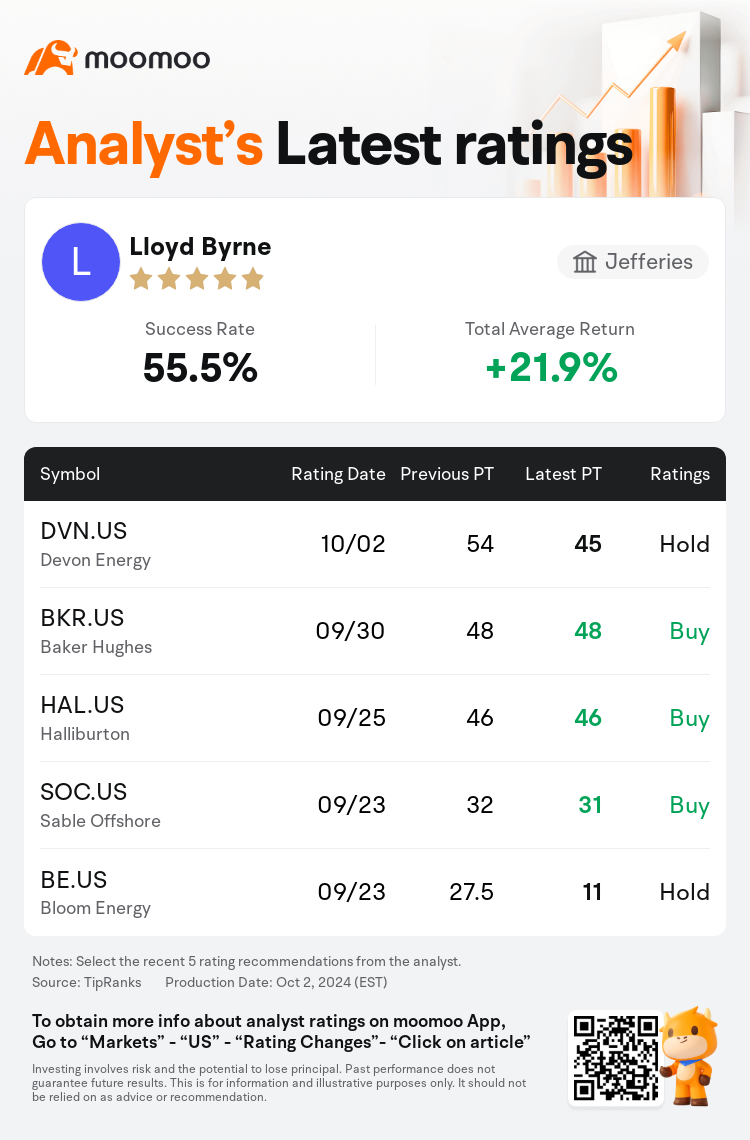

Jefferies analyst Lloyd Byrne maintains $Devon Energy (DVN.US)$ with a hold rating, and adjusts the target price from $54 to $45.

According to TipRanks data, the analyst has a success rate of 55.5% and a total average return of 21.9% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Devon Energy (DVN.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Devon Energy (DVN.US)$'s main analysts recently are as follows:

Estimates within the integrated oil and exploration and production sector have been adjusted to accommodate a decrease in oil price forecasts for the years ahead. Despite the recent downturn in the sector, it is suggested that the potential benefits outweigh the risks for stocks, given that company fundamentals and operational momentum are reported to be strong.

The resumption of coverage on Devon Energy noted that the completion of the Grayson Mill acquisition brings additional layers to Devon's Bakken position and is expected to contribute positively to free cash flow as development activities are fine-tuned. The market's attention is largely on the Delaware's longevity and outcomes from its core play, yet the expanded Bakken presence is acknowledged as a beneficial move.

