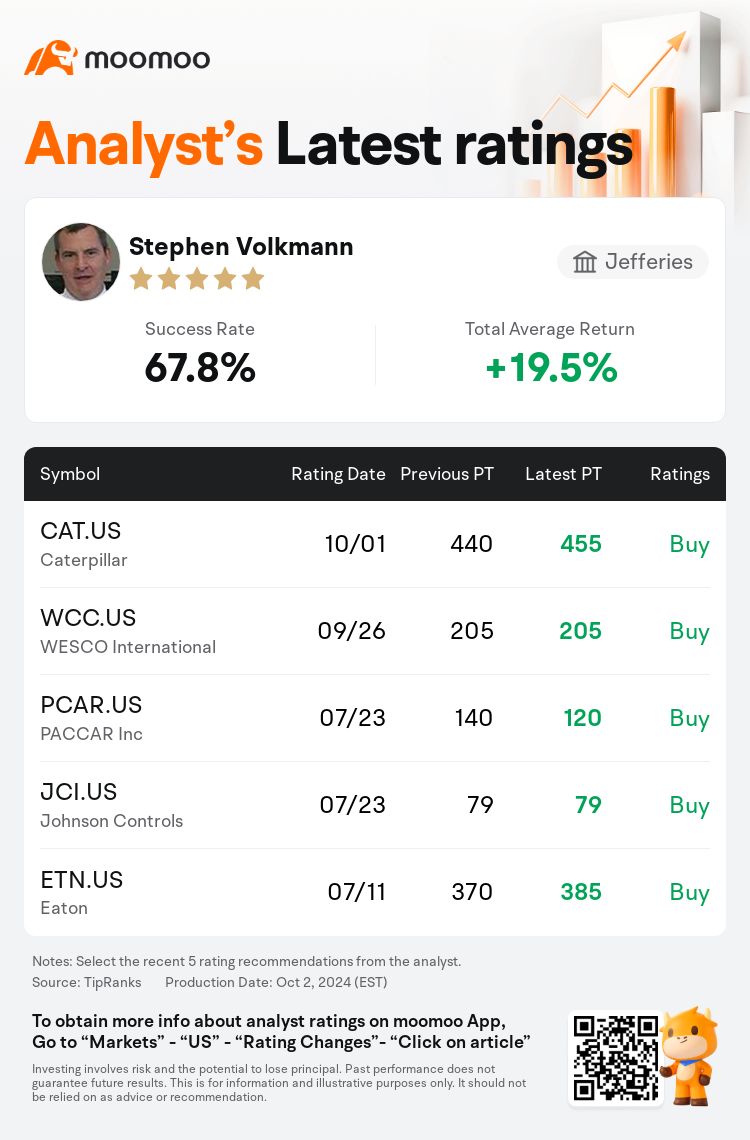

Jefferies analyst Stephen Volkmann maintains $Caterpillar (CAT.US)$ with a buy rating, and adjusts the target price from $440 to $455.

According to TipRanks data, the analyst has a success rate of 67.8% and a total average return of 19.5% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Caterpillar (CAT.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Caterpillar (CAT.US)$'s main analysts recently are as follows:

The sentiment following the MINExpo event last week was interpreted as cautiously optimistic, as reflected through conversations with original equipment manufacturers, dealers, and industry experts. For Caterpillar, it is anticipated that the Resource Industries division will likely experience limited variation in the short term, with a greater potential for earnings growth in the long term, which is expected to support a forthcoming higher earnings per share cycle. The prevailing opinion is to favor 'Miners over Farmers' after the event, with a preference for Caterpillar within the Large Cap Machinery sector, based on the belief that the company's earnings per share will remain at current elevated levels, supported by monetary policy adjustments and economic stimulus efforts.

