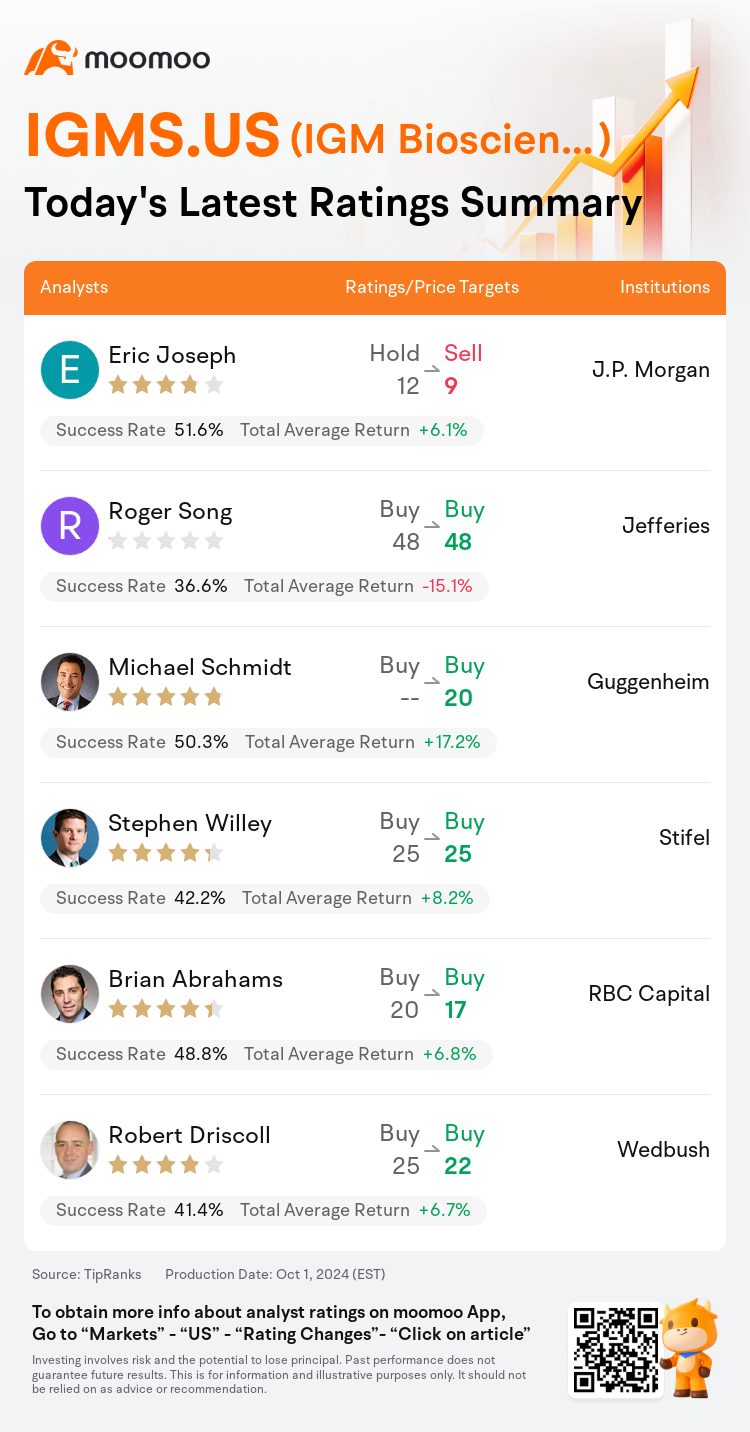

On Oct 01, major Wall Street analysts update their ratings for $IGM Biosciences (IGMS.US)$, with price targets ranging from $9 to $48.

J.P. Morgan analyst Eric Joseph downgrades to a sell rating, and adjusts the target price from $12 to $9.

Jefferies analyst Roger Song maintains with a buy rating, and maintains the target price at $48.

Guggenheim analyst Michael Schmidt maintains with a buy rating, and sets the target price at $20.

Guggenheim analyst Michael Schmidt maintains with a buy rating, and sets the target price at $20.

Stifel analyst Stephen Willey maintains with a buy rating, and maintains the target price at $25.

RBC Capital analyst Brian Abrahams maintains with a buy rating, and adjusts the target price from $20 to $17.

