- 要闻

- 澳优乳制品有限公司(HKG:1717)股价飙升26%,看起来正合适

Ausnutria Dairy Corporation Ltd (HKG:1717) Looks Just Right With A 26% Price Jump

Ausnutria Dairy Corporation Ltd (HKG:1717) Looks Just Right With A 26% Price Jump

Ausnutria Dairy Corporation Ltd (HKG:1717) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

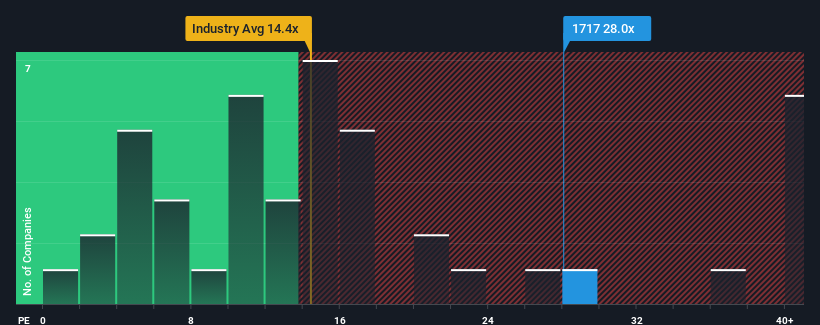

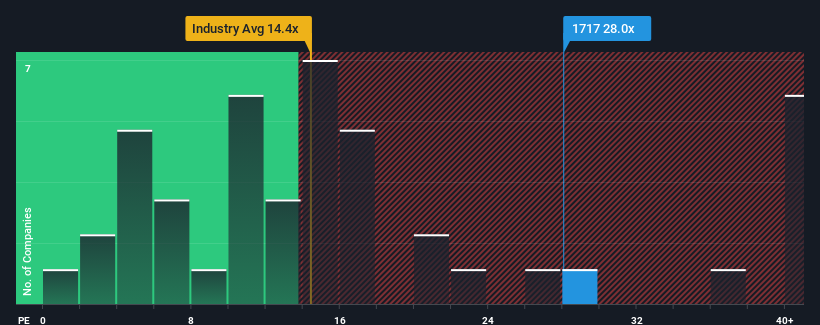

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Ausnutria Dairy as a stock to avoid entirely with its 28x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Ausnutria Dairy hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Ausnutria Dairy's is when the company's growth is on track to outshine the market decidedly.

The only time you'd be truly comfortable seeing a P/E as steep as Ausnutria Dairy's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 89% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 51% per annum over the next three years. With the market only predicted to deliver 12% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Ausnutria Dairy's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Ausnutria Dairy's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Ausnutria Dairy maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about this 1 warning sign we've spotted with Ausnutria Dairy.

Of course, you might also be able to find a better stock than Ausnutria Dairy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

澳优乳业股份有限公司(HKG:1717)的股东们会对股价在一个月内飙升26%并从先前的疲软中恢复感到兴奋。不幸的是,上个月的涨幅对去年的亏损几乎没有补偿,股价仍比上一年下跌了17%。

在价格大幅上涨之后,鉴于香港近一半公司的市盈率(或“P/E”)低于9倍,您可能认为澳优乳业是一只完全需避免的股票,因为其市盈率为28倍。但是,市盈率可能相对较高是有原因的,需要进一步调查来判断是否合理。

近期澳优乳业的业绩表现不佳,因其收益下降与其他公司相比表现不佳。可能许多人预计黯淡的收益表现将大幅恢复,这一预期使市盈率没有崩盘。希望如此,否则你将为没有特定原因支付相当昂贵的价格。

增长指标告诉我们关于高市盈率的什么?

唯一当您真正愿意看到澳优乳业的市盈率如此之高时,是因为公司的增长正朝着明显超越市场的方向发展。

唯一当您真正愿意看到澳优乳业的市盈率如此之高时,是因为公司的增长正朝着明显超越市场的方向发展。

回顾过去一年,公司的底线利润下降了令人沮丧的31%。因此,三年前的收益总体也下降了89%。因此,股东们可能对中期收益增长速度感到沮丧。

展望未来,涵盖该公司的五位分析师的估计表明,未来三年的收益预计每年将增长51%。由于市场预计仅每年增长12%,该公司将获得更强劲的收益结果。

考虑到这一点,可以理解澳优乳业的市盈率高于大多数其他公司。大多数投资者似乎期待着这种强劲的未来增长,并愿意为这支股票支付更高的价格。

重要提示

澳优乳业的市盈率高得像它在过去一个月内的股价一样飞涨。我们认为市盈率的力量主要不在于作为估值工具,而是用来衡量当前投资者情绪和未来预期。

我们已经确定,澳优乳业保持高市盈率的原因是预期增长速度高于整体市场,这是意料之中的。目前股东对市盈率感到满意,因为他们相当确信未来收益不会受到威胁。在这种情况下,很难看到股价在短期内大幅下跌。

另外,您还应该了解一下,我们发现了澳优乳业存在一个警示信号。

当然,您可能会找到比澳优乳业更好的股票。因此,您可能希望查看这些具有合理市盈率并且收益增长强劲的其他公司的免费收藏。

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

风险及免责提示

moomoo是Moomoo Technologies Inc.公司提供的金融信息和交易应用程序。

在美国,moomoo上的投资产品和服务由Moomoo Financial Inc.提供,一家受美国证券交易委员会(SEC)监管的持牌主体。 Moomoo Financial Inc.是金融业监管局(FINRA)和证券投资者保护公司(SIPC)的成员。

在新加坡,moomoo上的投资产品和服务是通过Moomoo Financial Singapore Pte. Ltd.提供,该公司受新加坡金融管理局(MAS)监管(牌照号码︰CMS101000) ,持有资本市场服务牌照 (CMS) ,持有财务顾问豁免(Exempt Financial Adviser)资质。本内容未经新加坡金融管理局的审查。

在澳大利亚,moomoo上的金融产品和服务是通过Moomoo Securities Australia Limited提供,该公司是受澳大利亚证券和投资委员会(ASIC)监管的澳大利亚金融服务许可机构(AFSL No. 224663)。请阅读并理解我们的《金融服务指南》、《条款与条件》、《隐私政策》和其他披露文件,这些文件可在我们的网站 https://www.moomoo.com/au中获取。

在加拿大,通过moomoo应用提供的仅限订单执行的券商服务由Moomoo Financial Canada Inc.提供,并受加拿大投资监管机构(CIRO)监管。

在马来西亚,moomoo上的投资产品和服务是通过Moomoo Securities Malaysia Sdn. Bhd. 提供,该公司受马来西亚证券监督委员会(SC)监管(牌照号码︰eCMSL/A0397/2024) ,持有资本市场服务牌照 (CMSL) 。本内容未经马来西亚证券监督委员会的审查。

Moomoo Technologies Inc., Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd., Moomoo Securities Australia Limited, Moomoo Financial Canada Inc.,和Moomoo Securities Malaysia Sdn. Bhd.是关联公司。

- 分享到weixin

- 分享到qq

- 分享到facebook

- 分享到twitter

- 分享到微博

- 粘贴板

使用浏览器的分享功能,分享给你的好友吧