Market Whales and Their Recent Bets on Block Options

Market Whales and Their Recent Bets on Block Options

Financial giants have made a conspicuous bullish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 16 unusual trades.

金融巨头在板块上做出了明显的看好举动。我们对纽交所出现的期权历史进行分析,发现16笔飞凡交易。

Delving into the details, we found 62% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $294,142, and 10 were calls, valued at $533,520.

深入细节后,我们发现62%的交易者看好,而37%表现出看淡趋势。在我们发现的所有交易中,有6笔看跌交易,价值294,142美元,10笔看涨交易,价值533,520美元。

What's The Price Target?

目标价是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $30.0 to $80.0 for Block over the last 3 months.

考虑到这些合约的成交量和未平仓合约量,似乎鲸鱼们在过去3个月内一直瞄准了板块价格在30.0至80.0美元的区间。

Volume & Open Interest Trends

成交量和未平仓量趋势

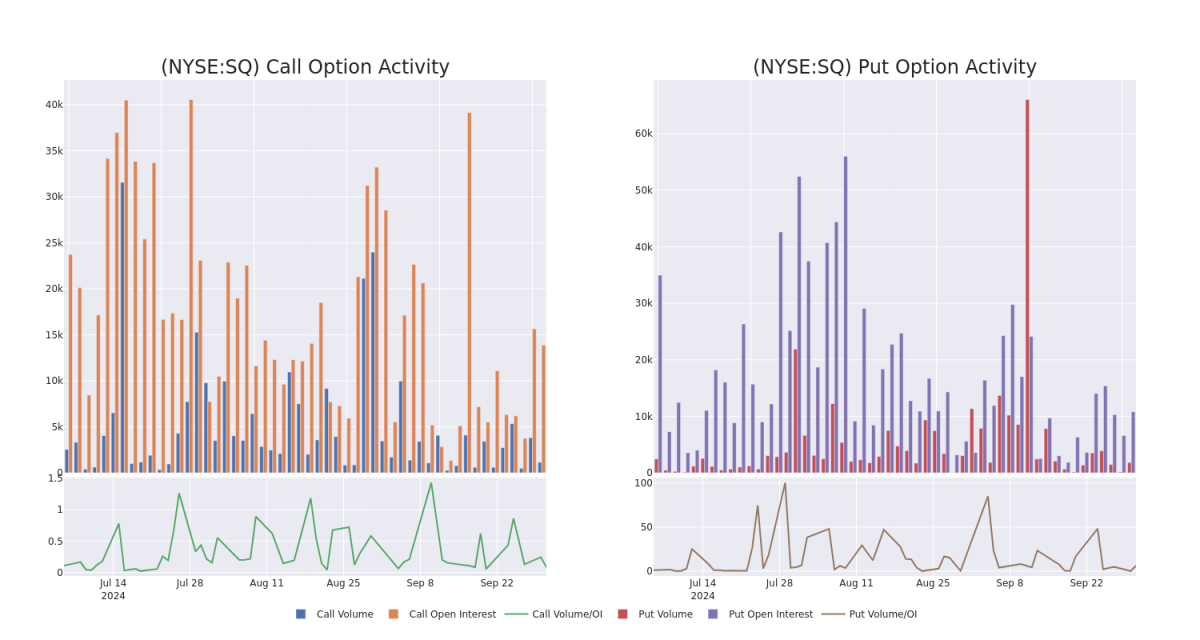

In today's trading context, the average open interest for options of Block stands at 1541.06, with a total volume reaching 2,962.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Block, situated within the strike price corridor from $30.0 to $80.0, throughout the last 30 days.

在今天的交易背景下,板块期权的平均未平仓合约量为1541.06,总成交量达到2,962.00。随附的图表详细描述了板块高价交易的看涨和看跌期权成交量和未平仓合约量的发展情况,在过去30天内都位于30.0至80.0美元的行权价走廊内。

Block 30-Day Option Volume & Interest Snapshot

Block 30天期权成交量和持仓量快照

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BULLISH | 12/18/26 | $38.85 | $37.3 | $38.33 | $32.50 | $95.8K | 36 | 0 |

| SQ | CALL | SWEEP | BULLISH | 12/20/24 | $9.75 | $9.65 | $9.75 | $60.00 | $87.7K | 601 | 113 |

| SQ | CALL | TRADE | BULLISH | 01/17/25 | $36.4 | $34.95 | $36.4 | $30.00 | $80.0K | 363 | 0 |

| SQ | PUT | SWEEP | BEARISH | 01/17/25 | $3.5 | $3.45 | $3.5 | $57.50 | $65.4K | 2.4K | 397 |

| SQ | PUT | TRADE | BEARISH | 10/04/24 | $1.98 | $1.73 | $1.9 | $66.00 | $64.4K | 1.8K | 878 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 看涨 | 交易 | 看好 | 12/18/26 | $38.85 | $37.3 | $38.33 | $32.50 | 95.8千美元 | 36 | 0 |

| SQ | 看涨 | SWEEP | 看好 | 12/20/24 | $9.75 | $9.65 | $9.75 | $60.00 | $87.7K | 601 | 113 |

| SQ | 看涨 | 交易 | 看好 | 01/17/25 | 36.4美元 | $34.95 | 36.4美元 | $30.00 | $80.0K | 363 | 0 |

| SQ | 看跌 | SWEEP | 看淡 | 01/17/25 | $3.5 | $3.45 | $3.5 | $57.50 | $65.4千美元 | 2.4K | 397 |

| SQ | 看跌 | 交易 | 看淡 | 10/04/24 | $1.98 | $1.73 | $1.9 | $66.00 | $64.4K | 1.8K | 878 |

About Block

关于Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

成立于2009年,Block为商家提供支付服务及相关服务。该公司还推出了Cash App,一个人对人的支付网络。2023年,Square的支付量略超过2亿美元。

After a thorough review of the options trading surrounding Block, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对Block周边的期权交易进行彻底审查后,我们转而更详细地研究该公司。这包括对其当前市场地位和表现的评估。

Where Is Block Standing Right Now?

区块现在的位置在哪里?

- Trading volume stands at 2,008,015, with SQ's price down by -3.29%, positioned at $64.92.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 30 days.

- 交易量为2,008,015,SQ的价格下跌了-3.29%,定位在$64.92。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 预计30天内公布收益公告。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

In today's trading context, the average open interest for options of Block stands at 1541.06, with a total volume reaching 2,962.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Block, situated within the strike price corridor from $30.0 to $80.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Block stands at 1541.06, with a total volume reaching 2,962.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Block, situated within the strike price corridor from $30.0 to $80.0, throughout the last 30 days.