Check Out What Whales Are Doing With ENVX

Check Out What Whales Are Doing With ENVX

Investors with a lot of money to spend have taken a bullish stance on Enovix (NASDAQ:ENVX).

有大量资金可以花的投资者对Enovix(纳斯达克股票代码:ENVX)采取了看涨立场。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

今天,当我们在本辛加追踪的公开期权历史记录中出现头寸时,我们注意到了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ENVX, it often means somebody knows something is about to happen.

无论这些是机构还是仅仅是富人,我们都不知道。但是,当ENVX发生如此大的事情时,通常意味着有人知道某件事即将发生。

Today, Benzinga's options scanner spotted 12 options trades for Enovix.

今天,Benzinga的期权扫描仪发现了Enovix的12笔期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 75% bullish and 25%, bearish.

这些大笔交易者的整体情绪分为75%的看涨和25%的看跌。

Out of all of the options we uncovered, there was 1 put, for a total amount of $27,126, and 11, calls, for a total amount of $494,386.

在我们发现的所有期权中,有1个看跌期权,总额为27,126美元,还有11个看涨期权,总额为494,386美元。

Expected Price Movements

预期的价格走势

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $3.0 to $15.0 for Enovix over the last 3 months.

考虑到这些合约的交易量和未平仓合约,在过去的3个月中,鲸鱼似乎一直将Enovix的价格定在3.0美元至15.0美元之间。

Insights into Volume & Open Interest

对交易量和未平仓合约的见解

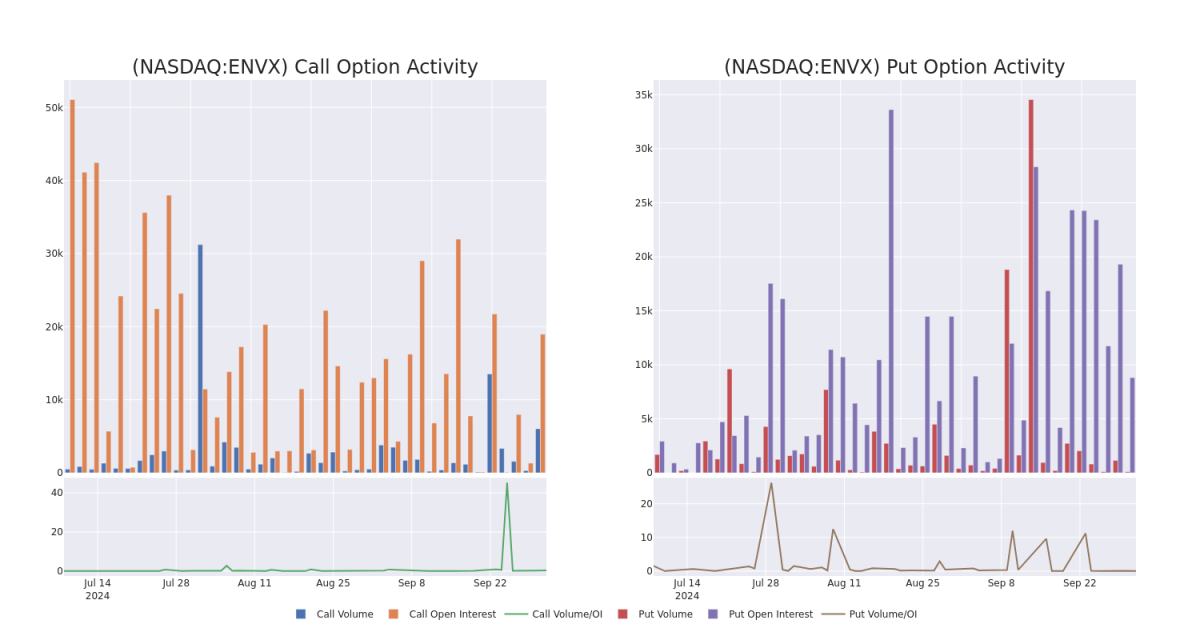

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Enovix's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Enovix's whale trades within a strike price range from $3.0 to $15.0 in the last 30 days.

