A Closer Look at Intuit's Options Market Dynamics

A Closer Look at Intuit's Options Market Dynamics

Financial giants have made a conspicuous bearish move on Intuit. Our analysis of options history for Intuit (NASDAQ:INTU) revealed 8 unusual trades.

金融巨头已经对 Intuit 采取了明显的看淡举措。我们对 Intuit(纳斯达克:INTU)的期权历史进行分析发现了 8 笔异常交易。

Delving into the details, we found 25% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $135,320, and 5 were calls, valued at $344,908.

深入研究后,我们发现25%的交易员持买入看好态度,而37%则展现出看淡倾向。在所有我们发现的交易中,有 3 笔为看跌,价值为 $135,320,而有 5 笔为看涨,价值为 $344,908。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $670.0 for Intuit during the past quarter.

分析这些合约的成交量和未平仓量,似乎大户在过去一季度一直关注着 Intuit 在 $400.0 到 $670.0 之间的价格区间。

Insights into Volume & Open Interest

成交量和持仓量分析

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.

就流动性和利息而言,今天 Intuit 期权交易的平均未平仓量为 257.0,总成交量为 230.00。

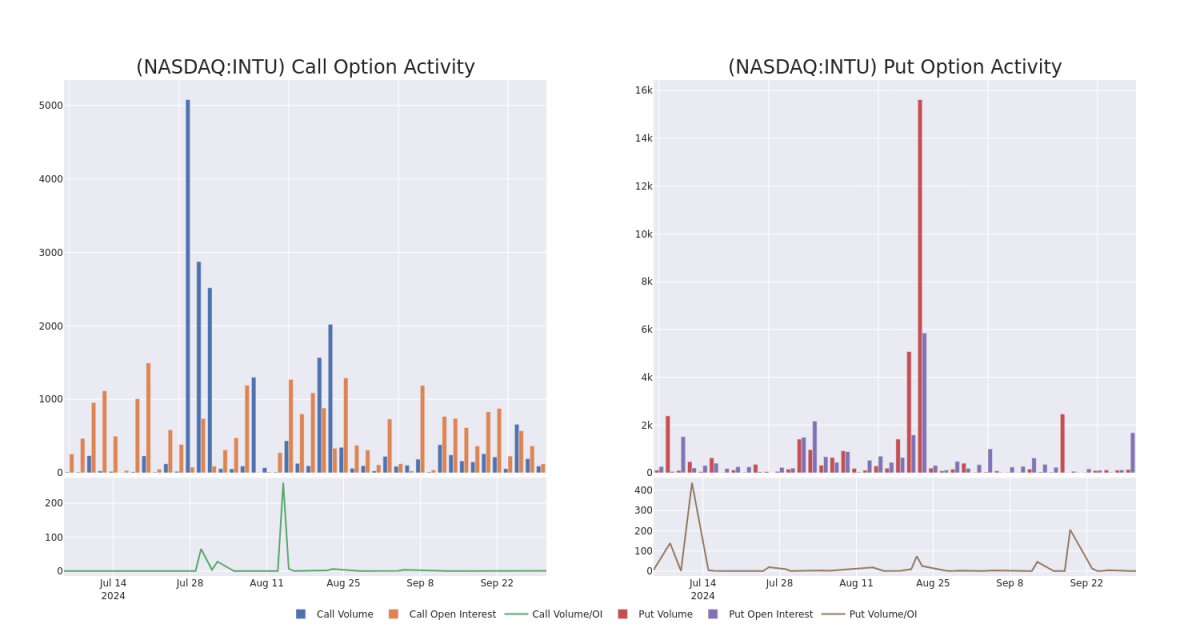

In the following chart, we are able to follow the development of volume and open interest of call and put options for Intuit's big money trades within a strike price range of $400.0 to $670.0 over the last 30 days.

在接下来的图表中,我们可以追踪过去 30 天内 Intuit 大额交易的看涨和看跌期权的成交量和未平仓量发展,涵盖了 $400.0 到 $670.0 的行权价区间。

Intuit Option Activity Analysis: Last 30 Days

Intuit 期权活动分析:过去 30 天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | CALL | SWEEP | BEARISH | 01/16/26 | $66.0 | $65.5 | $65.5 | $670.00 | $157.2K | 71 | 32 |

| INTU | CALL | TRADE | NEUTRAL | 01/17/25 | $39.0 | $38.2 | $38.55 | $610.00 | $65.5K | 46 | 45 |

| INTU | PUT | TRADE | BULLISH | 10/18/24 | $12.4 | $11.9 | $12.0 | $600.00 | $60.0K | 1.5K | 104 |

| INTU | CALL | SWEEP | BEARISH | 04/17/25 | $42.7 | $40.6 | $40.95 | $640.00 | $53.0K | 5 | 15 |

| INTU | PUT | TRADE | NEUTRAL | 12/20/24 | $22.6 | $22.0 | $22.3 | $590.00 | $44.6K | 101 | 21 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 财捷 | 看涨 | SWEEP | 看淡 | 01/16/26 | $66.0 | $65.5 | $65.5 | 670.00美元 | $157.2K | 71 | 32 |

| 财捷 | 看涨 | 交易 | 中立 | 01/17/25 | $39.0 | 38.2美元 | $38.55 | $610.00 | $65.5K | 46 | 45 |

| 财捷 | 看跌 | 交易 | 看好 | 10/18/24 | $12.4 | $11.9 | $12.0 | $600.00 | $60.0K | 1.5K | 104 |

| 财捷 | 看涨 | SWEEP | 看淡 | 04/17/25 | $42.7 | $40.6 | $40.95 | $640.00 | 53.0千美元 | 5 | 15 |

| 财捷 | 看跌 | 交易 | 中立 | 12/20/24 | $22.6 | $22.0 | $22.3 | 590.00美元 | 44.6千美元 | 101 | 21 |

About Intuit

关于Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Intuit是小型企业会计软件(QuickBooks)、个人税务解决方案(TurboTax)和专业税务服务(Lacerte)的提供商。成立于1980年代中期,Intuit控制着美国小型企业会计和自助报税软件的大部分市场份额。

Following our analysis of the options activities associated with Intuit, we pivot to a closer look at the company's own performance.

在对Intuit的期权交易活动进行分析后,我们转而更详细地研究了该公司自身的表现。

Present Market Standing of Intuit

Intuit的现有市场地位

- Trading volume stands at 859,127, with INTU's price down by -1.66%, positioned at $610.68.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 56 days.

- 交易量达到859,127,INTU的价格下跌了-1.66%,位于$610.68。

- RSI指标显示该股票目前处于超买和超卖之间的中立状态。

- 盈利公告将于56天后发布。

Expert Opinions on Intuit

有关Intuit的专家意见

In the last month, 1 experts released ratings on this stock with an average target price of $768.0.

在过去一个月里,有1位专家对这只股票发布了评级,平均目标价为$768.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Piper Sandler has decided to maintain their Overweight rating on Intuit, which currently sits at a price target of $768.

20年期权交易专家揭示了他的一行图表技巧,可以显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处进行访问。* 派杰投资的分析师决定维持对Intuit的超配评级,目标价目前为$768。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.

In terms of liquidity and interest, the mean open interest for Intuit options trades today is 257.0 with a total volume of 230.00.