Decoding Carnival's Options Activity: What's the Big Picture?

Decoding Carnival's Options Activity: What's the Big Picture?

High-rolling investors have positioned themselves bullish on Carnival (NYSE:CCL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CCL often signals that someone has privileged information.

投机性投资者在嘉年华存托凭证(纽交所:CCL)上看好,对零售交易者来说这很重要。 这一活动是通过Benzinga追踪公开可获得的期权数据而引起我们的注意的。这些投资者的身份尚不确定,但CCL股票的如此重大变动常常意味着有人掌握了内幕信息。

Today, Benzinga's options scanner spotted 8 options trades for Carnival. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了8笔针对嘉年华的期权交易。这并不是一个典型的模式。

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $33,000, and 7 calls, totaling $518,532.

这些主要交易者中情绪分为两派,有50%看好,50%看淡。在我们识别的所有期权中,有一个看跌,金额为33,000美元,还有7个看涨,总额为518,532美元。

What's The Price Target?

目标价是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

分析这些合同的成交量和未平仓量,似乎大户一直在关注嘉年华在过去一个季度的12.5美元至19.0美元的价格区间内的窗口。

Insights into Volume & Open Interest

成交量和持仓量分析

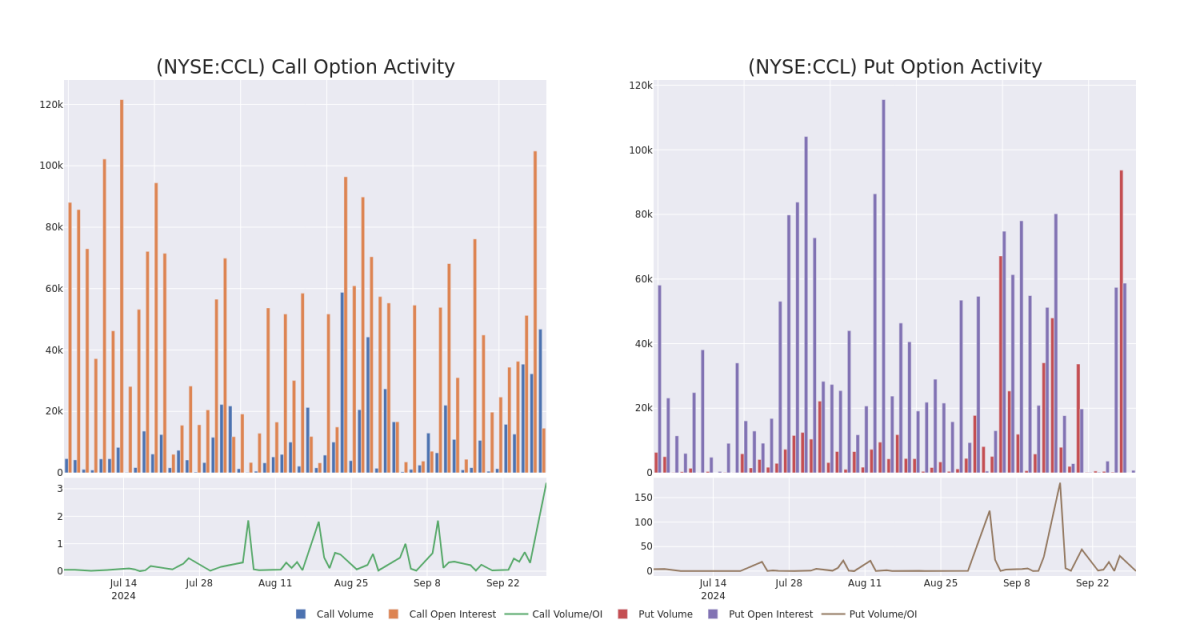

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carnival's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carnival's significant trades, within a strike price range of $12.5 to $19.0, over the past month.

