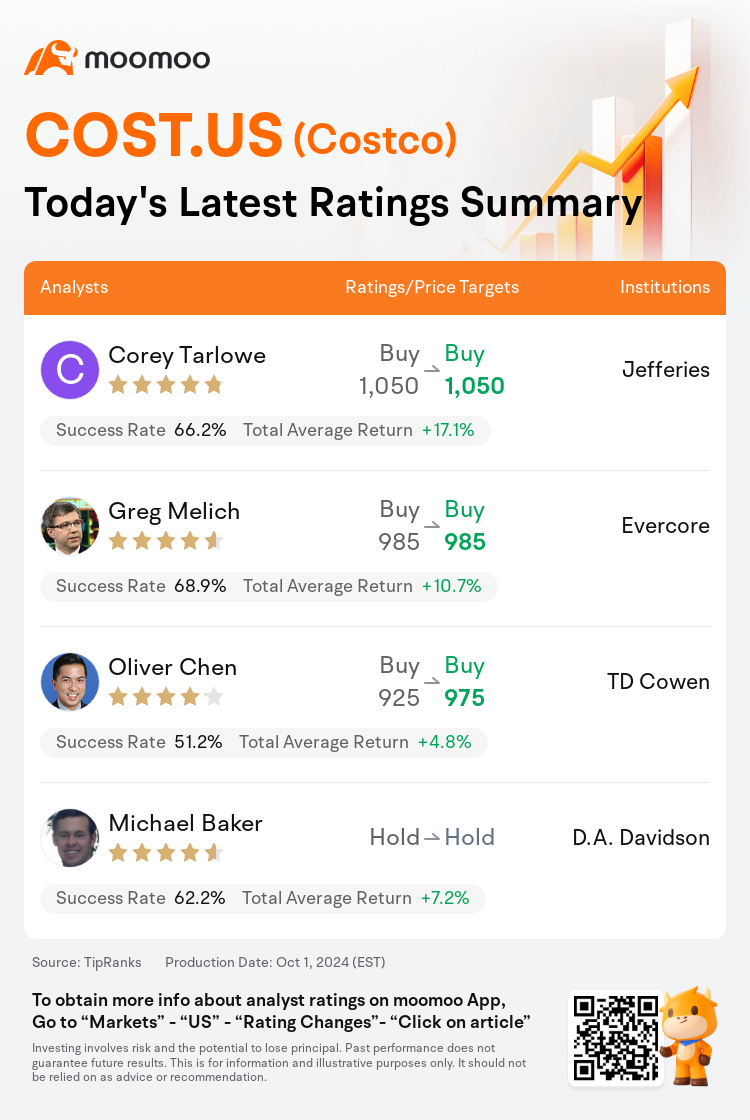

On Oct 01, major Wall Street analysts update their ratings for $Costco (COST.US)$, with price targets ranging from $975 to $1,050.

Jefferies analyst Corey Tarlowe maintains with a buy rating, and maintains the target price at $1,050.

Evercore analyst Greg Melich maintains with a buy rating, and maintains the target price at $985.

TD Cowen analyst Oliver Chen maintains with a buy rating, and adjusts the target price from $925 to $975.

TD Cowen analyst Oliver Chen maintains with a buy rating, and adjusts the target price from $925 to $975.

D.A. Davidson analyst Michael Baker maintains with a hold rating.

Furthermore, according to the comprehensive report, the opinions of $Costco (COST.US)$'s main analysts recently are as follows:

The company has reported another robust quarter, showcasing stable underlying trends, advancements in e-commerce coupled with enhanced profitability, and solid trends in membership. There is an anticipation that the company's momentum will be sustained.

The notable increase in U.S. traffic by 5.6% and a gross margin improvement of 44 basis points reflect positively on Costco's emphasis on value, enhancement of product offerings, and appeal to a younger demographic. The company has also benefited from the positive effects of digital expansion and fuel operations on its gross margins, which have helped to balance out investments in administrative expenses and employee wages.

Costco has demonstrated robust underlying earnings for Q4, with gross margins and comparable sales slightly surpassing expectations, coupled with a steady 6% rise in global customer traffic. Despite above-average EPS growth projections for FY24, there is a more cautious forecast for the following years due to the company's pattern of reinvesting member fee income hikes. Nonetheless, the positive trajectory of e-commerce growth is noted, and the valuation of the stock is considered to remain appealing.

The company has reported robust fiscal Q4 results with EBIT slightly surpassing the consensus. A 6.9% comparable store sales growth, alongside a marginal year-over-year expansion in core-on-core gross margin, has led to approximately 13% growth in earnings per share, indicating the robustness of the company's business model. It is anticipated that the recent increase in membership fees will be primarily reinvested, which is expected to further support sales, comparable store sales, and traffic growth over the forthcoming 12 to 18 months. Consequently, earnings per share estimates for FY25-FY26 have been modestly increased post-report.

The firm maintains a positive outlook on Costco following a Q4 earnings report that surpassed expectations. The firm recognizes significant value in driving customer traffic to shopping clubs and notes that there has been no substantial shift in membership renewal rates even with the recent fee hike. Additionally, Costco's e-commerce platform shows robust growth, with a notable 20% rise on a core basis, particularly in segments like appliances and home furnishings, which are believed to be approaching a cyclical low point.

