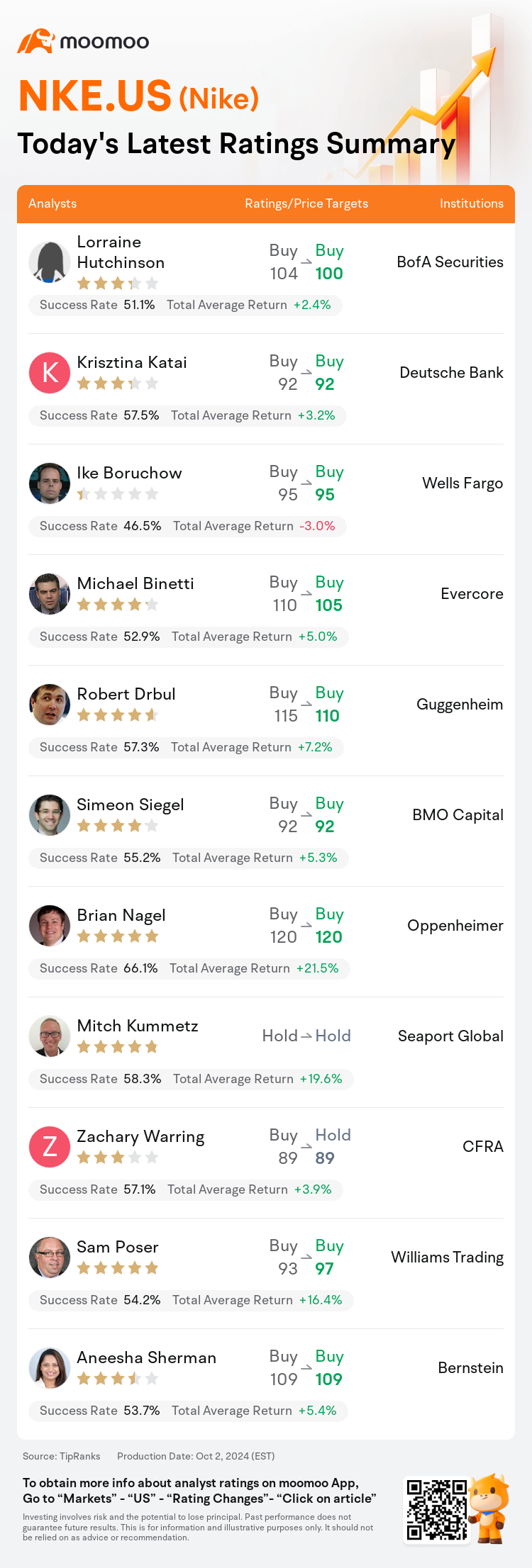

On Oct 02, major Wall Street analysts update their ratings for $Nike (NKE.US)$, with price targets ranging from $89 to $120.

BofA Securities analyst Lorraine Hutchinson maintains with a buy rating, and adjusts the target price from $104 to $100.

Deutsche Bank analyst Krisztina Katai maintains with a buy rating, and maintains the target price at $92.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $95.

Evercore analyst Michael Binetti maintains with a buy rating, and adjusts the target price from $110 to $105.

Guggenheim analyst Robert Drbul maintains with a buy rating, and adjusts the target price from $115 to $110.

Furthermore, according to the comprehensive report, the opinions of $Nike (NKE.US)$'s main analysts recently are as follows:

The latest quarterly report from Nike has solidified the perspective that the company's recovery will be prolonged, akin to a marathon rather than a swift race. The updated fiscal 2025 guidance suggests a potential decline in sales for the second half of the year by a high-single-digit percentage, differing from earlier predictions which indicated a stable outlook. This adjustment signifies a lengthier journey toward growth and sets a new baseline for future expectations. The current market demands unique creativity within the footwear industry to maintain sales, an area where Nike's innovation and narrative drive have seen a diminishing impact. There is a sense of optimism for the direction the company will take under the leadership of the incoming CEO Elliott Hill.

The company's Q1 report indicated a 10% decline in revenues year-over-year, attributed to underwhelming traffic and unit sales, which were somewhat mitigated by increased selling prices. The turnaround timeline for Nike has been perceived to be prolonged.

