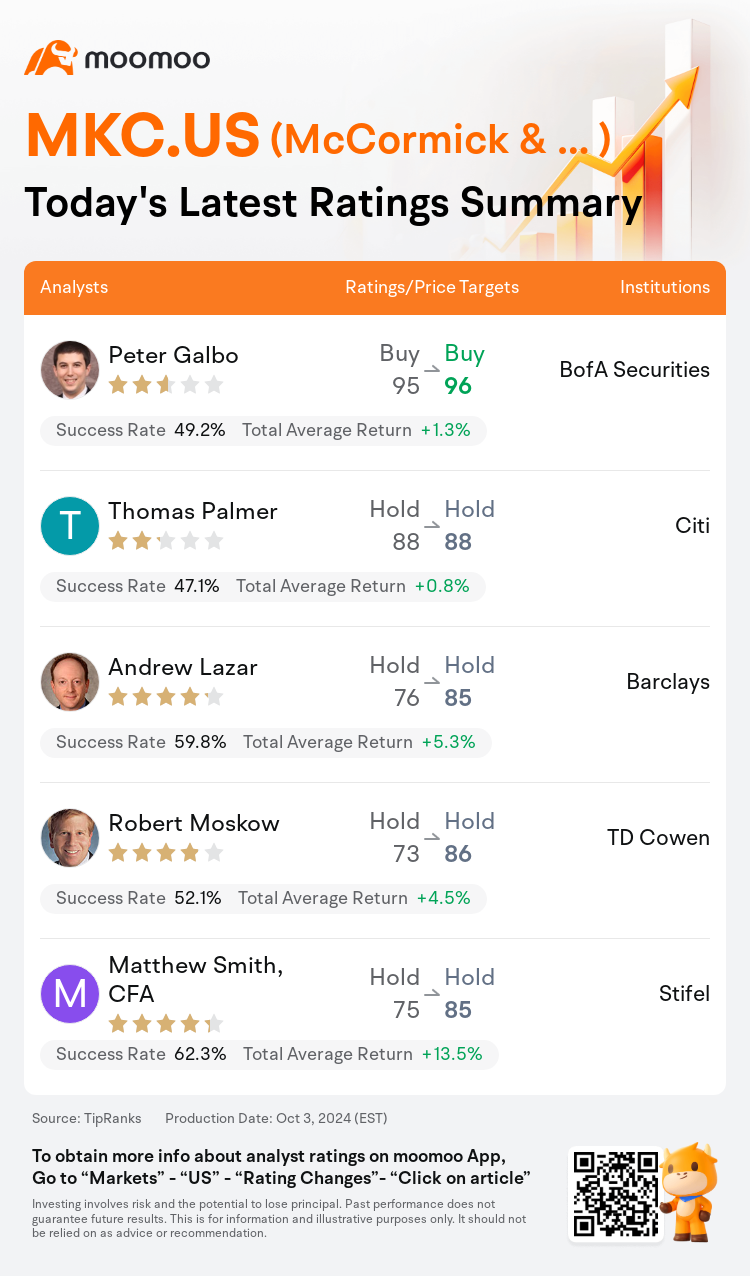

On Oct 03, major Wall Street analysts update their ratings for $McCormick & Co (MKC.US)$, with price targets ranging from $85 to $96.

BofA Securities analyst Peter Galbo maintains with a buy rating, and adjusts the target price from $95 to $96.

Citi analyst Thomas Palmer maintains with a hold rating, and maintains the target price at $88.

Barclays analyst Andrew Lazar maintains with a hold rating, and adjusts the target price from $76 to $85.

Barclays analyst Andrew Lazar maintains with a hold rating, and adjusts the target price from $76 to $85.

TD Cowen analyst Robert Moskow maintains with a hold rating, and adjusts the target price from $73 to $86.

Stifel analyst Matthew Smith, CFA maintains with a hold rating, and adjusts the target price from $75 to $85.

Furthermore, according to the comprehensive report, the opinions of $McCormick & Co (MKC.US)$'s main analysts recently are as follows:

Post McCormick's Q3 earnings, which surpassed expectations owing to improved gross and operating margins, the company also elevated its financial outlook for FY24. Subsequent to the earnings report and updated guidance, forecasts for FY24 adjusted EPS were increased.

McCormick's Q3 results surpassed expectations, though a significant part of this performance was due to tax effects, foreign exchange, and a shift in the timing of SG&A / IT investments to the fourth quarter. Management also observed a lower-than-anticipated consumer response in China, with the APAC region being the sole area without volume growth.

The company reported a solid third-quarter earnings per share outperformance, and management has adjusted the full-year guidance upwards to account for a specific tax advantage. The performance is perceived as acceptable though not exceptional, considering the organic sales expanded by a modest 0.4%.

Following McCormick's report of a robust third quarter, an analyst highlighted the company's earnings per share of 83 cents, which signified a 28% increase and surpassed estimates by 17 cents, inclusive of a 10 cent benefit from certain items and a stronger than anticipated margin expansion. The company's reiteration of its constant currency guidance for the full year and its assurance in reaching the mid-to-high end of its sales growth projection was also underscored. Consequently, the analyst has adjusted the earnings per share estimate upward by 5 cents, now anticipating an earnings per share of $2.89 for the full year.

