Smart Money Is Betting Big In VRT Options

Smart Money Is Betting Big In VRT Options

Financial giants have made a conspicuous bearish move on Vertiv Hldgs. Our analysis of options history for Vertiv Hldgs (NYSE:VRT) revealed 31 unusual trades.

金融巨头在Vertiv Hldgs上做出了明显的看淡举动。我们对Vertiv Hldgs(纽交所:VRT)的期权历史进行分析,发现了31笔异常交易。

Delving into the details, we found 41% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $83,958, and 28 were calls, valued at $2,020,528.

深入细节,我们发现41%的交易员持看涨态度,而45%显示出看淡倾向。在我们发现的所有交易中,有3笔看跌,价值$83,958,28笔看涨,价值$2,020,528。

Expected Price Movements

预期价格波动

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $150.0 for Vertiv Hldgs over the recent three months.

根据交易活动,重要投资者似乎瞄准了在过去三个月里Vertiv Hldgs的股价区间,从$50.0到$150.0。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

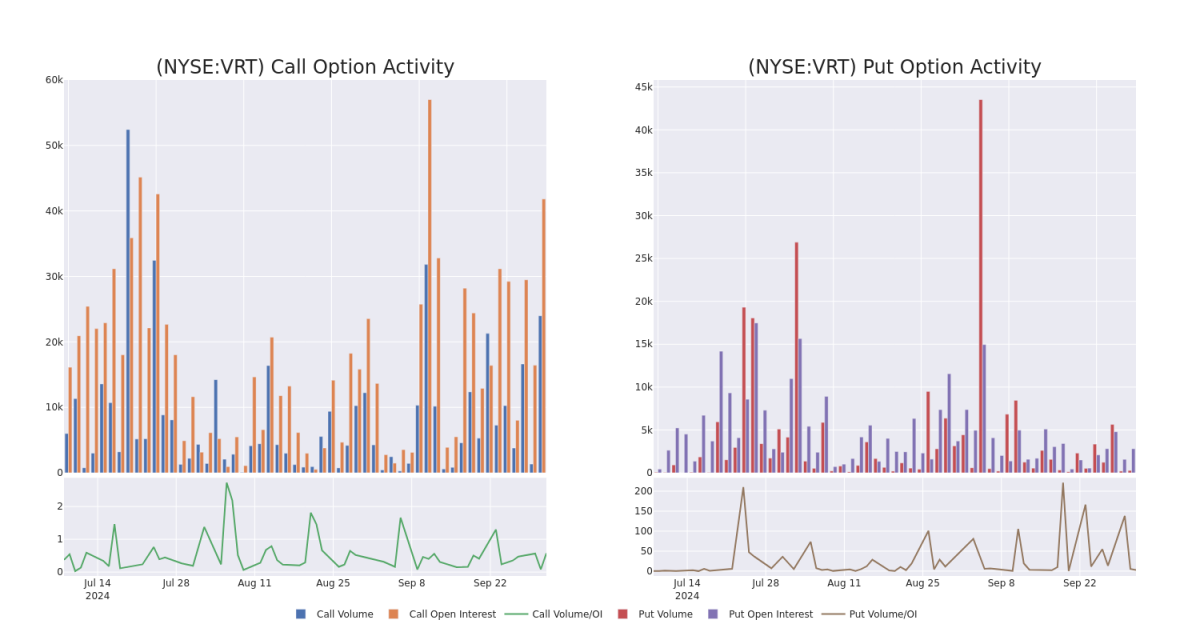

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertiv Hldgs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertiv Hldgs's substantial trades, within a strike price spectrum from $50.0 to $150.0 over the preceding 30 days.

