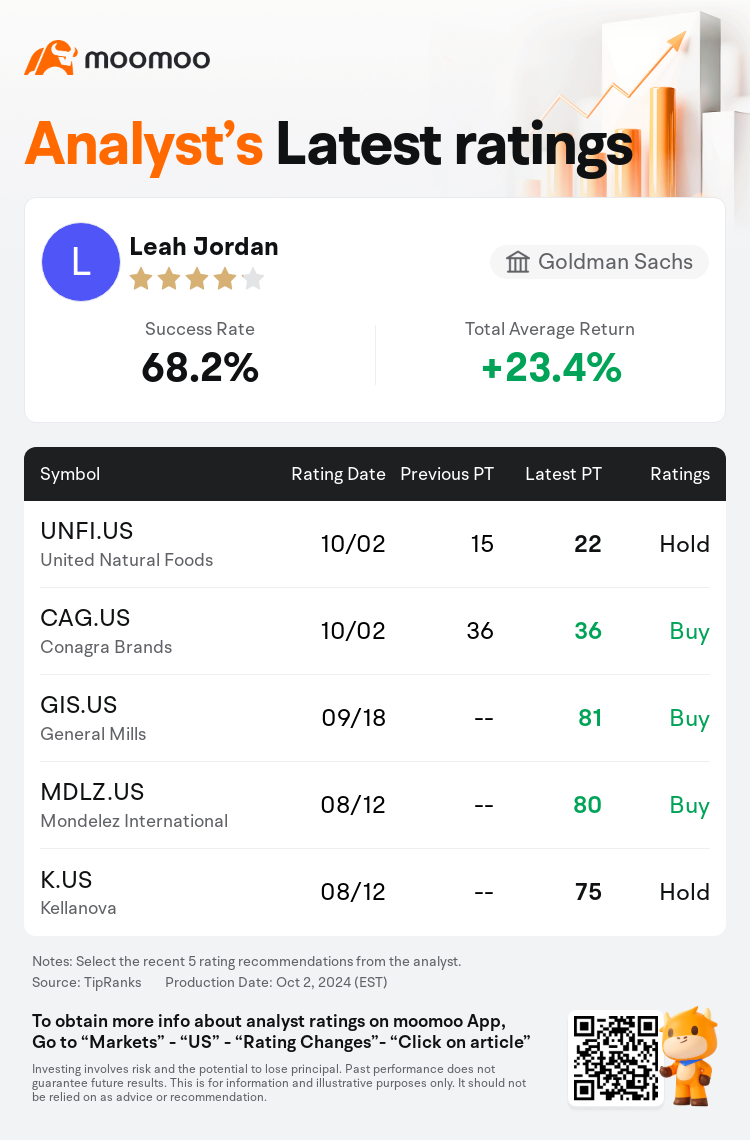

Goldman Sachs analyst Leah Jordan maintains $United Natural Foods (UNFI.US)$ with a hold rating, and adjusts the target price from $15 to $22.

According to TipRanks data, the analyst has a success rate of 68.2% and a total average return of 23.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $United Natural Foods (UNFI.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $United Natural Foods (UNFI.US)$'s main analysts recently are as follows:

United Natural Foods reported a Q4 earnings beat and provided FY25 guidance that aligned with expectations, despite a bearish sentiment prior to the announcement. The company's shift to positive wholesale volumes at the end of the quarter, along with a new three-year outlook that projects margin growth despite flat sales, suggests that the cyclical pressures faced in the past may now be subsiding. Additionally, there is potential for further upside from a rise in vendor promotions or advantageous procurement circumstances.

United Natural Foods is demonstrating progress in its turnaround efforts despite challenging macroeconomic conditions. Although growth in food at home has remained moderate, the company has experienced encouraging signs, such as a return to positive volume growth towards the end of Q4. The long-term guidance appears to be attainable, which may contribute to stabilizing its valuation multiple.

