This Is What Whales Are Betting On United Parcel Service

This Is What Whales Are Betting On United Parcel Service

Financial giants have made a conspicuous bullish move on United Parcel Service. Our analysis of options history for United Parcel Service (NYSE:UPS) revealed 13 unusual trades.

金融巨头在联合包裹的股票上做出了明显的看好举动。我们对联合包裹(纽交所:UPS)期权历史的分析显示出了13笔飞凡的交易。

Delving into the details, we found 38% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 11 were puts, with a value of $405,725, and 2 were calls, valued at $138,120.

深入细节,我们发现38%的交易员持看好态度,而30%表现出看淡倾向。在所有我们发现的交易中,有11笔看跌,价值405,725美元,还有2笔看涨,价值138,120美元。

Projected Price Targets

预计价格目标

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $90.0 to $210.0 for United Parcel Service over the recent three months.

根据交易活动,显而易见的投资者正瞄准联合包裹在最近三个月内的股价区间从90.0美元到210.0美元。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

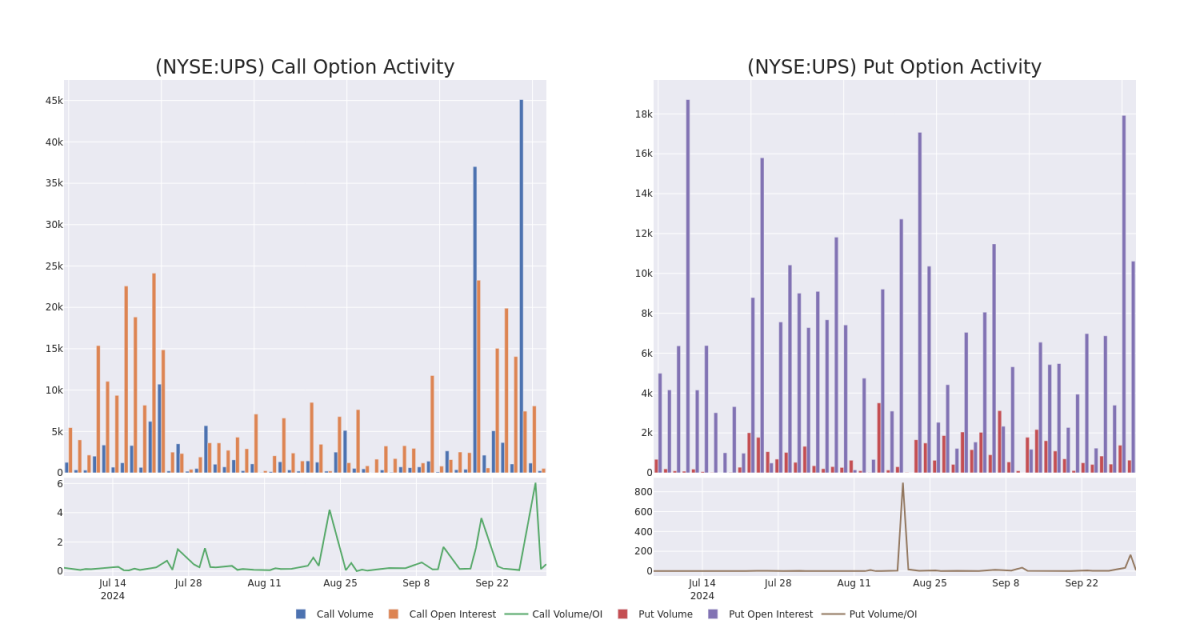

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.

评估成交量和未平仓合约在期权交易中是一个战略性步骤。这些指标揭示了投资者对于联合包裹指定执行价格的期权的流动性和兴趣。即将公布的数据将呈现出最近30天内,涉及联合包裹实质性交易的看涨和看跌的成交量和未平仓合约的波动,这两者在执行价格区间从90.0美元到210.0美元之间。

United Parcel Service Option Volume And Open Interest Over Last 30 Days

联合包裹期权成交量和未平仓合约在过去30天的情况

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | CALL | SWEEP | BEARISH | 10/25/24 | $4.9 | $4.75 | $4.75 | $134.00 | $95.0K | 371 | 225 |

| UPS | PUT | SWEEP | NEUTRAL | 01/17/25 | $23.5 | $23.5 | $23.5 | $155.00 | $61.1K | 9.0K | 28 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $77.2 | $76.65 | $77.19 | $210.00 | $54.0K | 2 | 7 |

| UPS | CALL | SWEEP | BULLISH | 06/20/25 | $19.6 | $19.35 | $19.6 | $120.00 | $43.1K | 148 | 24 |

| UPS | PUT | SWEEP | BEARISH | 01/17/25 | $47.75 | $47.6 | $47.75 | $180.00 | $42.9K | 7 | 9 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UPS | 看涨 | SWEEP | 看淡 | 10/25/24 | $4.9 | $4.75 | $4.75 | $134.00 | 95.0千美元 | 371 | 225 |

| UPS | 看跌 | SWEEP | 中立 | 01/17/25 | $23.5 | $23.5 | $23.5 | $155.00 | $61.1K | 9.0K | 28 |

| UPS | 看跌 | SWEEP | 看淡 | 01/17/25 | $77.2 | $76.65 | $77.19 | 目标股价为$210.00。 | $54.0K | 2 | 7 |

| UPS | 看涨 | SWEEP | 看好 | 06/20/25 | $19.6 | $19.35 | $19.6 | $120.00 | $43.1K | 148 | 24 |

| UPS | 看跌 | SWEEP | 看淡 | 01/17/25 | $47.75 | $47.6 | $47.75 | 180.00美元 | $42.9K | 7 | 9 |

About United Parcel Service

关于联合包裹

As the world's largest parcel delivery company, UPS manages a massive fleet of more than 500 planes and 100,000 vehicles, along with many hundreds of sorting facilities, to deliver an average of about 22 million packages per day to residences and businesses across the globe. UPS' domestic US package operations generate around 64% of total revenue while international package makes up 20%. Air and ocean freight forwarding, truckload brokerage, and contract logistics make up the remainder. UPS is currently pursuing "strategic alternatives" for its truck brokerage unit, Coyote, which it acquired in 2015.

作为全球最大的包裹递送公司,联合包裹 (UPS) 管理着一个庞大的机队,拥有超过500架飞机和10万辆车辆,以及数百个分拣设施,每天向全球住宅和企业递送约2200万个包裹。UPS的美国国内包裹业务占据总营业收入的约64%,而国际包裹业务占据20%。航空和海运货运,卡车运输中介和合同物流业务占据其余部分。UPS目前正在为其于2015年收购的卡车运输中介部门Coyote寻求“战略替代方案”。

Following our analysis of the options activities associated with United Parcel Service, we pivot to a closer look at the company's own performance.

在分析与联合包裹相关的期权活动之后,我们转向更仔细地观察该公司自身的表现。

Current Position of United Parcel Service

联合包裹的当前位置

- Currently trading with a volume of 1,281,411, the UPS's price is down by -0.45%, now at $132.67.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 22 days.

- 联合包裹目前的成交量为1,281,411,价格下跌了-0.45%,目前为132.67美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计将在22天内发布财报。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Parcel Service's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Parcel Service's substantial trades, within a strike price spectrum from $90.0 to $210.0 over the preceding 30 days.