Jim Cramer Calls Starbucks A 'Stimulus Play': Golden Cross Signals Bullish Run Ahead

Jim Cramer Calls Starbucks A 'Stimulus Play': Golden Cross Signals Bullish Run Ahead

Starbucks Corp (NASDAQ:SBUX) is brewing excitement as a Golden Cross formation suggests a potential bullish run.

星巴克公司(纳斯达克:SBUX)正酝酿激动人心,因为金叉形态暗示着潜在的看好行情。

The stock is up 6.84% over the past year, with a 3.94% gain year-to-date.

过去一年股价上涨了6.84%,年初至今涨幅为3.94%。

Jim Cramer recently put the spotlight on Starbucks, naming it one of his top "stimulus plays" in the wake of China's renewed economic efforts, alongside heavyweights like Alibaba Group Holdings Ltd (NYSE:BABA) (NYSE:BABAF) and Apple Inc (NASDAQ:AAPL).

吉姆·克雷默最近将焦点放在星巴克上,将其列为他在中国经济再度振兴之际的顶级“刺激性投资”,与阿里巴巴集团控股有限公司(纽交所:BABA)(纽交所:BABAF)和苹果公司(纳斯达克:AAPL)等巨头并列。

In a Sept. 30 tweet, the "Mad Money" host said:

在9月30日的推文中,“疯狂金钱”主持人说:

Back in action after some nice time off and i see that the Chinese are, once again, stimulating and everyone's back... Perfect....Sorry to be so cynical. But if you want stimulus plays: BABA, AAPL and SBUX will do

— Jim Cramer (@jimcramer) September 30, 2024

在一些愉快的休息后重返工作,我发现中国人再次刺激经济,每个人都回来了...完美....抱歉这么愤世嫉俗。但如果您想要刺激性投资:BABA、AAPL和SBUX会做到

— 吉姆·克雷默 (@jimcramer) 2024年9月30日

Cramer's call comes at a pivotal moment for Starbucks. The coffee giant faces headwinds in its second-largest market, China. Last quarter, Starbucks saw a 14% drop in same-store sales in China. The U.S. market experienced a more modest 2% decline.

克雷默的看涨来到了关键时刻的星巴克。这家咖啡巨头在其次大市场中国面临阻力。上个季度,星巴克在中国同店销售额下降了14%。美国市场经历了更为温和的2%下降。

Read Also: Is Starbucks Stock a Buy, Sell or Retain at 24.79x P/E?

阅读更多:星巴克股票今天是买入、卖出还是持有?24.79倍市盈率?

Despite these challenges, the technicals suggest Starbucks stock is gearing up for a strong push forward.

尽管面临这些挑战,技术指标表明星巴克股票正准备迎来强劲的向前推动。

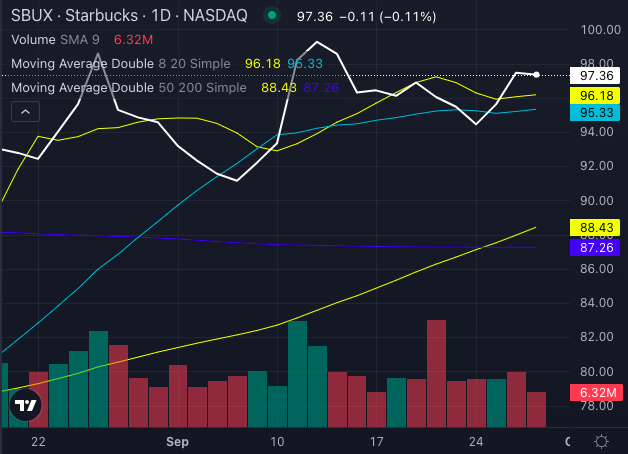

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

The Golden Cross — a key technical indicator where the 50-day moving average crosses above the 200-day moving average— signals that bullish momentum is taking hold.

黄金交叉——一个关键的技术指标,即50天移动平均线上穿200天移动平均线——表明看涨势头正在形成。

With the current share price at $97.36, Starbucks stock remains well above its 50-day SMA of $88.43 and 200-day SMA of $87.26, reinforcing the bullish signal.

当前股价为97.36美元,星巴克股票仍远高于其88.43美元的50天简单移动平均线和87.26美元的200天简单移动平均线,加强了看涨信号。

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Additionally, Starbucks stock is trading above its shorter-term moving averages, with its eight-day SMA at $96.18 and its 20-day SMA at $95.33, both of which are also bullish signals. This alignment of moving averages shows that Starbucks stock has maintained consistent upward momentum, even amid some broader market volatility.

此外,星巴克股票的交易价格高于其较短期的移动平均线,其8天简单移动平均线为96.18美元,20天简单移动平均线为95.33美元,这两者也都是积极信号。这些移动平均线的走势一致显示,星巴克股票一直保持着持续向上的势头,即使在一些更广泛的市场波动中。

While Starbucks continues to navigate its union negotiations in the U.S., CEO Brian Niccol has signaled a new era of constructive dialogue, which could further stabilize the company's U.S. operations.

星巴克正继续在美国进行其工会谈判,首席执行官Brian Niccol已经暗示了一种新的建设性对话时代,这可能进一步稳定该公司的美国业务。

Investors are keen to see if Cramer's endorsement and the Golden Cross can help fuel the stock's next move higher.

投资者渴望看到Cramer的支持和黄金交叉是否能帮助推动股价进一步上涨。

As the coffee retailer navigates both economic pressures and labor relations, the technicals suggest the stock is well-positioned for a breakout.

随着这家咖啡零售商在经济压力和劳资关系两方面的变化,技术指标表明该股票已经准备好突破。

- Intuitive Machines Rockets 240% Year-To-Date, Forms Golden Cross After $4.8B NASA Contract

- Intuitive Machines今年迄今上涨240%,在与48亿美元NASA合同后形成金叉

Image: Shutterstock

图片:shutterstock

In a Sept. 30 tweet, the "Mad Money" host said:

In a Sept. 30 tweet, the "Mad Money" host said: