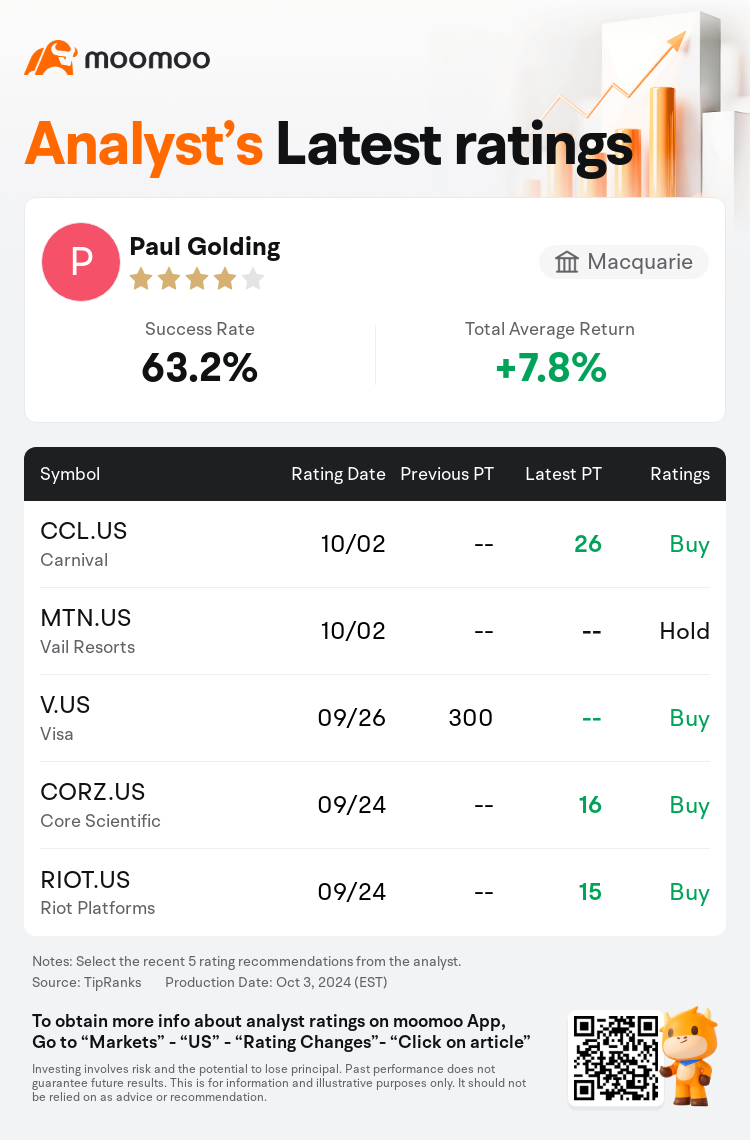

Macquarie analyst Paul Golding maintains $Carnival (CCL.US)$ with a buy rating, and sets the target price at $26.

According to TipRanks data, the analyst has a success rate of 63.2% and a total average return of 7.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Carnival (CCL.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Carnival (CCL.US)$'s main analysts recently are as follows:

Following Carnival's Q3 report, forecasts for the fiscal years 2024, 2025, and 2026 exhibit increases of 8%, 13%, and 12% respectively. Nonetheless, despite the cruise booking environment showing greater strength compared to other travel segments, and advantageous movements in fuel and currency, Carnival's model is characterized by its asset intensity and significant operating and financial leverage, rendering it more susceptible to economic downturns compared to other entities in the analyst's purview.

The company's third-quarter report and fourth-quarter guidance may not meet all the criteria, but the positive underlying demand indicators and commentary suggest that the potential for growth by 2025 remains. Despite not being the most straightforward 'beat and raise,' the period demonstrated another quarter of robust key performance indicators.

Carnival's incremental margins have been reported as surpassing expectations, and the company's ability to achieve revenue and EBITDA rates noticeably superior to those of 2019 during the second and third quarters indicates potential for enhanced overall business margins. With the company poised to leverage additional revenue over a refined cost structure, it's posited that the strength of these incremental margins is currently undervalued.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

麦格理集团分析师Paul Golding维持$嘉年华邮轮 (CCL.US)$买入评级,目标价26美元。

根据TipRanks数据显示,该分析师近一年总胜率为63.2%,总平均回报率为7.8%。

此外,综合报道,$嘉年华邮轮 (CCL.US)$近期主要分析师观点如下:

此外,综合报道,$嘉年华邮轮 (CCL.US)$近期主要分析师观点如下:

继嘉年华发布第三季度报告之后,对2024、2025和2026财年的预测分别显示了8%、13%和12%的增长。尽管如此,尽管与其他旅行细分市场相比,邮轮预订环境表现出更强劲的实力,而且燃料和货币的变动也具有优势,但嘉年华的模式以其资产密集度以及显著的运营和财务杠杆率为特征,因此与分析师职权范围内的其他实体相比,嘉年华更容易受到经济衰退的影响。

该公司的第三季度报告和第四季度指引可能不符合所有标准,但积极的基本需求指标和评论表明,到2025年,增长潜力仍然存在。尽管这不是最直截了当的 “涨停加薪”,但这一时期又显示出四分之一的关键绩效指标表现强劲。

据报道,嘉年华的增量利润率超出了预期,该公司在第二和第三季度实现收入和息税折旧摊销前利润率明显优于2019年的能力,这表明整体业务利润率有可能提高。由于该公司准备利用额外收入来完善的成本结构,因此据推测,这些增量利润率的强度目前被低估了。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$嘉年华邮轮 (CCL.US)$近期主要分析师观点如下:

此外,综合报道,$嘉年华邮轮 (CCL.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of