Furthermore, according to the comprehensive report, the opinions of $IGM Biosciences (IGMS.US)$'s main analysts recently are as follows:

IGM Biosciences announced a shift in their pipeline focus, emphasizing their I&I candidates imvotamab and IGM-2644 while discontinuing the oncology asset aplitabart following an interim evaluation of a study for second-line metastatic renal cell carcinoma. Concurrent with this pipeline update, there was a significant turnover among the company's executive leadership. This alteration in strategy has led to a perceived reduction in potential catalysts for IGM's stock value in the mid-term, resulting in a view of an unfavorable risk/reward scenario at the current share price.

IGM Biosciences has decided to halt the advancement of aplitabart in oncology to pivot its attention towards autoimmune diseases exclusively. This strategic shift follows data from a recent trial in combination with FOLFIRI and bevacizumab for second-line metastatic colorectal cancer, which reached full enrollment earlier. Analysts maintain a positive outlook on bispecific T cell engagers for B cell-mediated autoimmune conditions and suggest that IgM bispecifics could offer superior safety and efficacy compared to IgG counterparts. Consequently, forecasts have been adjusted to exclude aplitabart, while incorporating projections for imvotamab in systemic lupus erythematosus due to the redirection of resources and focus.

Following IGM Biosciences' strategic shift to concentrate solely on autoimmune diseases, including halting the development of aplitabart in second-line mCRC and advancing imvotamab and IGM-2644 for autoimmune conditions, analysts perceive the discontinuation of aplitabart as a disappointment. However, it is not considered essential to the core investment narrative as it was deemed a high-risk initiative. The pipeline's recent realignment is seen positively and as a proper strategic decision.

The halting of aplitabart has been seen as a setback, yet IGM Biosciences' transition towards a dedicated autoimmune entity with a focus on T-cell engagers is expected to clarify their investment narrative, concentrate on the most promising sectors, and conserve resources. Despite a drop in the stock's post-market performance, it is perceived as an opportunity to invest before the release of significant autoimmune data related to imvotamab.

Here are the latest investment ratings and price targets for $IGM Biosciences (IGMS.US)$ from 6 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

