Smart Money Is Betting Big In MRVL Options

Smart Money Is Betting Big In MRVL Options

Whales with a lot of money to spend have taken a noticeably bullish stance on Marvell Tech.

具有大量资金的鲸鱼对Marvell Tech持有显著看好态度。

Looking at options history for Marvell Tech (NASDAQ:MRVL) we detected 9 trades.

查看迈威尔科技(纳斯达克:MRVL)的期权交易历史,我们检测到了9笔交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

如果我们考虑每次交易的具体情况,准确地说,44%的投资者带着看好的预期开启了交易,而44%则是看淡的。

From the overall spotted trades, 4 are puts, for a total amount of $239,185 and 5, calls, for a total amount of $370,011.

在所有发现的交易中,有4笔为看跌,总金额为239,185美元,5笔为看涨,总金额为370,011美元。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $85.0 for Marvell Tech over the recent three months.

根据交易活动,看起来重要的投资者们正在瞄准迈威尔科技在最近三个月内的价格区间,从65.0美元到85.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

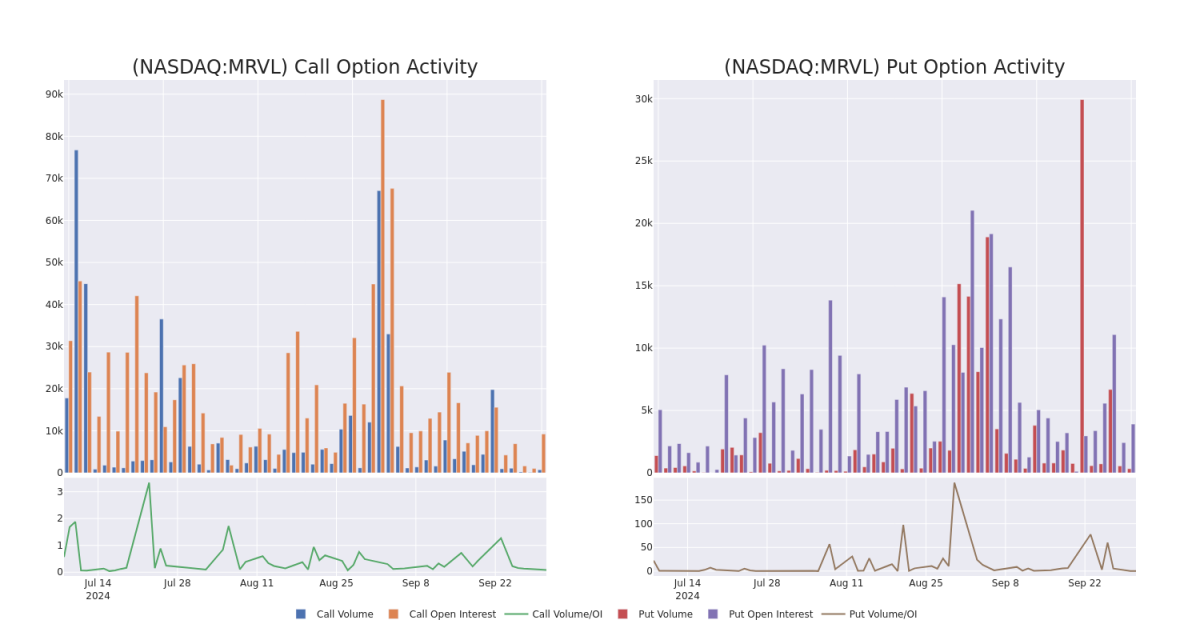

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marvell Tech's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marvell Tech's substantial trades, within a strike price spectrum from $65.0 to $85.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易的战略步骤。这些指标揭示了在指定执行价格下,对迈威尔科技期权的流动性和投资者兴趣。接下来的数据可视化展示了在过去30天内,关于迈威尔科技的重要交易所涉及的期权成交量和未平仓合约的波动,涵盖了从65.0美元到85.0美元的执行价格范围。

Marvell Tech Option Activity Analysis: Last 30 Days

Marvell Tech期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $11.2 | $11.05 | $11.2 | $65.00 | $224.0K | 3.0K | 200 |

| MRVL | PUT | SWEEP | BEARISH | 11/15/24 | $7.8 | $7.7 | $7.8 | $77.50 | $103.7K | 697 | 133 |

| MRVL | PUT | SWEEP | BULLISH | 10/18/24 | $1.64 | $1.59 | $1.59 | $67.50 | $54.8K | 1.9K | 116 |

| MRVL | PUT | SWEEP | BEARISH | 11/15/24 | $6.4 | $6.3 | $6.4 | $75.00 | $50.5K | 936 | 79 |

| MRVL | CALL | SWEEP | NEUTRAL | 01/17/25 | $2.94 | $2.87 | $2.89 | $85.00 | $39.3K | 4.2K | 272 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 迈威尔科技 | 看涨 | SWEEP | 看好 | 01/17/25 | $11.2 | $11.05 | $11.2 | $65.00 | $224.0K | 3.0K | 200 |

| 迈威尔科技 | 看跌 | SWEEP | 看淡 | 11/15/24 | $7.8 | $7.7 | $7.8 | $77.50 | $103.7K | 697 | 133 |

| 迈威尔科技 | 看跌 | SWEEP | 看好 | 10/18/24 | $1.64 | $1.59 | $1.59 | $67.50 | $54.8K | 1.9K | 279 |

| 迈威尔科技 | 看跌 | SWEEP | 看淡 | 11/15/24 | 6.4美元 | $6.3 | 6.4美元 | $75.00 | $50.5K | 936 | 79 |

| 迈威尔科技 | 看涨 | SWEEP | 中立 | 01/17/25 | 2.94美元 | $2.87 | $2.89 | $85.00 | $39.3K | 4.2千 | 272 |

About Marvell Tech

关于迈威尔科技

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

迈威尔科技是一家无晶圆厂的芯片设计公司,专门从事有线网络领域的业务,其市场占有率排名第二。迈威尔公司在处理器、光纤和铜传送器、交换机和存储控制器方面为数据中心、运营商、企业、汽车和消费者等各领域提供服务。

Following our analysis of the options activities associated with Marvell Tech, we pivot to a closer look at the company's own performance.

在分析与Marvell Tech相关的期权活动后,我们转而更加密切地关注公司自身的表现。

Where Is Marvell Tech Standing Right Now?

Marvell Tech如今处于什么位置?

- Currently trading with a volume of 3,079,868, the MRVL's price is down by -1.66%, now at $70.92.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 59 days.

- 目前成交量为3,079,868,迈威尔科技的价格下跌了-1.66%,目前为$70.92。

- RSI读数表明该股目前可能接近超买水平。

- 预计收益发布还有59天。

Unusual Options Activity Detected: Smart Money on the Move

检测到期权异动:智慧资金在行动。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的期权异动模块可以提前发现潜在的市场热点。了解大笔的资金在您喜欢的股票上的仓位变动。点击这里获取访问权限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

From the overall spotted trades, 4 are puts, for a total amount of $239,185 and 5, calls, for a total amount of $370,011.

From the overall spotted trades, 4 are puts, for a total amount of $239,185 and 5, calls, for a total amount of $370,011.