United Natural Foods' Q4 EBITDA surpassed expectations, aligning FY24 EBITDA with the upper range of projections. The company's outlook for FY25 suggests a stable to modest growth trajectory, potentially reassuring investors. Furthermore, while management has outlined a long-term objective for high-single-digit annual EBITDA growth, the anticipation of steady sales in the near future may curtail the potential for valuation increase.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

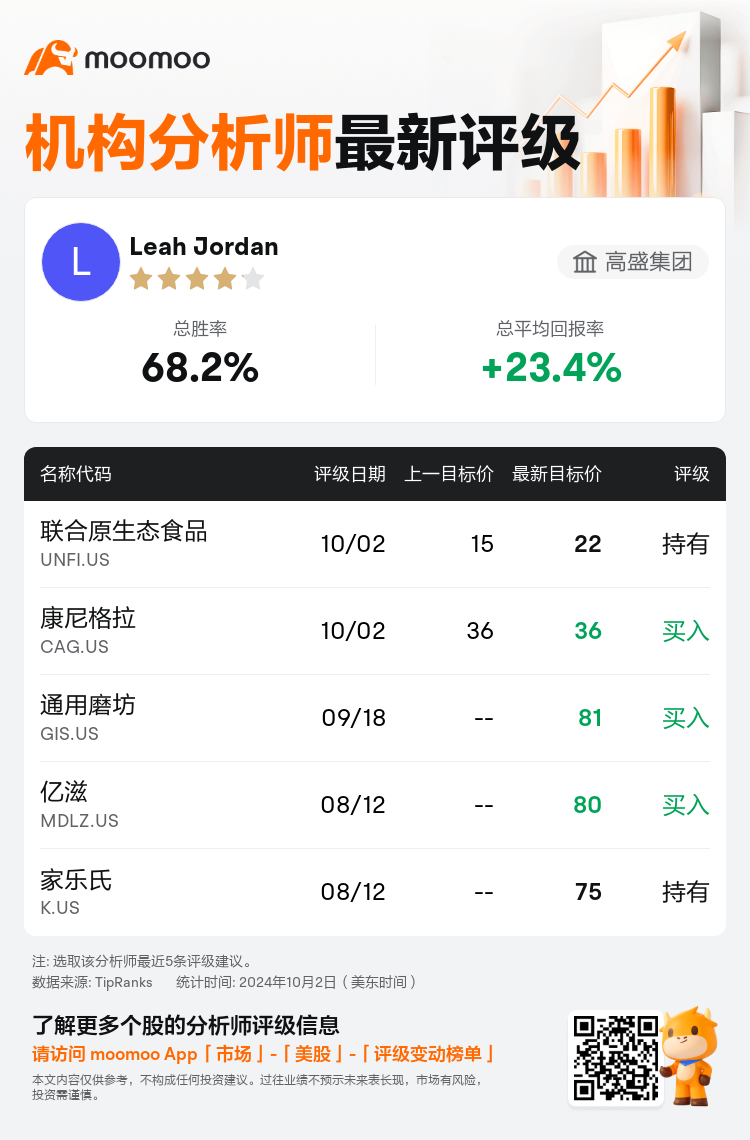

高盛集团分析师Leah Jordan维持$联合原生态食品 (UNFI.US)$持有评级,并将目标价从15美元上调至22美元。

根据TipRanks数据显示,该分析师近一年总胜率为68.2%,总平均回报率为23.4%。

此外,综合报道,$联合原生态食品 (UNFI.US)$近期主要分析师观点如下:

此外,综合报道,$联合原生态食品 (UNFI.US)$近期主要分析师观点如下:

联合天然食品公布了第四季度业绩好转,并提供了与预期一致的25财年指导,尽管在宣布之前情绪看跌。该公司在本季度末转向正的批发量,以及新的三年展望,尽管销售持平,但预计利润率仍将增长,这表明过去面临的周期性压力现在可能正在减弱。此外,供应商促销活动的增加或有利的采购环境有可能带来进一步的上行空间。

尽管宏观经济条件艰难,但联合天然食品的转型工作仍取得了进展。尽管国内食品的增长保持温和,但该公司已经出现了令人鼓舞的迹象,例如在第四季度末恢复正增长。长期指引似乎是可以实现的,这可能有助于稳定其估值倍数。

联合天然食品第四季度的息税折旧摊销前利润超出预期,使24财年的息税折旧摊销前利润与较高的预测范围保持一致。该公司对25财年的展望显示出稳定至温和的增长轨迹,这可能会让投资者放心。此外,尽管管理层已经概述了高个位数的年度息税折旧摊销前利润增长的长期目标,但对近期稳定销售的预期可能会抑制估值上升的可能性。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$联合原生态食品 (UNFI.US)$近期主要分析师观点如下:

此外,综合报道,$联合原生态食品 (UNFI.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of