评估成交量和未平仓合约是期权交易中的战略步骤。这些指标揭示了在指定行使价格下,对Vertiv Hldgs期权的流动性和投资者兴趣。即将到来的数据将对在过去30天内与Vertiv Hldgs的大宗交易相关的因素的成交量和未平仓合约的波动进行可视化,行使价格范围从$50.0到$150.0。

Vertiv Hldgs Call and Put Volume: 30-Day Overview

Vertiv Hldgs看涨期权和看跌期权成交量:30天总览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00 | $323.3K | 3.9K | 606 |

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00 | $175.4K | 3.9K | 279 |

| VRT | CALL | SWEEP | BEARISH | 11/15/24 | $3.4 | $3.4 | $3.4 | $120.00 | $155.0K | 714 | 475 |

| VRT | CALL | SWEEP | BULLISH | 10/18/24 | $3.2 | $3.1 | $3.2 | $105.00 | $128.0K | 6.4K | 2.8K |

| VRT | CALL | SWEEP | BULLISH | 01/17/25 | $23.4 | $23.1 | $23.4 | $85.00 | $114.6K | 5.2K | 49 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VRT | 看涨 | SWEEP | 看淡 | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00。 | 323.3千美元 | 3.9K | 606 |

| VRT | 看涨 | SWEEP | 看淡 | 11/15/24 | $10.3 | $10.2 | $10.2 | $100.00。 | $175.4K | 3.9K | 279 |

| VRT | 看涨 | SWEEP | 看淡 | 11/15/24 | $3.4 | $3.4 | $3.4 | $120.00 | $155.0K | 714 | 475 |

| VRT | 看涨 | SWEEP | 看好 | 10/18/24 | $3.2 | $3.1 | $3.2 | $105.00 | $128.0K | 6.4千 | 2.8K |

| VRT | 看涨 | SWEEP | 看好 | 01/17/25 | $23.4 | $23.1 | $23.4 | $85.00 | $114.6K | 5.2K | 49 |

About Vertiv Hldgs

关于Vertiv Hldgs

Vertiv Holdings Co brings together hardware, software, analytics and ongoing services to ensure its customers vital applications run continuously, perform optimally and grow with their business needs. The company solves the important challenges faced by data centers, communication networks and commercial and industrial facilities with a portfolio of power, cooling and IT infrastructure solutions and services that extends from the cloud to the edge of the network. Its services include critical power, thermal management, racks and enclosures, monitoring and management, and other services. Its three business segments include the Americas, Asia Pacific; and Europe, Middle East & Africa.

Vertiv Holdings Co整合了硬件、软件、分析和持续服务,确保客户的关键应用程序连续运行、最佳表现并随着业务需求而增长。该公司通过一系列从云到网络边缘的电力、冷却和IT基础设施解决数据中心、通信网络和商业及工业设施面临的挑战。其服务包括关键电力、热管理、机柜和外壳、监控和管理以及其他服务。其三个业务板块包括美洲、亚太和欧洲、中东和非洲。

After a thorough review of the options trading surrounding Vertiv Hldgs, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

经过对围绕Vertiv Hldgs的期权交易的全面审查,我们深入研究了该公司的更多细节。这包括对其当前市场地位和表现的评估。

Where Is Vertiv Hldgs Standing Right Now?

Vertiv Hldgs目前处于什么状态?

- With a trading volume of 6,116,950, the price of VRT is up by 5.0%, reaching $102.5.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 21 days from now.

- 交易量为6,116,950,VRt的价格上涨了5.0%,达到102.5美元。

- 当前RSI值表明股票可能已经超买。

- 下次盈利报告计划在21天后。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Vertiv Hldgs options trades with real-time alerts from Benzinga Pro.

期权交易存在更高的风险和潜在回报。精明的交易者通过不断学习、调整策略、监控多种因子和密切关注市场动向来应对这些风险。通过Benzinga Pro实时警报,了解最新的Vertiv Hldgs期权交易。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertiv Hldgs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertiv Hldgs's substantial trades, within a strike price spectrum from $50.0 to $150.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vertiv Hldgs's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vertiv Hldgs's substantial trades, within a strike price spectrum from $50.0 to $150.0 over the preceding 30 days.