检查成交量和未平仓量为股票研究提供了重要见解。这些信息对于衡量在特定行权价格上有关嘉年华期权的流动性和兴趣水平至关重要。在下面,我们展示在过去一个月内关于嘉年华重大交易中看涨和看跌期权成交量和未平仓量的趋势快照,范围为12.5至19.0美元之间的行权价格。

Carnival Option Activity Analysis: Last 30 Days

嘉年华存托凭证期权活动分析:过去30天

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | TRADE | BEARISH | 10/04/24 | $0.75 | $0.73 | $0.73 | $17.50 | $242.1K | 1.6K | 8.3K |

| CCL | CALL | SWEEP | BULLISH | 10/04/24 | $0.86 | $0.83 | $0.85 | $17.50 | $65.3K | 1.6K | 11.9K |

| CCL | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.5 | $1.52 | $19.00 | $64.6K | 9.3K | 569 |

| CCL | CALL | TRADE | BULLISH | 10/04/24 | $1.01 | $0.98 | $1.01 | $17.50 | $50.5K | 1.6K | 12.8K |

| CCL | CALL | SWEEP | BEARISH | 10/11/24 | $4.95 | $4.85 | $4.95 | $12.50 | $34.1K | 1 | 86 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 嘉年华邮轮 | 看涨 | 交易 | 看淡 | 10/04/24 | 0.75美元 | 0.73美元 | 0.73美元 | $17.50 | $242.1K | 1.6K | 8.3K |

| 嘉年华邮轮 | 看涨 | SWEEP | 看好 | 10/04/24 | 每股0.86美元 | 0.83美元 | $0.85 | $17.50 | $65.3K | 1.6K | 11.9K |

| 嘉年华邮轮 | 看涨 | SWEEP | 看好 | 01/17/25 | $1.52 | $1.5 | $1.52 | 19.00美元 | $64.6K | 9.3K | 569 |

| 嘉年华邮轮 | 看涨 | 交易 | 看好 | 10/04/24 | $1.01 | $0.98 | $1.01 | $17.50 | $50.5K | 1.6K | 12.8K |

| 嘉年华邮轮 | 看涨 | SWEEP | 看淡 | 10/11/24 | $4.95 | $4.85 | $4.95 | 该公司股价收盘价为10.54美元。 | $34.1K | 1 | 86 |

About Carnival

关于Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

Carnival是全球最大的游轮公司,在2023财年结束时拥有92艘船只。其品牌组合包括北美的Carnival Cruise Lines,Holland America,Princess Cruises和Seabourn;英国的P&O Cruises和Cunard Line;德国的Aida;南欧的Costa Cruises。它目前正在将其P&O Australia品牌整合到Carnival中。该公司还拥有Alaska的Holland America Princess Alaska Tours和加拿大育空地区的公司。在2019年新冠肺炎疫情之前,Carnival的品牌吸引了近1300万客人,这个水平在2023年恢复。

Where Is Carnival Standing Right Now?

嘉年华存托凭证目前处于什么位置?

- With a trading volume of 21,317,495, the price of CCL is down by -3.86%, reaching $17.82.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

- 成交量为21,317,495,CCL的价格下跌了-3.86%,达到$17.82。

- 当前RSI值表明该股票可能接近超买状态。

- 下一次盈利报告计划在0天内发布。

What Analysts Are Saying About Carnival

关于嘉年华存托凭证有多少分析师表示

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

过去一个月,有2位行业分析师分享了他们对这只股票的见解,提出了26.0美元的平均目标价。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Stifel persists with their Buy rating on Carnival, maintaining a target price of $27. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Carnival with a target price of $25.

Benzinga Edge的飞凡期权板块在潜在市场走势发生前发现了潜在的市场动向。看看大笔资金在你喜爱的股票上持有何种头寸。点击这里进行查看。*斯蒂芬尔的一位分析师坚持给予嘉年华买入评级,并维持目标价27美元。*米酒的一位分析师持续看好嘉年华,保持目标价25美元,并对其评级为表现优异。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多个因子,并密切关注市场走势来管理这些风险。通过Benzinga Pro实时警报及时了解最新的嘉年华存托凭证期权交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.