Here's Why We Think Fair Isaac (NYSE:FICO) Might Deserve Your Attention Today

Here's Why We Think Fair Isaac (NYSE:FICO) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

许多投资者,特别是没经验的投资者,买入公司的股份时会想要听取一个好故事,即使那些公司亏损。不幸的是,这些高风险投资往往几乎没有实现其付出的可能性,许多投资者会为此付出代价去吸取教训。亏损公司会像一块资金的海绵,因此投资者要谨慎,以免把好钱投进去坏钱后面。

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Fair Isaac (NYSE:FICO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

如果高风险高回报的想法不适合您,您可能会更感兴趣于像Fair Isaac(NYSE:FICO)这样盈利增长的公司。现在这并不是说这家公司提供了最佳的投资机会,但盈利能力是业务成功的关键组成部分。

Fair Isaac's Earnings Per Share Are Growing

Fair Isaac的每股收益正在增长

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Fair Isaac managed to grow EPS by 16% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

如果一家公司能够保持足够长时间的每股收益(EPS)增长,其股价最终应该会跟随。这意味着EPS增长被大多数成功的长期投资者视为真正的利好。Fair Isaac设法在过去三年内每年增长16%的EPS。假设公司能够保持这种增长速度,那增长速度相当不错。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Fair Isaac achieved similar EBIT margins to last year, revenue grew by a solid 12% to US$1.7b. That's progress.

仔细考虑营业收入增长和利润之前的利息和税前税后利润(EBIT)利润率,可以帮助了解最近利润增长的可持续性。虽然我们注意到Fair Isaac实现了类似于去年的EBIt利润率,但营业收入实现了实际上的12%增长,达到了 US$17亿。那是进步。

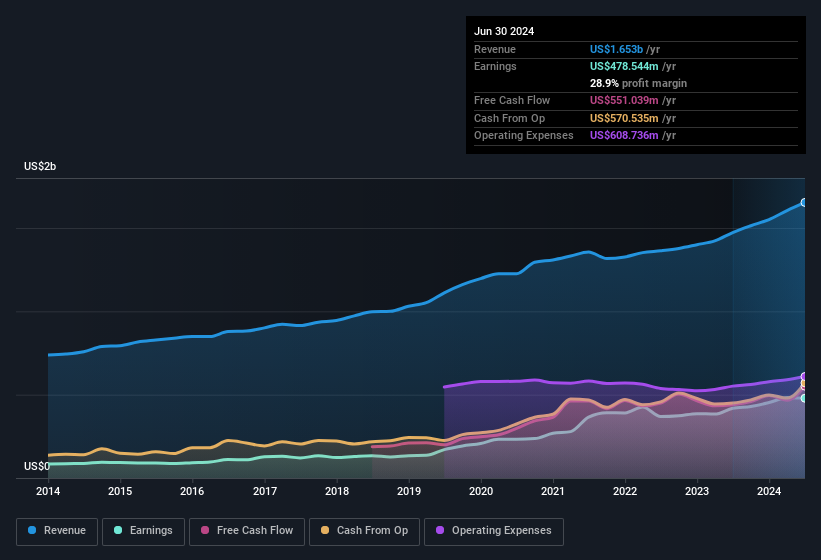

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

下图显示了该公司底线和顶线随着时间的推移而发展的情况。点击图片以获取更精细的详细信息。

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Fair Isaac's future profits.

不要一味借助后视镜来开车,因此您可能对此免费报告更感兴趣,显示分析师对fair isaac未来利润的预测。

Are Fair Isaac Insiders Aligned With All Shareholders?

Fair Isaac的内部人员是否与所有股东保持一致?

Owing to the size of Fair Isaac, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Notably, they have an enviable stake in the company, worth US$1.2b. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

考虑到fair isaac的规模,我们不会指望内部人士持有公司的重大比例。但我们对他们是公司投资者这一事实感到安心。值得注意的是,他们在公司拥有令人羡慕的12亿美元股份。这表明领导层在做决定时会非常考虑股东的利益!

Is Fair Isaac Worth Keeping An Eye On?

fair isaac 值得密切关注吗?

As previously touched on, Fair Isaac is a growing business, which is encouraging. To add an extra spark to the fire, significant insider ownership in the company is another highlight. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Fair Isaac that you should be aware of.

如前所述,fair isaac是一个增长中的企业,这是鼓舞人心的。再加之,公司内部人士持有大量股份也是另一个亮点。这两个因素是公司的重要亮点,应成为您观察清单中的一个强有力竞争者。不要忘记仍然可能存在风险。例如,我们已经确定了您应该注意的fair isaac的2个警告信号。

Although Fair Isaac certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

尽管fair isaac看起来不错,但如果内部人士在购买股票,可能会吸引更多投资者。如果您喜欢看到更多公司投入游戏中,那就看看这些精心挑选的公司,它们不仅拥有强劲增长,而且有强大的内部支持。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

请注意,本文讨论的内部交易是指在相关司法管辖区中报告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Fair Isaac achieved similar EBIT margins to last year, revenue grew by a solid 12% to US$1.7b. That's progress.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Fair Isaac achieved similar EBIT margins to last year, revenue grew by a solid 12% to US$1.7b. That's progress.