Decoding GameStop's Options Activity: What's the Big Picture?

Decoding GameStop's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bearish approach towards GameStop (NYSE:GME), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in GME usually suggests something big is about to happen.

金字塔投资者对游戏驿站(纽交所:GME)采取了看淡的态度,市场参与者不应忽视这一点。我们在Benzinga跟踪的公共期权记录中发现了这一重大举动。这些投资者的身份仍然未知,但在GME(游戏驿站)中进行如此重大的操作通常意味着即将发生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for GameStop. This level of activity is out of the ordinary.

我们从Benzinga的期权扫描器今天突出显示的10个非同寻常的游戏驿站期权活动中获得了这些信息。这种活动水平超出了寻常。

The general mood among these heavyweight investors is divided, with 10% leaning bullish and 60% bearish. Among these notable options, 2 are puts, totaling $120,000, and 8 are calls, amounting to $307,311.

这些大宗投资者中普遍情绪分歧,有10%倾向于看好,60%倾向于看淡。在这些显著的期权中,有2个看跌期权,总额为12万美元,8个看涨期权,总额为30万7311美元。

Predicted Price Range

预测价格区间

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $125.0 for GameStop during the past quarter.

分析这些合约中的成交量和未平仓合约,看起来大户已经将游戏驿站在过去一个季度的价格区间定位在10.0美元至125.0美元。

Insights into Volume & Open Interest

成交量和持仓量分析

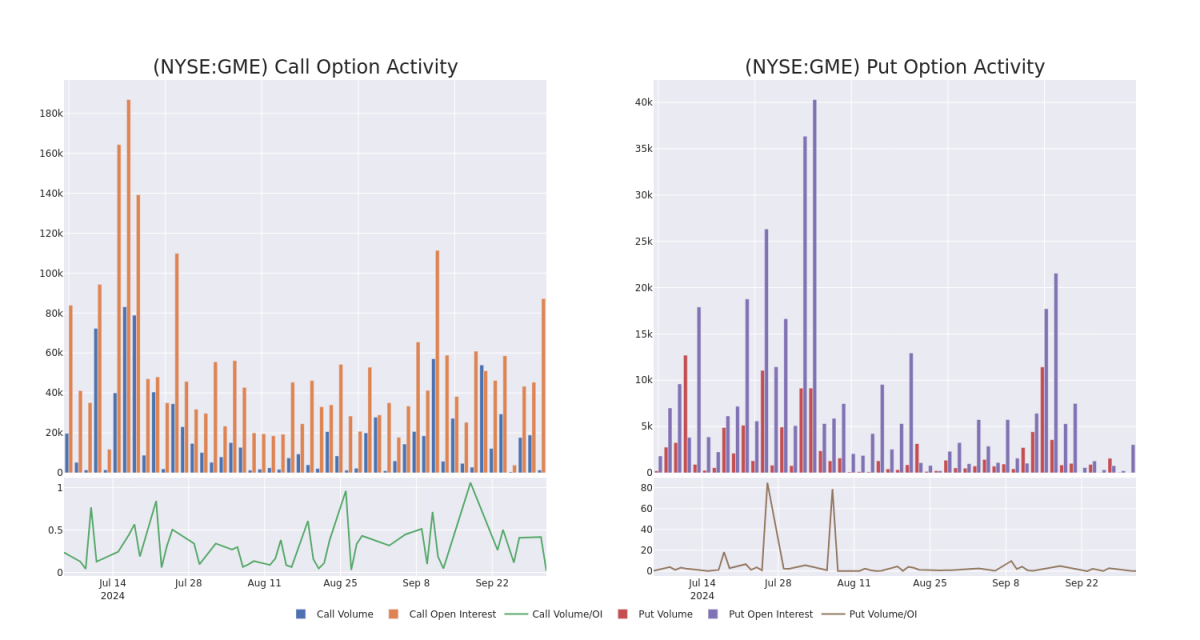

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for GameStop's options for a given strike price.