The exploration and production group had their estimates modified to reflect updated commodity price decks and investment perspectives. With long-term oil and gas price expectations set at $80 for Brent and $3.50 for Henry Hub, there's potential for sustained capital efficiency through 2025 if operational efficiency gains continue and service costs further decline. This could counterbalance the effects of resource maturity.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

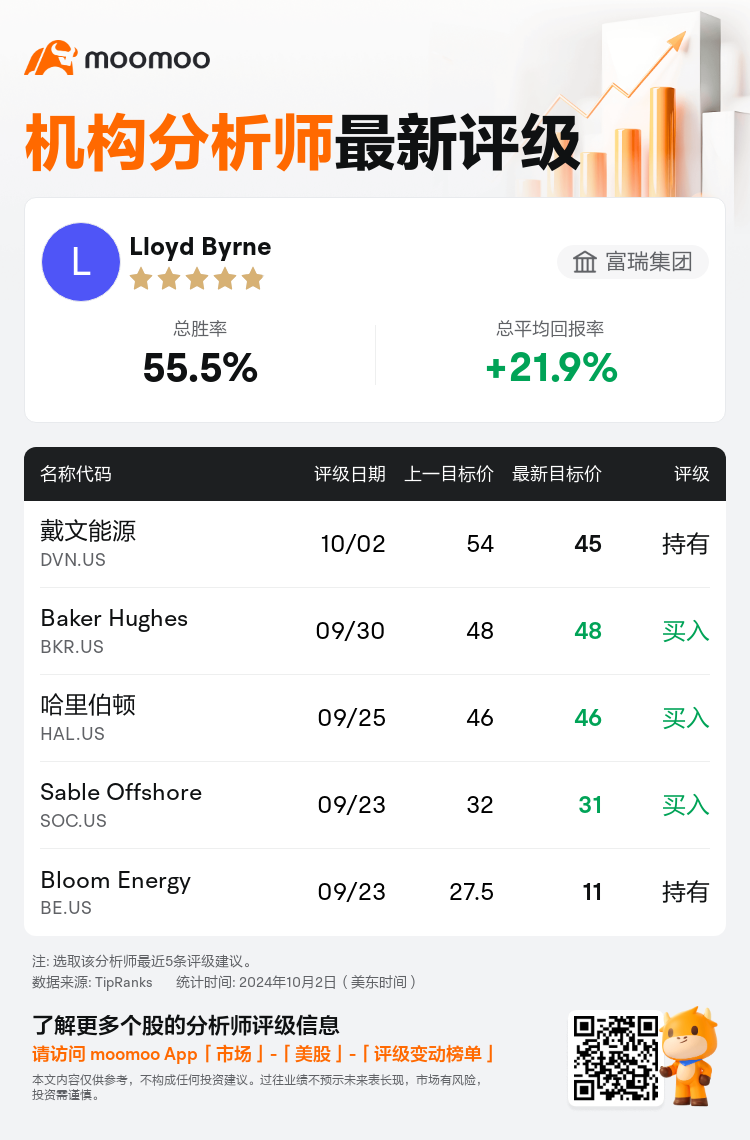

富瑞集团分析师Lloyd Byrne维持$戴文能源 (DVN.US)$持有评级,并将目标价从54美元下调至45美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.5%,总平均回报率为21.9%。

此外,综合报道,$戴文能源 (DVN.US)$近期主要分析师观点如下:

此外,综合报道,$戴文能源 (DVN.US)$近期主要分析师观点如下:

对综合石油和勘探与生产部门的估计进行了调整,以适应未来几年油价预测的下降。尽管该行业最近出现低迷,但鉴于据报道公司基本面和运营势头强劲,有迹象表明,股票的潜在收益大于风险。

德文能源公司的恢复报道指出,对格雷森磨坊的收购的完成为德文郡的巴肯地位带来了额外的保障,随着开发活动的微调,预计将为自由现金流做出积极贡献。市场的注意力主要集中在特拉华州的寿命及其核心业务的业绩上,但扩大Bakken的业务被认为是一个有益的举动。

勘探和生产小组修改了估计,以反映最新的大宗商品价格和投资前景。布伦特原油的长期石油和天然气价格预期为80美元,Henry Hub的长期石油和天然气价格预期为3.50美元,如果运营效率持续提高和服务成本进一步下降,则有可能在2025年之前实现持续的资本效率。这可以抵消资源成熟度的影响。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$戴文能源 (DVN.US)$近期主要分析师观点如下:

此外,综合报道,$戴文能源 (DVN.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of