Here are the latest investment ratings and price targets for $McCormick & Co (MKC.US)$ from 5 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

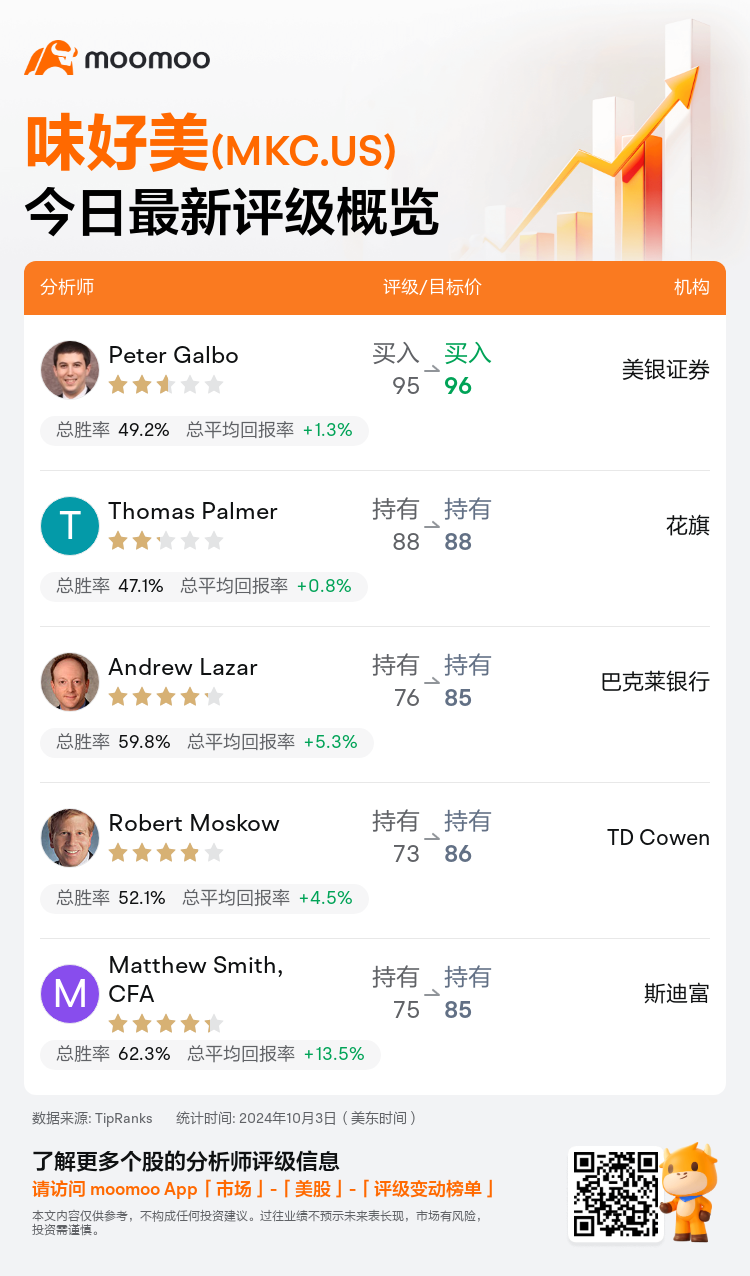

美东时间10月3日,多家华尔街大行更新了$味好美 (MKC.US)$的评级,目标价介于85美元至96美元。

美银证券分析师Peter Galbo维持买入评级,并将目标价从95美元上调至96美元。

花旗分析师Thomas Palmer维持持有评级,维持目标价88美元。

巴克莱银行分析师Andrew Lazar维持持有评级,并将目标价从76美元上调至85美元。

巴克莱银行分析师Andrew Lazar维持持有评级,并将目标价从76美元上调至85美元。

TD Cowen分析师Robert Moskow维持持有评级,并将目标价从73美元上调至86美元。

斯迪富分析师Matthew Smith, CFA维持持有评级,并将目标价从75美元上调至85美元。

此外,综合报道,$味好美 (MKC.US)$近期主要分析师观点如下:

由于毛利率和营业利润率的提高,麦考密克第三季度收益超出了预期,此后,该公司还上调了24财年的财务前景。继收益报告和更新的指导方针之后,对24财年调整后每股收益的预测有所增加。

麦考密克第三季度的业绩超出了预期,尽管这一业绩的很大一部分是由于税收影响、外汇以及SG&A/It投资时间转移到第四季度所致。管理层还观察到中国消费者的反应低于预期,亚太地区是唯一没有销量增长的区域。

该公司报告称,第三季度每股收益表现稳健,跑赢大盘,管理层已经上调了全年预期,以考虑特定的税收优惠。考虑到有机销售额小幅增长了0.4%,这种表现被认为是可以接受的,但并不例外。

继麦考密克公布强劲的第三季度报告后,一位分析师强调该公司的每股收益为83美分,这意味着增长了28%,比预期高出17美分,其中包括某些项目的10美分收益和强于预期的利润增长。该公司重申了其全年恒定货币指引,并保证达到销售增长预期的中高端,这一点也得到了强调。因此,分析师将每股收益估计值上调了5美分,现在预计全年每股收益为2.89美元。

以下为今日5位分析师对$味好美 (MKC.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

巴克莱银行分析师Andrew Lazar维持持有评级,并将目标价从76美元上调至85美元。

巴克莱银行分析师Andrew Lazar维持持有评级,并将目标价从76美元上调至85美元。

Barclays analyst Andrew Lazar maintains with a hold rating, and adjusts the target price from $76 to $85.

Barclays analyst Andrew Lazar maintains with a hold rating, and adjusts the target price from $76 to $85.