Decoding Salesforce's Options Activity: What's the Big Picture?

Decoding Salesforce's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Salesforce (NYSE:CRM).

持有大量资金的投资者看淡赛富时 (纽交所:CRM)。

And retail traders should know.

零售交易者应该知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我们在这里追踪的公开期权历史记录上看到交易时发现了这一点。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

无论这些投资者是机构还是富人,我们不得而知。但当CRM发生这样的大事情时,通常意味着有人知道即将发生什么。

So how do we know what these investors just did?

那么我们如何知道这些投资者刚刚做了什么呢?

Today, Benzinga's options scanner spotted 61 uncommon options trades for Salesforce.

今天,Benzinga的期权扫描器发现了61笔赛富时的不寻常期权交易。

This isn't normal.

这不正常。

The overall sentiment of these big-money traders is split between 36% bullish and 40%, bearish.

这些大额交易者的总体情绪在36%看好和40%看淡之间分化。

Out of all of the special options we uncovered, 15 are puts, for a total amount of $498,753, and 46 are calls, for a total amount of $3,511,650.

在我们发现的所有特殊选择中,有15个看跌期权,总金额为$498,753,还有46个看涨期权,总金额为$3,511,650。

Projected Price Targets

预计价格目标

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $350.0 for Salesforce, spanning the last three months.

经评估交易量和未平仓合约后,显而易见,主要市场推动因素集中在赛富时价格区间在$150.0和$350.0之间,这跨越了过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

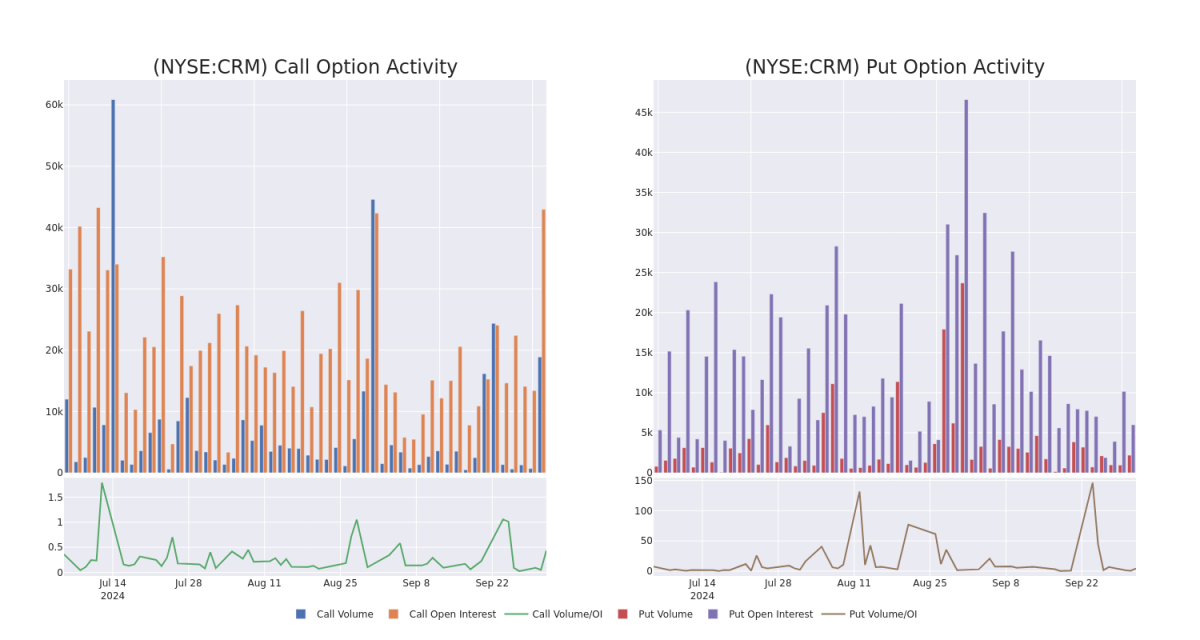

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Salesforce's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Salesforce's significant trades, within a strike price range of $150.0 to $350.0, over the past month.

检视成交量和未平仓合约为股票研究提供了关键洞见。这些信息对于评估在某些执行价格处赛富时期权的流动性和兴趣水平至关重要。下面,我们提供了过去一个月内赛富时重要交易中看涨和看跌期权在$150.0至$350.0执行价格区间内成交量和未平仓合约趋势的快照。

Salesforce Call and Put Volume: 30-Day Overview

Salesforce看涨期权和看跌期权成交量:30天总览

Noteworthy Options Activity:

值得注意的期权活动:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | SWEEP | BEARISH | 11/15/24 | $12.2 | $12.1 | $12.2 | $280.00 | $676.1K | 3.5K | 601 |

| CRM | CALL | SWEEP | BEARISH | 11/15/24 | $12.35 | $12.1 | $12.1 | $280.00 | $539.8K | 3.5K | 1.6K |

| CRM | CALL | SWEEP | BEARISH | 01/17/25 | $20.9 | $20.85 | $20.85 | $280.00 | $200.1K | 3.3K | 405 |

| CRM | CALL | SWEEP | NEUTRAL | 01/17/25 | $21.75 | $21.6 | $21.7 | $280.00 | $195.3K | 3.3K | 243 |

| CRM | CALL | TRADE | BULLISH | 12/20/24 | $13.85 | $13.7 | $13.85 | $290.00 | $138.5K | 2.3K | 198 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 看涨 | SWEEP | 看淡 | 11/15/24 | $12.2 | $12.1 | $12.2 | $280.00 | $676.1K | 3.5K | 601 |

| CRM | 看涨 | SWEEP | 看淡 | 11/15/24 | $12.35 | $12.1 | $12.1 | $280.00 | 539.8千美元 | 3.5K | 1.6K |

| CRM | 看涨 | SWEEP | 看淡 | 01/17/25 | $20.9 | $20.85 | $20.85 | $280.00 | $200.1K | 3.3K | 405 |

| CRM | 看涨 | SWEEP | 中立 | 01/17/25 | $21.75 | $21.6 | $21.7 | $280.00 | $195.3K | 3.3K | 243 |

| CRM | 看涨 | 交易 | 看好 | 12/20/24 | $13.85 | $13.7 | $13.85 | $290.00 | $138.5K | 2.3K | 198 |

About Salesforce

关于赛富时

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

赛富时提供企业级云计算解决方案。该公司提供客户关系管理技术,将公司和客户联系在一起。其客户360平台帮助集团提供单一的数据来源,连接客户数据跨系统、应用和设备,帮助公司销售、服务、市场和开展商业。它还为客户支持提供服务云,为数字营销活动提供营销云,作为电子商务引擎的商业云,提供赛富时平台,以允许企业构建应用程序和其他解决方案,例如用于数据集成的MuleSoft。

Current Position of Salesforce

Salesforce当前的持仓状况

- With a trading volume of 7,570,877, the price of CRM is up by 3.47%, reaching $280.26.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 56 days from now.

- 交易量为7,570,877,CRM价格上涨3.47%,达到280.26美元。

- 当前RSI值表明股票可能已经超买。

- 下一份盈利报告将在56天后发布。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with CRM, it often means somebody knows something is about to happen.