence of SharkNinja offerings across various U.S. retailers, which is perceived as a positive indicator for the company's enduring growth potential.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

摩根大通分析师Andrea Faria Teixeira维持$SharkNinja (SN.US)$买入评级,并将目标价从97美元上调至128美元。

根据TipRanks数据显示,该分析师近一年总胜率为49.2%,总平均回报率为2.0%。

此外,综合报道,$SharkNinja (SN.US)$近期主要分析师观点如下:

此外,综合报道,$SharkNinja (SN.US)$近期主要分析师观点如下:

在投资者与SharkNinja管理层会面后,大多数投资者对SharkNinja快速销售扩张的持久性有了更多的了解。这种增长归因于持续创新和三个主要增长动力:增加当前类别的市场份额、进入新类别以及地域扩张。管理层对其实现持续增长的能力表示了乐观的展望,人们对超过短期预期的可能性增强了信心。

SharkNinja因其出色的表现而获得认可,尽管美国耐用消费品格局充满挑战,但最近几个季度仍持续超出预期。展望未来,该公司的知名品牌系列、重大创新的历史和独特的营销举措预计将进一步推动市场份额的增长。正在进行的零售分析显示,SharkNinja产品在美国多家零售商中的业务有所扩大,这被视为该公司持续增长潜力的积极指标。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$SharkNinja (SN.US)$近期主要分析师观点如下:

此外,综合报道,$SharkNinja (SN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of