On Oct 03, major Wall Street analysts update their ratings for $Diamondback Energy (FANG.US)$, with price targets ranging from $182 to $286.

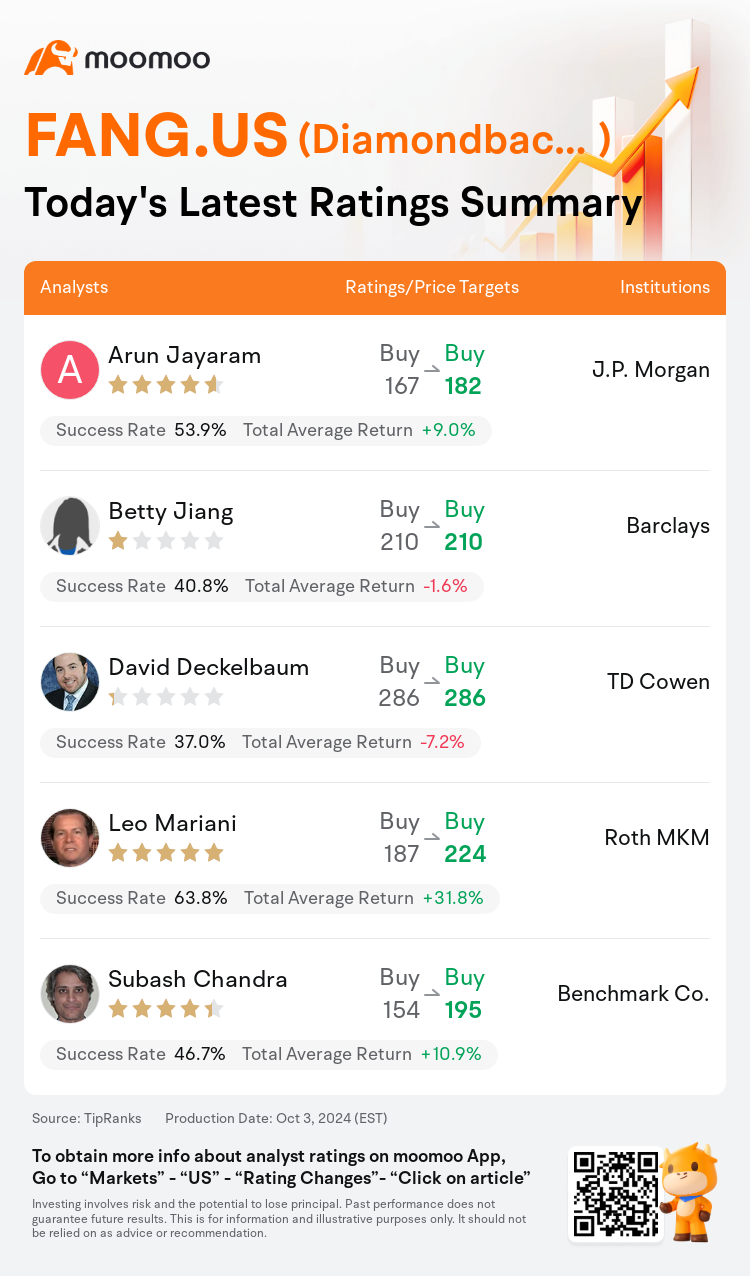

J.P. Morgan analyst Arun Jayaram maintains with a buy rating, and adjusts the target price from $167 to $182.

Barclays analyst Betty Jiang maintains with a buy rating, and maintains the target price at $210.

TD Cowen analyst David Deckelbaum maintains with a buy rating, and maintains the target price at $286.

TD Cowen analyst David Deckelbaum maintains with a buy rating, and maintains the target price at $286.

Roth MKM analyst Leo Mariani maintains with a buy rating, and adjusts the target price from $187 to $224.

Benchmark Co. analyst Subash Chandra maintains with a buy rating, and adjusts the target price from $154 to $195.

Furthermore, according to the comprehensive report, the opinions of $Diamondback Energy (FANG.US)$'s main analysts recently are as follows:

In a potentially challenging near-term oil macro environment, with the anticipated return of OPEC+ barrels, Diamondback Energy is poised to outperform relatively due to its advantageous position. With a cost structure that is at the lower end in the Midland Basin, and dividend coverage below $45 per barrel, the company is expected to maintain a stronger performance.

Diamondback Energy is perceived to have one of the most definitive positive event trajectories in the upcoming quarters, primarily as it completes the integration of Endeavor. It is anticipated that the company will announce a 2025 plan that proves to be considerably more capital efficient than previously projected. The recent decline in share prices, partly due to a liquidity event by Endeavor sellers, is seen as a compelling entry point for investors.

Estimates within the exploration and production sector have been revised to reflect updated commodity price projections and the investment landscape. The expectation for long-term oil and gas prices is to stabilize at certain levels. Should operational efficiencies continue and service costs further decrease, the exploration and production companies are positioned to maintain robust capital efficiency into 2025, potentially counterbalancing the effects of resource maturity.

