This Is What Whales Are Betting On Deere

This Is What Whales Are Betting On Deere

Financial giants have made a conspicuous bearish move on Deere. Our analysis of options history for Deere (NYSE:DE) revealed 11 unusual trades.

金融巨头在迪尔股份上做出了明显的看淡举动。我们对迪尔股份(NYSE:DE)期权历史的分析显示,出现了11次飞凡交易。

Delving into the details, we found 36% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $109,655, and 8 were calls, valued at $296,345.

深入细节,我们发现36%的交易者看好,而45%表现出看淡倾向。在我们发现的所有交易中,有3次看跌交易,价值109,655美元,和8次看涨交易,价值296,345美元。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $360.0 and $440.0 for Deere, spanning the last three months.

在评估交易量和未平仓合约后,显而易见的是,主要市场推动者将注意力集中在迪尔股份的价格区间360.0美元至440.0美元之间,跨越过去三个月。

Volume & Open Interest Trends

成交量和未平仓量趋势

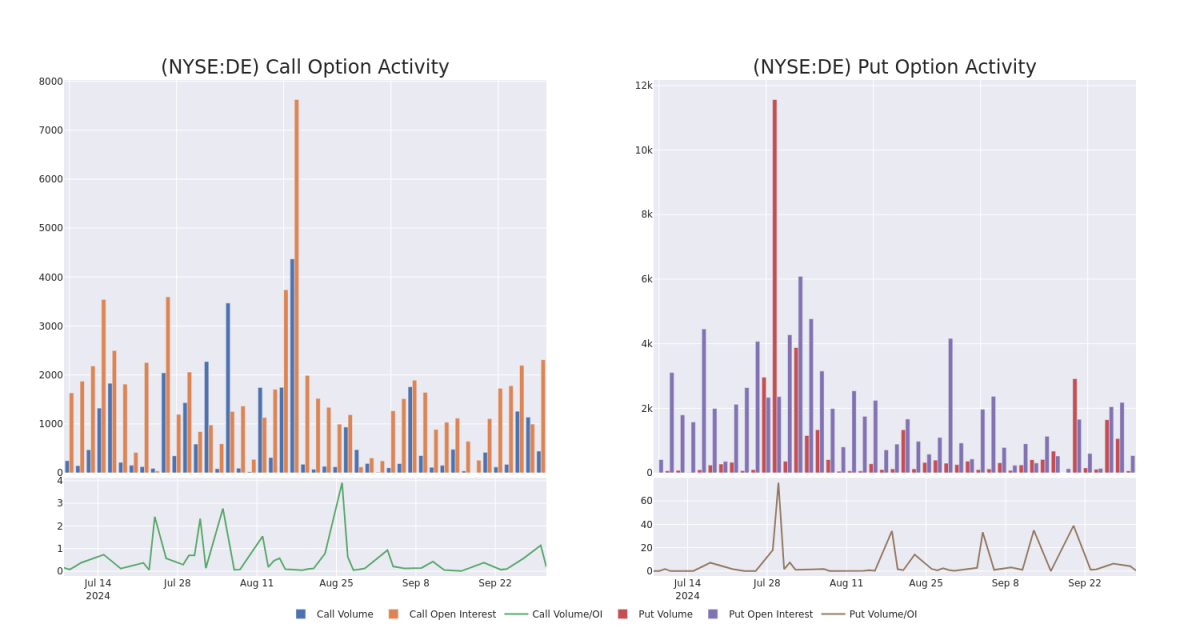

In today's trading context, the average open interest for options of Deere stands at 258.55, with a total volume reaching 496.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Deere, situated within the strike price corridor from $360.0 to $440.0, throughout the last 30 days.

在今日的交易背景下,迪尔股份期权的平均未平仓合约为258.55,总成交量达到496.00。随附的图表描述了过去30天内迪尔股份高价值交易的看涨和看跌期权成交量和未平仓合约的发展情况,这些高价值交易均位于360.0美元至440.0美元的行权价回廊内。

Deere Call and Put Volume: 30-Day Overview

迪尔看涨期权和看跌期权:30天概况

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | CALL | SWEEP | BULLISH | 10/18/24 | $13.5 | $13.3 | $13.5 | $410.00 | $55.3K | 461 | 44 |

| DE | PUT | SWEEP | BEARISH | 12/20/24 | $24.5 | $23.95 | $24.2 | $430.00 | $51.1K | 37 | 10 |

| DE | CALL | TRADE | BEARISH | 03/21/25 | $44.65 | $44.2 | $44.2 | $400.00 | $39.7K | 124 | 9 |

| DE | CALL | TRADE | NEUTRAL | 01/17/25 | $37.4 | $36.5 | $36.95 | $400.00 | $36.9K | 877 | 10 |

| DE | CALL | TRADE | BEARISH | 01/16/26 | $92.9 | $90.3 | $90.3 | $360.00 | $36.1K | 33 | 4 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | 看涨 | SWEEP | 看好 | 10/18/24 | $13.5 | $13.3 | $13.5 | $410.00 | $55.3K | 461 | 44 |

| DE | 看跌 | SWEEP | 看淡 | 12/20/24 | $24.5 | $23.95 | $24.2 | $430.00 | $51.1K | 37 | 10 |

| DE | 看涨 | 交易 | 看淡 | 03/21/25 | $44.65 | $44.2 | $44.2 | $400.00 | $39.7K | 124 | 9 |

| DE | 看涨 | 交易 | 中立 | 01/17/25 | $37.4 | $36.5 | $36.95 | $400.00 | $36.9K | 877 | 10 |

| DE | 看涨 | 交易 | 看淡 | 01/16/26 | 92.9美元 | $90.3 | $90.3 | $360.00 | $36.1K | 33 | 4 |

About Deere

关于迪尔股份

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

迪尔股份是世界领先的农业设备制造商,在重型机械行业以绿色和黄色为主色调的标志性机器而闻名。公司分为四个可报告部门:生产和精确农业、小农业和草坪、施工和林业以及约翰·迪尔资本。其产品通过广泛的经销商网络销售,包括北美地区的2000多个经销商位置和全球约3700个位置。约翰·迪尔资本为其客户提供机械零售融资,此外还为经销商提供批发融资,从而增加了迪尔公司产品销售的可能性。

After a thorough review of the options trading surrounding Deere, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对迪尔股份周边期权交易的全面评估,我们继续更详尽地审视该公司。这包括对其当前市场地位和表现的评估。

Current Position of Deere

迪尔的现状

- With a trading volume of 483,962, the price of DE is up by 0.6%, reaching $419.82.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 50 days from now.

- 交易量达到483,962股,DE的价格上涨0.6%,达到419.82美元。

- 当前RSI值表明股票可能已经超买。

- 下一份收益报告将在50天后发布。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

In today's trading context, the average open interest for options of Deere stands at 258.55, with a total volume reaching 496.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Deere, situated within the strike price corridor from $360.0 to $440.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Deere stands at 258.55, with a total volume reaching 496.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Deere, situated within the strike price corridor from $360.0 to $440.0, throughout the last 30 days.