交易期权时,查看交易量和未平仓合约是一个强有力的举动。这些数据可以帮助您跟踪给定行使价下Enovix期权的流动性和利息。下面,我们可以观察过去30天在3.0美元至15.0美元行使价范围内所有Enovix鲸鱼交易的看涨期权和看跌期权交易量和未平仓合约的分别变化。

Enovix Option Volume And Open Interest Over Last 30 Days

过去 30 天的 Enovix 期权交易量和未平仓合约

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | CALL | TRADE | BULLISH | 04/17/25 | $2.6 | $2.5 | $2.6 | $10.00 | $130.0K | 324500 | |

| ENVX | CALL | SWEEP | BULLISH | 04/17/25 | $2.84 | $2.76 | $2.84 | $10.00 | $73.6K | 3241.0K | |

| ENVX | CALL | TRADE | BULLISH | 10/25/24 | $0.39 | $0.35 | $0.39 | $12.00 | $39.0K | 2251.0K | |

| ENVX | CALL | TRADE | BULLISH | 04/17/25 | $7.75 | $6.9 | $7.53 | $3.00 | $37.6K | 45100 | |

| ENVX | CALL | TRADE | BULLISH | 01/15/27 | $7.45 | $7.05 | $7.29 | $3.00 | $36.4K | 953 |

| 符号 | 看跌/看涨 | 交易类型 | 情绪 | Exp。日期 | 问 | 出价 | 价格 | 行使价 | 总交易价格 | 未平仓合约 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENVX | 打电话 | 贸易 | 看涨 | 04/17/25 | 2.6 美元 | 2.5 美元 | 2.6 美元 | 10.00 美元 | 130.0K | 324500 | |

| ENVX | 打电话 | 扫 | 看涨 | 04/17/25 | 2.84 美元 | 2.76 美元 | 2.84 美元 | 10.00 美元 | 73.6 万美元 | 3241.0K | |

| ENVX | 打电话 | 贸易 | 看涨 | 10/25/24 | 0.39 美元 | 0.35 美元 | 0.39 美元 | 12.00 美元 | 39.0 万美元 | 2251.0K | |

| ENVX | 打电话 | 贸易 | 看涨 | 04/17/25 | 7.75 美元 | 6.9 美元 | 7.53 美元 | 3.00 美元 | 37.6 万美元 | 45100 | |

| ENVX | 打电话 | 贸易 | 看涨 | 01/15/27 | 7.45 美元 | 7.05 美元 | 7.29 美元 | 3.00 美元 | 36.4 万美元 | 953 |

About Enovix

关于 Enovix

Enovix Corp is engaged in the business of advanced silicon-anode lithium-ion battery development and production. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable the widespread utilization of renewable energy.

Enovix Corp 从事先进的硅阳极锂离子电池开发和生产业务。它还在为电动汽车和储能市场开发其三维电池技术和生产工艺,以帮助实现可再生能源的广泛利用。

Current Position of Enovix

Enovix 的当前位置

- Currently trading with a volume of 8,574,382, the ENVX's price is up by 6.06%, now at $9.1.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 34 days.

- ENVX目前的交易量为8,574,382美元,其价格上涨了6.06%,目前为9.1美元。

- RSI读数表明,该股目前可能接近超买。

- 预计将在34天后发布财报。

Turn $1000 into $1270 in just 20 days?

在短短 20 天内将 1000 美元变成 1270 美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年专业期权交易员透露了他的单线图技术,该技术显示何时买入和卖出。复制他的交易,平均每20天获利27%。点击此处访问。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

与仅交易股票相比,期权是一种风险更高的资产,但它们具有更高的获利潜力。严肃的期权交易者通过每天自我教育、扩大交易规模、关注多个指标以及密切关注市场来管理这种风险。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ENVX, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ENVX, it often means somebody knows something is about to happen.