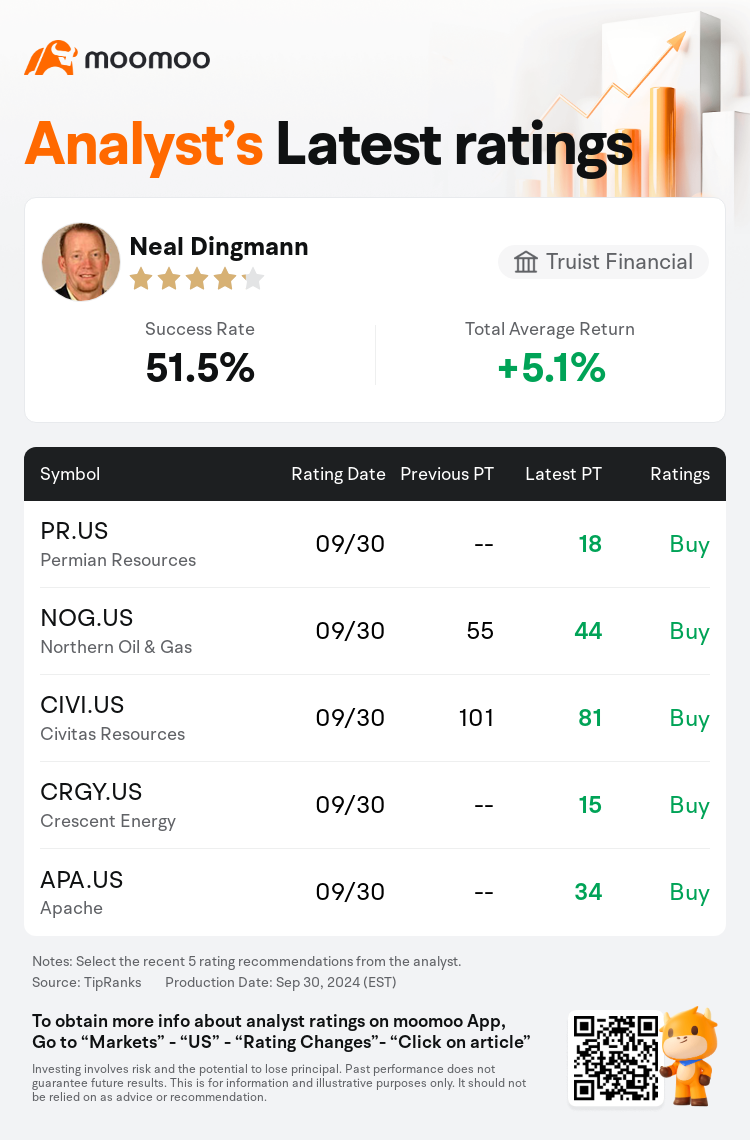

Truist Financial analyst Neal Dingmann maintains $Permian Resources (PR.US)$ with a buy rating, and sets the target price at $18.

According to TipRanks data, the analyst has a success rate of 51.5% and a total average return of 5.1% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Permian Resources (PR.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Permian Resources (PR.US)$'s main analysts recently are as follows:

Permian Resources is positioned to outperform its peers due to 'several fundamental elements' that provide scarcity value in its investment portfolio. It is considered one of the few 'high quality' pure-play companies focused on the Permian Basin, which ensures strong inventory quality compared to peers, especially with its acreage concentrated in the high-quality resource area of the Delaware Basin.

The exploration and production group estimates have been adjusted to align with updated commodity price projections and investment perspectives. Despite the adjustment of the estimates, the long-term oil and gas price expectations remain steady, with Brent at $80 and Henry Hub at $3.50. Should operational efficiency gains continue and service costs reduce further, it's anticipated that the exploration and production companies could maintain improved capital efficiency up until 2025. This might help to counterbalance the effects of resource maturity.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

储亿银行分析师Neal Dingmann维持$Permian Resources (PR.US)$买入评级,目标价18美元。

根据TipRanks数据显示,该分析师近一年总胜率为51.5%,总平均回报率为5.1%。

此外,综合报道,$Permian Resources (PR.US)$近期主要分析师观点如下:

此外,综合报道,$Permian Resources (PR.US)$近期主要分析师观点如下:

由于 “几个基本要素” 为其投资组合提供了稀缺价值,Permian Resources有望跑赢同行。它被认为是为数不多的专注于二叠纪盆地的 “高质量” 纯粹公司之一,与同行相比,二叠纪盆地确保了良好的库存质量,尤其是其种植面积集中在特拉华盆地的高质量资源区。

对勘探和生产集团的估计进行了调整,以适应最新的大宗商品价格预测和投资前景。尽管调整了估计,但长期石油和天然气价格预期保持稳定,布伦特原油为80美元,亨利枢纽为3.50美元。如果运营效率持续提高,服务成本进一步降低,预计勘探和生产公司可以在2025年之前保持更高的资本效率。这可能有助于抵消资源成熟度的影响。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Permian Resources (PR.US)$近期主要分析师观点如下:

此外,综合报道,$Permian Resources (PR.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of