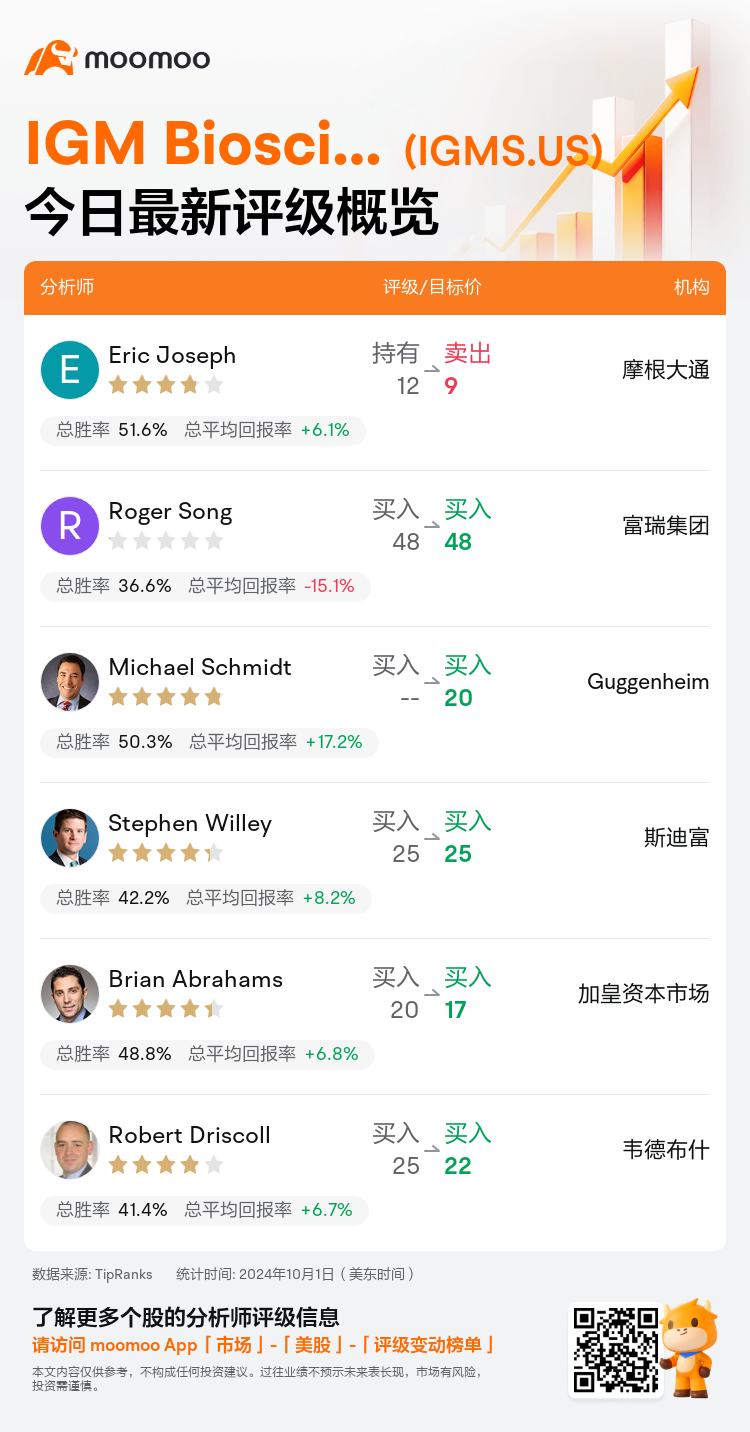

美东时间10月1日,多家华尔街大行更新了$IGM Biosciences (IGMS.US)$的评级,目标价介于9美元至48美元。

摩根大通分析师Eric Joseph下调至卖出评级,并将目标价从12美元下调至9美元。

富瑞集团分析师Roger Song维持买入评级,维持目标价48美元。

Guggenheim分析师Michael Schmidt维持买入评级,目标价20美元。

Guggenheim分析师Michael Schmidt维持买入评级,目标价20美元。

斯迪富分析师Stephen Willey维持买入评级,维持目标价25美元。

加皇资本市场分析师Brian Abrahams维持买入评级,并将目标价从20美元下调至17美元。

此外,综合报道,$IGM Biosciences (IGMS.US)$近期主要分析师观点如下:

IgM Biosciences宣布转变研发重点,强调其I&I候选药物imvotamab和IgM-2644,同时在对一项二线转移性肾细胞癌的研究进行中期评估后,停止了肿瘤资产aplitabart。在这次管道更新的同时,公司高管领导层的人员流失率也很高。这种战略的改变导致IGM股票价值的潜在催化剂在中期内明显减少,导致人们认为当前股价的风险/回报情景不利。

IgM Biosciences已决定停止aplitabart在肿瘤学领域的发展,将其注意力完全集中在自身免疫性疾病上。这一战略转变是在最近一项与FOLFIRI和贝伐珠单抗联合治疗二线转移性结直肠癌的试验数据之后发生的,该试验较早已达到满员入组。分析师对治疗b细胞介导的自身免疫性疾病的双特异性T细胞参与剂保持乐观展望,并认为与IgG同行相比,IgM双特异性可以提供更高的安全性和有效性。因此,由于资源和重点的重定向,对预测进行了调整,将aplitabart排除在系统性红斑狼疮中,同时纳入了对imvotamab的预测。

继IgM Biosciences的战略转向仅专注于自身免疫性疾病之后,包括停止二线mCRC中aplitabart的开发以及推进针对自身免疫性疾病的imvotamab和IgM-2644的开发,分析人士认为停止使用aplitabart令人失望。但是,它被认为是一项高风险举措,因此不被认为对核心投资叙述至关重要。该管道最近的调整被视为积极的战略决策。

aplitabart的停产被视为挫折,但预计IgM Biosciences向专注于T细胞参与者的专门自身免疫实体的过渡将澄清他们的投资理念,专注于最有前途的行业,并节省资源。尽管该股的盘后表现有所下降,但在发布与imvotamab相关的重要自身免疫数据之前,它被视为投资的机会。

以下为今日6位分析师对$IGM Biosciences (IGMS.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

Guggenheim分析师Michael Schmidt维持买入评级,目标价20美元。

Guggenheim分析师Michael Schmidt维持买入评级,目标价20美元。

Guggenheim analyst Michael Schmidt maintains with a buy rating, and sets the target price at $20.

Guggenheim analyst Michael Schmidt maintains with a buy rating, and sets the target price at $20.