Investors in China Dongxiang (Group) (HKG:3818) From Five Years Ago Are Still Down 40%, Even After 30% Gain This Past Week

Investors in China Dongxiang (Group) (HKG:3818) From Five Years Ago Are Still Down 40%, Even After 30% Gain This Past Week

China Dongxiang (Group) Co., Ltd. (HKG:3818) shareholders will doubtless be very grateful to see the share price up 44% in the last month. But over the last half decade, the stock has not performed well. In fact, the share price is down 56%, which falls well short of the return you could get by buying an index fund.

中国动向(集团)有限公司(HKG:3818)的股东无疑会非常感激,因为股价在过去一个月内上涨了44%。但在过去的五年里,该股表现不佳。实际上,股价下跌了56%,远远不及购买指数基金可以获得的回报。

On a more encouraging note the company has added HK$528m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

更令人鼓舞的是,公司在过去的7天内市值增加了52800万港币,让我们看看是什么导致了股东五年来的损失。

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

尽管市场是一个强大的定价机制,股价不仅反映了基本业务表现,还反映了投资者的情绪。通过比较每股收益(EPS)和股价变化,并随时间推移这样做,我们可以了解股东对公司的态度如何随时间变化。

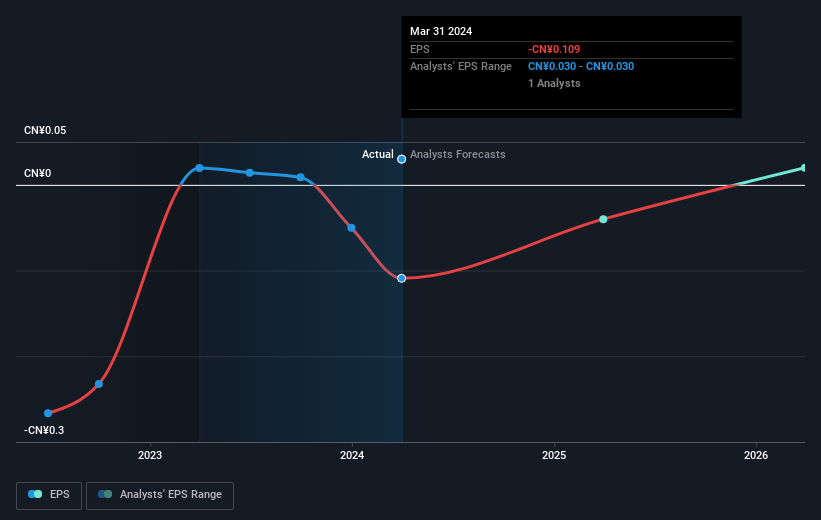

In the last half decade China Dongxiang (Group) saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

在过去的五年里,中国动向(集团)的股价下跌,同时每股收益下滑至零以下。目前很难对每股收益和股价进行有效比较。但一般情况下我们会期待价格更低,鉴于这种情况。

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

该公司的每股收益(随时间的推移)如下图所示(单击可查看确切数字)。

Dive deeper into China Dongxiang (Group)'s key metrics by checking this interactive graph of China Dongxiang (Group)'s earnings, revenue and cash flow.

通过查看中国动向(集团)的收益、营业收入和现金流的互动图,进一步了解中国动向(集团)的关键指标。

What About Dividends?

那么分红怎么样呢?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of China Dongxiang (Group), it has a TSR of -40% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

对于任何给定的股票,考虑总股东回报以及股价回报是很重要的。TSR是一种回报计算,考虑了现金股息的价值(假设任何收到的股息都被再投资)以及任何折现资本募集和分拆计算值。因此,对于那些支付丰厚股息的公司,TSR往往比股价回报高得多。就中国动向(集团)而言,过去5年TSR达到-40%。这超过了我们之前提到的股价回报。公司支付的股息因此提升了总股东回报。

A Different Perspective

不同的观点

It's nice to see that China Dongxiang (Group) shareholders have received a total shareholder return of 55% over the last year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for China Dongxiang (Group) that you should be aware of before investing here.

很高兴看到中国动向(集团)股东在过去一年内获得了55%的总股东回报。 包括股息在内。 毫无疑问,这些最近的回报远远好于过去5年每年7%的TSR亏损。这让我们有点担忧,但该业务可能已扭转其命运。 我觉得长期观察股价作为业务绩效的代理很有趣。 但要真正获得洞察,我们还需要考虑其他信息。 例如,我们发现了中国动向(集团)的1个警告信号,您在投资之前应该注意。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您愿意查看另一家公司(具有潜在的更好财务状况),请不要错过这个免费的公司列表,证明它们可以增长收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

请注意,本文引用的市场回报反映了当前在香港证券交易所交易的股票的市场加权平均回报。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

In the last half decade China Dongxiang (Group) saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

In the last half decade China Dongxiang (Group) saw its share price fall as its EPS declined below zero. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.