这些数据可以帮助您跟踪针对给定行权价格的GameStop期权的流动性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GameStop's whale activity within a strike price range from $10.0 to $125.0 in the last 30 days.

下面,我们可以观察过去30天内,所有游戏驿站涉及的鲸鱼活动中,看涨和看跌期权的成交量和未平仓量的演变,分别在$10.0到$125.0的行权价区间内。

GameStop 30-Day Option Volume & Interest Snapshot

游戏驿站30天期权成交量和持仓量快照

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | PUT | TRADE | BEARISH | 01/16/26 | $98.9 | $98.9 | $98.9 | $120.00 | $89.0K | 782 | 10 |

| GME | CALL | TRADE | NEUTRAL | 01/16/26 | $14.0 | $13.0 | $13.51 | $10.00 | $67.5K | 3.1K | 50 |

| GME | CALL | TRADE | BEARISH | 01/15/27 | $15.9 | $14.15 | $14.15 | $10.00 | $53.7K | 390 | 127 |

| GME | CALL | SWEEP | BEARISH | 01/15/27 | $15.95 | $14.05 | $14.05 | $10.00 | $43.5K | 390 | 83 |

| GME | PUT | TRADE | BULLISH | 01/16/26 | $106.0 | $101.7 | $103.3 | $125.00 | $30.9K | 2.2K | 3 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | 看跌 | 交易 | 看淡 | 01/16/26 | $98.9 | $98.9 | $98.9 | $120.00 | $89.0K | 782 | 10 |

| GME | 看涨 | 交易 | 中立 | 01/16/26 | $14.0 | $13.0 | $13.51 | $10.00 | $67.5K | 3.1K | 50 |

| GME | 看涨 | 交易 | 看淡 | 01/15/27 | $15.9 | $14.15 | $14.15 | $10.00 | $53.7K | 390 | 127 |

| GME | 看涨 | SWEEP | 看淡 | 01/15/27 | $15.95 | 14.05美元 | 14.05美元 | $10.00 | $43.5千 | 390 | 83 |

| GME | 看跌 | 交易 | 看好 | 01/16/26 | 106.0美元 | 101.7美元 | $103.3 | $125.00 | $30.9K | 2.2K | 3 |

About GameStop

关于游戏驿站

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

GameStop Corp是美国的一家多渠道视频游戏、消费电子和服务零售商。该公司在欧洲、加拿大、澳洲和美国等地区运营。GameStop主要通过GameStop、Eb Games和Micromania商店以及国际电子商务网站销售新和二手视频游戏硬件、实体和数字视频游戏软件和视频游戏配件。销售收入的大部分来自美国。

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鉴于游戏驿站最近的期权历史,现在应该专注于公司本身。我们的目标是探索其当前的表现。

Current Position of GameStop

游戏驿站当前的位置

- With a volume of 2,339,650, the price of GME is up 0.36% at $22.05.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 63 days.

- 成交量为2,339,650,GME的价格上涨0.36%,为22.05美元。

- RSI指标暗示该标的股票目前处于超买和超卖的中立区间。

- 下一次财报预计在63天发布。

What Analysts Are Saying About GameStop

分析师对游戏驿站的评价

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $10.0.

过去30天中,共有1位专业分析师对这支股票发表了意见,设定了平均价格目标为$10.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Wedbush continues to hold a Underperform rating for GameStop, targeting a price of $10.

20年期权交易专家揭示了他的一行图表技巧,显示何时买入和卖出。复制他的交易,平均每20天获利27%。单击此处进行访问。* Wedbush的分析师维持其立场,继续持有游戏驿站的低于市场表现评级,并设定目标价格为10美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.

期权交易带来更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种指标和密切关注市场动态来管理这些风险。通过Benzinga Pro获取GameStop期权交易的实时提醒,保持最新动态。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $125.0 for GameStop during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $10.0 to $125.0 for GameStop during the past quarter.