Caterpillar's significant leverage to commodities has been noted as a potential influencer of both its stock performance and fundamental business operations, particularly within its Mining and Energy segments which are suggested to be near low points. Anticipated demands, projected capital expenditures in the mining sector, and growth trends related to the mining's role in the global energy shift are seen as factors that could potentially lead to a doubling of Caterpillar's Resource Industries revenue, with an additional impact on its earnings per share.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

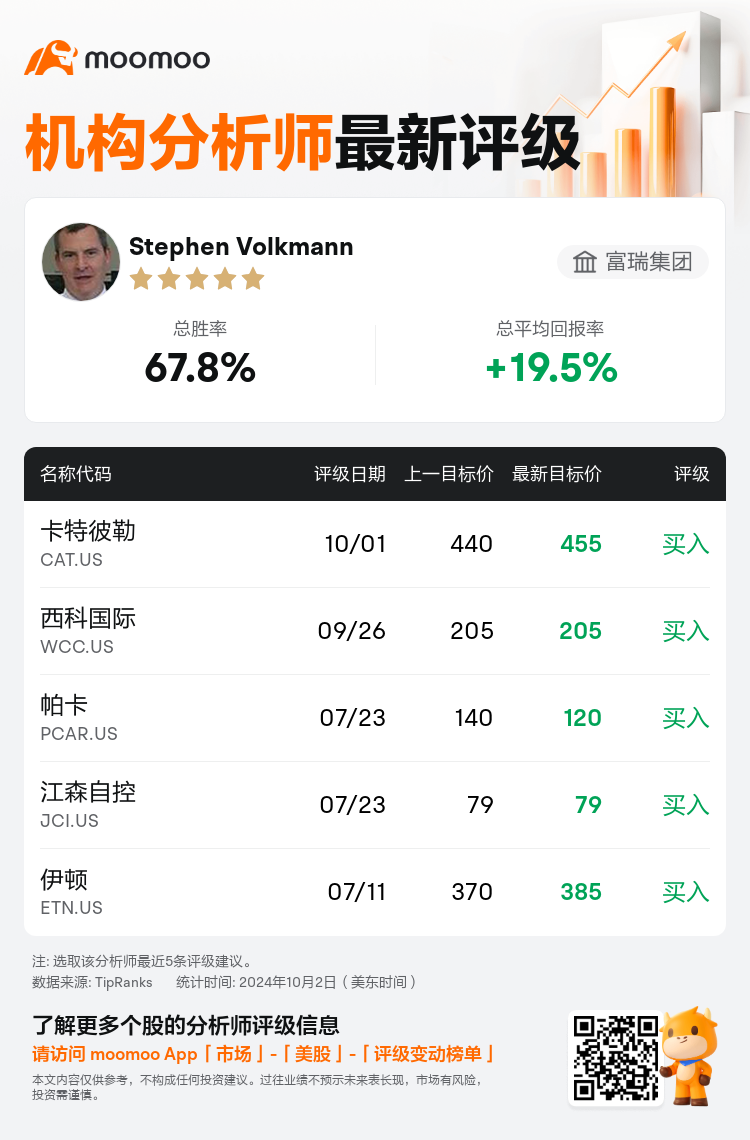

富瑞集团分析师Stephen Volkmann维持$卡特彼勒 (CAT.US)$买入评级,并将目标价从440美元上调至455美元。

根据TipRanks数据显示,该分析师近一年总胜率为67.8%,总平均回报率为19.5%。

此外,综合报道,$卡特彼勒 (CAT.US)$近期主要分析师观点如下:

此外,综合报道,$卡特彼勒 (CAT.US)$近期主要分析师观点如下:

正如与原始设备制造商、经销商和行业专家的对话所反映的那样,上周MinExpo活动之后的情绪被解释为谨慎乐观。对于卡特彼勒而言,预计资源工业部门在短期内可能会出现有限的变化,长期收益增长的潜力更大,预计这将支持即将到来的更高每股收益周期。普遍的看法是,在货币政策调整和经济刺激措施的支持下,卡特彼勒的每股收益将保持在目前的较高水平,因此在大型股机械领域更倾向于 “矿工” 而不是 “农民”,而在大型股机械行业更倾向于卡特彼勒。

卡特彼勒对大宗商品的巨大杠杆作用被认为是其股票表现和基本业务运营的潜在影响因素,尤其是在矿业和能源板块,据称这些板块已接近低点。采矿业的预期需求、预计的资本支出以及与矿业在全球能源转移中的作用相关的增长趋势被视为可能导致卡特彼勒资源行业收入翻一番并对其每股收益产生额外影响的因素。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$卡特彼勒 (CAT.US)$近期主要分析师观点如下:

此外,综合报道,$卡特彼勒 (CAT.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of