Here are the latest investment ratings and price targets for $Diamondback Energy (FANG.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月3日,多家华尔街大行更新了$Diamondback Energy (FANG.US)$的评级,目标价介于182美元至286美元。

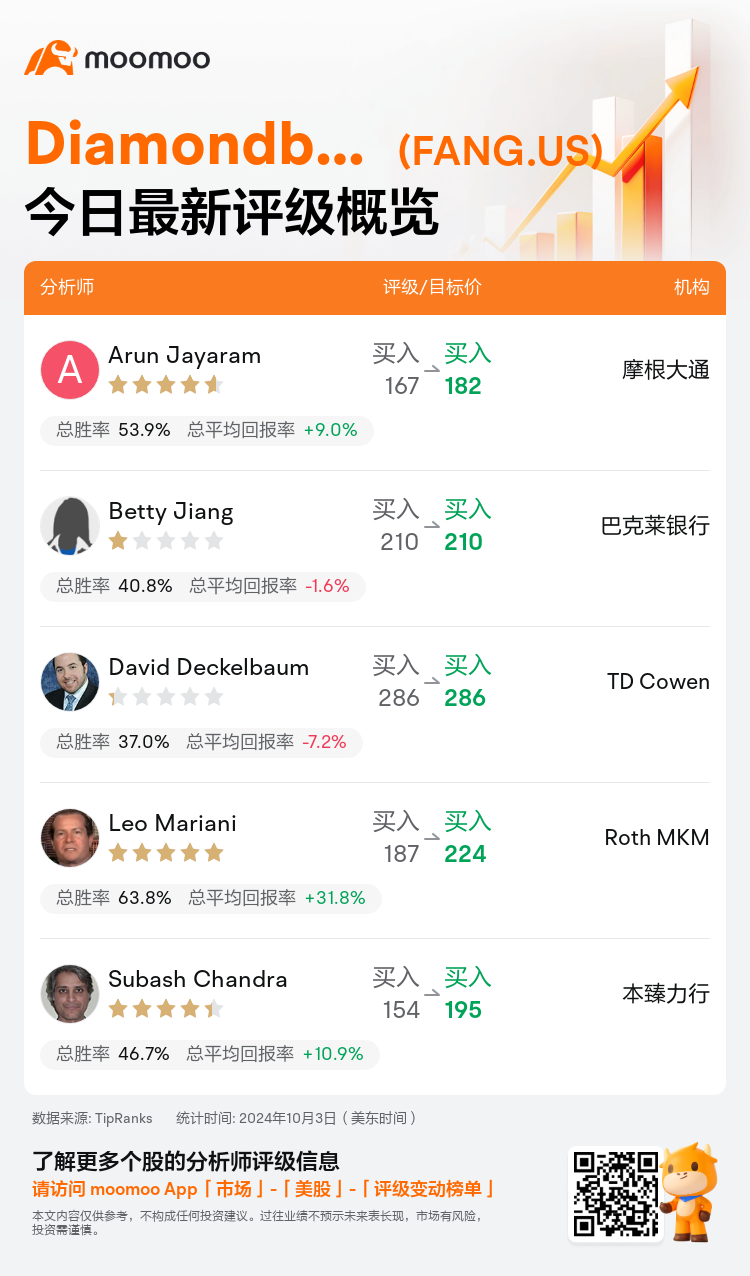

摩根大通分析师Arun Jayaram维持买入评级,并将目标价从167美元上调至182美元。

巴克莱银行分析师Betty Jiang维持买入评级,维持目标价210美元。

TD Cowen分析师David Deckelbaum维持买入评级,维持目标价286美元。

TD Cowen分析师David Deckelbaum维持买入评级,维持目标价286美元。

Roth MKM分析师Leo Mariani维持买入评级,并将目标价从187美元上调至224美元。

本臻力行分析师Subash Chandra维持买入评级,并将目标价从154美元上调至195美元。

此外,综合报道,$Diamondback Energy (FANG.US)$近期主要分析师观点如下:

在可能充满挑战的短期石油宏观环境中,随着欧佩克+原油的预期回报,由于其优势地位,响尾蛇能源有望相对跑赢大盘。由于米德兰盆地的成本结构处于较低水平,股息覆盖率低于每桶45美元,预计该公司将保持更强劲的业绩。

Diamondback Energy被认为是未来几个季度中最明确的积极事件轨迹之一,这主要是在它完成了对Endeavor的整合之时。预计该公司将宣布一项2025年计划,事实证明,该计划的资本效率比先前的预测高得多。近期股价下跌被视为投资者引人注目的切入点,部分原因是奋进号卖家的流动性事件。

对勘探和生产部门的估算进行了修订,以反映最新的大宗商品价格预测和投资格局。对长期石油和天然气价格的预期将稳定在一定水平。如果运营效率持续下去,服务成本进一步降低,勘探和生产公司有望在2025年之前保持强劲的资本效率,从而有可能抵消资源成熟度的影响。

以下为今日5位分析师对$Diamondback Energy (FANG.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

TD Cowen分析师David Deckelbaum维持买入评级,维持目标价286美元。

TD Cowen分析师David Deckelbaum维持买入评级,维持目标价286美元。

TD Cowen analyst David Deckelbaum maintains with a buy rating, and maintains the target price at $286.

TD Cowen analyst David Deckelbaum maintains with a buy rating, and maintains the target price at $286.