Here are the latest investment ratings and price targets for $Costco (COST.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

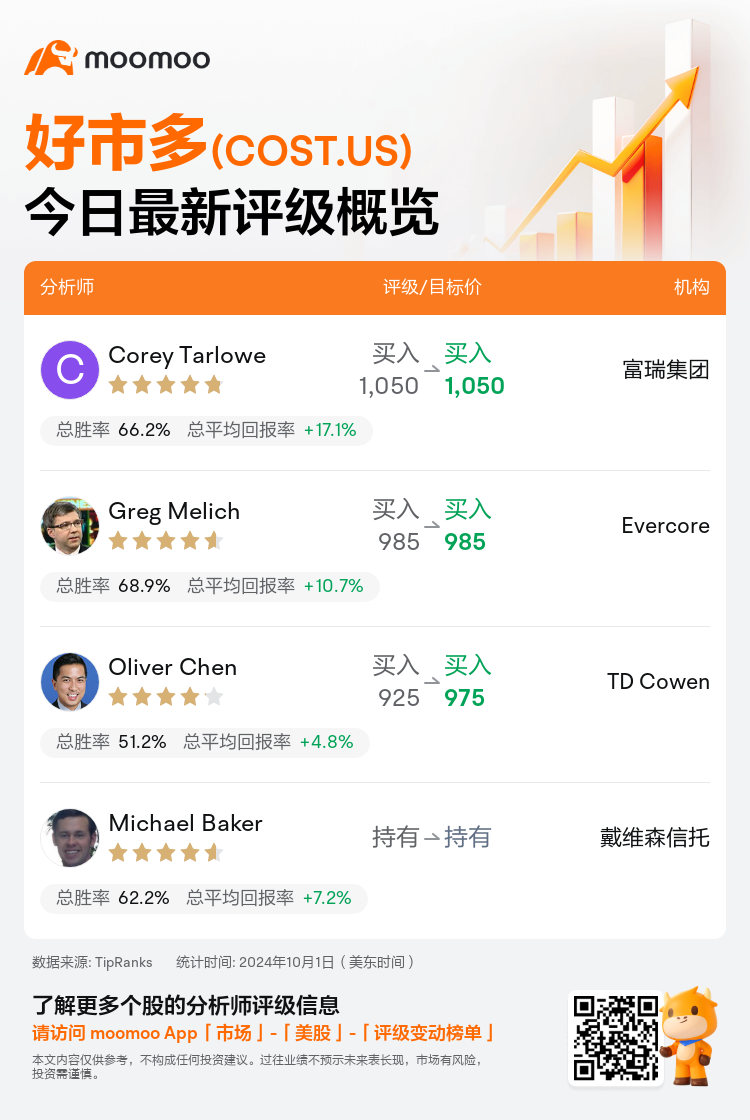

美东时间10月1日,多家华尔街大行更新了$好市多 (COST.US)$的评级,目标价介于975美元至1,050美元。

富瑞集团分析师Corey Tarlowe维持买入评级,维持目标价1,050美元。

Evercore分析师Greg Melich维持买入评级,维持目标价985美元。

TD Cowen分析师Oliver Chen维持买入评级,并将目标价从925美元上调至975美元。

TD Cowen分析师Oliver Chen维持买入评级,并将目标价从925美元上调至975美元。

戴维森信托分析师Michael Baker维持持有评级。

此外,综合报道,$好市多 (COST.US)$近期主要分析师观点如下:

该公司报告了又一个强劲的季度,显示出稳定的潜在趋势、电子商务的进步、盈利能力的提高以及会员人数的稳健趋势。预计该公司的势头将保持不变。

美国流量显著增长了5.6%,毛利率提高了44个基点,这积极反映了好市多对价值、增强产品供应和吸引年轻人群的重视。该公司还受益于数字化扩张和推动运营对其毛利率的积极影响,这有助于平衡管理费用和员工工资方面的投资。

Costco在第四季度表现出强劲的基础收益,毛利率和可比销售额略超预期,全球客户流量稳步增长6%。尽管对24财年的每股收益增长预测高于平均水平,但由于该公司对会员费收入增加进行再投资的模式,对未来几年的预测更为谨慎。尽管如此,人们注意到电子商务的积极增长轨迹,该股的估值被认为仍然具有吸引力。

该公司公布了强劲的第四财季业绩,息税前利润略高于市场预期。可比门店销售增长6.9%,核心毛利率同比略有增长,使每股收益增长了约13%,这表明了公司商业模式的稳健性。预计最近增加的会员费将主要用于再投资,这有望在未来12至18个月内进一步支持销售、同类门店销售和流量增长。因此,报告发布后,FY25-FY26 的每股收益估计略有增加。

在第四季度收益报告超出预期之后,该公司对Costco保持乐观的前景。该公司认识到增加购物俱乐部客户流量的巨大价值,并指出,即使最近费用上涨,会员续订率也没有实质性变化。此外,Costco的电子商务平台显示出强劲的增长,核心业务增长了20%,尤其是在电器和家居用品等细分市场,据信这些细分市场已接近周期性低点。

以下为今日4位分析师对$好市多 (COST.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师Oliver Chen维持买入评级,并将目标价从925美元上调至975美元。

TD Cowen分析师Oliver Chen维持买入评级,并将目标价从925美元上调至975美元。

TD Cowen analyst Oliver Chen maintains with a buy rating, and adjusts the target price from $925 to $975.

TD Cowen analyst Oliver Chen maintains with a buy rating, and adjusts the target price from $925 to $975.