The recent lackluster financial report from Nike was anticipated and the viewpoint is that a more opportune moment for investment may arise once a clear trajectory towards robust and enduring growth in sales and earnings becomes evident. Nonetheless, at present, the possibility of continued downturns is considerable, with an equally heightened potential for gains, leading to a balanced risk/reward scenario. It's suggested that Nike's sales growth may persist in underperforming, particularly due to a slump in its primary product lines and market challenges in China. Additionally, there's concern that Nike's gross margin might face greater strain than foreseen as a consequence of elevated inventory levels.

Following Nike's Q1 report where earnings per share surpassed forecasts and sales saw a 10% decline, matching projections, it is believed that the upcoming leadership change with Hill's appointment as CEO later this month mitigates the risk associated with potential sales shortfalls. This change provides Hill with the leeway to execute his strategic plans.

The company's fiscal Q1 results fell short of sales expectations due to diminishing trends in both direct-to-consumer and wholesale channels. This was somewhat offset by better-than-anticipated gross margins and lower spending, which contributed to earnings surpassing estimates. However, the performance of the quarter was considered of 'low-quality' as inventory levels are now exceeding the pace of sales growth, and the guidance for Q2 was below the consensus view.

Here are the latest investment ratings and price targets for $Nike (NKE.US)$ from 11 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月2日,多家华尔街大行更新了$耐克 (NKE.US)$的评级,目标价介于89美元至120美元。

美银证券分析师Lorraine Hutchinson维持买入评级,并将目标价从104美元下调至100美元。

德意志银行分析师Krisztina Katai维持买入评级,维持目标价92美元。

富国集团分析师Ike Boruchow维持买入评级,维持目标价95美元。

富国集团分析师Ike Boruchow维持买入评级,维持目标价95美元。

Evercore分析师Michael Binetti维持买入评级,并将目标价从110美元下调至105美元。

Guggenheim分析师Robert Drbul维持买入评级,并将目标价从115美元下调至110美元。

此外,综合报道,$耐克 (NKE.US)$近期主要分析师观点如下:

耐克最新的季度报告巩固了这样的观点,即公司的复苏将延长,就像一场马拉松而不是一场快速的比赛。最新的2025财年指导方针表明,下半年的销售额可能会以较高的个位数百分比下降,这与先前的预测不同,后者显示前景稳定。这一调整意味着更长的增长之旅,并为未来的预期设定了新的基准。当前的市场需要鞋类行业内独特的创造力来维持销售,而耐克的创新和叙事动力在这一领域的影响正在减弱。在即将上任的首席执行官埃利奥特·希尔的领导下,人们对公司的发展方向感到乐观。

该公司的第一季度报告显示,收入同比下降10%,这归因于流量和单位销售不佳,销售价格上涨在一定程度上缓解了这种情况。耐克的周转时间表被认为很长。

耐克最近发布的乏善可陈的财务报告是预料之中的,人们认为,一旦销售和收益实现强劲而持久增长的明确轨迹显而易见,就会出现更合适的投资时机。尽管如此,目前,持续下滑的可能性很大,收益潜力也同样增加,从而形成了平衡的风险/回报情景。有人认为,耐克的销售增长可能持续表现不佳,特别是由于其主要产品线的下滑以及中国的市场挑战。此外,有人担心,由于库存水平上升,耐克的毛利率可能面临比预期更大的压力。

耐克发布了第一季度报告,每股收益超过预期,销售额下降了10%,与预期相符。此后,希尔在本月晚些时候被任命为首席执行官后即将进行的领导层更迭缓解了与潜在销售短缺相关的风险。这一变化为希尔提供了执行其战略计划的余地。

由于直接面向消费者的渠道和批发渠道的趋势减弱,该公司第一财季的业绩未达到销售预期。毛利率好于预期和支出减少在一定程度上抵消了这一点,这使得收益超过预期。但是,该季度的业绩被认为是 “低质量”,因为库存水平现在已经超过了销售增长的步伐,而且第二季度的预期低于共识。

以下为今日11位分析师对$耐克 (NKE.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

富国集团分析师Ike Boruchow维持买入评级,维持目标价95美元。

富国集团分析师Ike Boruchow维持买入评级,维持目标价95美元。

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $95.

Wells Fargo analyst Ike Boruchow maintains with a buy rating, and maintains the target price at $95.