UP Fintech +10%, Here are Options Market Dynamics From Benzinga Pro

UP Fintech +10%, Here are Options Market Dynamics From Benzinga Pro

Investors with a lot of money to spend have taken a bullish stance on $UP Fintech (TIGR.US)$.

资金雄厚的投资者对看好态度持久 $向上融科 (TIGR.US)$.

Today, Benzinga's options scanner spotted 33 uncommon options trades for UP Fintech Holding. The overall sentiment of these big-money traders is split between 45% bullish and 45%, bearish.

今天,Benzinga的期权扫描器发现了33笔向上融科控股的不寻常期权交易。这些大额交易者的整体情绪在45%看涨和45%看跌之间分歧。

Out of all of the special options we uncovered, 3 are puts, for a total amount of $181,450, and 30 are calls, for a total amount of $1,241,915.

在我们发现的所有特殊期权中,有3单看跌,总额为$181,450,还有30单看涨,总额为$1,241,915。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

分析这些合同的成交量和持仓量,似乎大户关注向上融科控股在过去季度的价格区间在$5.0到$17.0之间。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

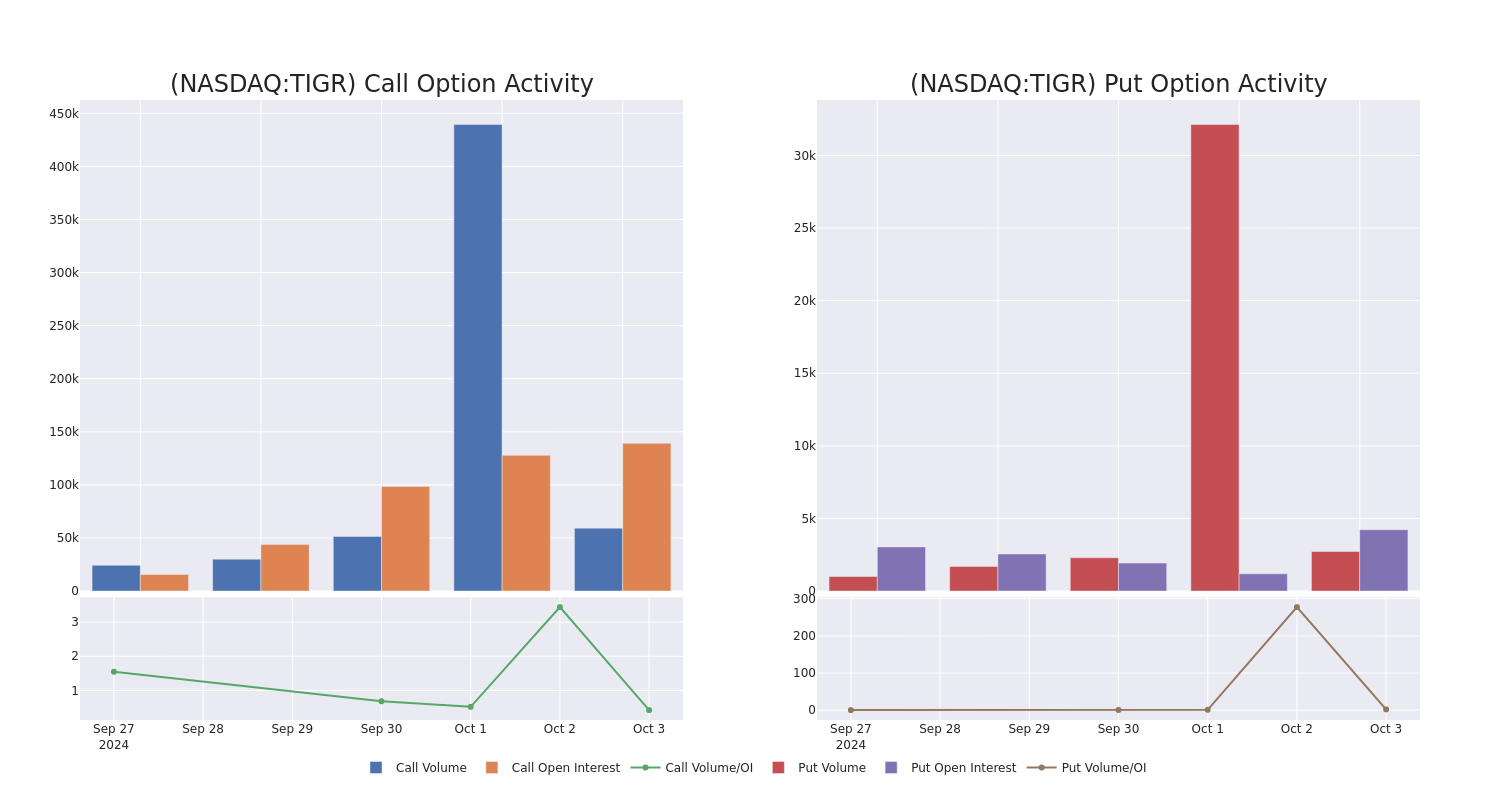

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for UP Fintech Holding's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of UP Fintech Holding's whale trades within a strike price range from $5.0 to $17.0 in the last 30 days.

在交易期权时,观察成交量和未平仓合约是一个强大的举措。这些数据可以帮助您跟踪向上融科控股公司特定行使价期权的流动性和兴趣。在下面,我们可以观察到过去30天内,对于所有向上融科控股公司特定行使价范围从$5.0到$17.0的大宗交易的看涨期权和看跌期权成交量和未平仓合约的演变。

UP Fintech Holding Call and Put Volume: 30-Day Overview

向上融科控股公司看涨和看跌期权成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

Symbol |

PUT/CALL |

Trade Type |

Sentiment |

Exp. Date |

Ask |

Bid |

Price |

Strike Price |

Total Trade Price |

Open Interest |

Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

TIGR |

CALL |

TRADE |

BEARISH |

10/18/24 |

$3.7 |

$3.5 |

$3.56 |

$5.50 |

$106.8K |

2.8K |

813 |

TIGR |

CALL |

SWEEP |

BULLISH |

11/15/24 |

$1.5 |

$1.4 |

$1.5 |

$10.00 |

$75.0K |

10.0K |

2.4K |

TIGR |

PUT |

SWEEP |

BEARISH |

11/15/24 |

$0.85 |

$0.75 |

$0.75 |

$7.00 |

$74.9K |

1.0K |

1.7K |

TIGR |

CALL |

SWEEP |

BEARISH |

11/15/24 |

$2.5 |

$2.35 |

$2.35 |

$8.00 |

$70.5K |

4.1K |

920 |

TIGR |

CALL |

SWEEP |

BEARISH |

10/18/24 |

$1.25 |

$1.2 |

$1.2 |

$10.00 |

$69.3K |

9.8K |

6.7K |

标的 |

看跌/看涨 |

交易类型 |

情绪 |

到期日 |

卖盘 |

买盘 |

价格 |

执行价格 |

总交易价格 |

未平仓合约数量 |

成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

TIGR |

看涨 |

交易 |

看淡 |

10/18/24 |

$3.7 |

$3.5 |

$3.56 |

5.50美元 |

$106.8K |

2.8K |

813 |

TIGR |

看涨 |

SWEEP |

看好 |

11/15/24 |

$1.5 |

$1.4 |

$1.5 |

$10.00 |

$75.0K |

10.0K |

2.4K |

TIGR |

看跌 |

SWEEP |

看淡 |

11/15/24 |

$0.85 |

0.75美元 |

0.75美元 |

$7.00 |

$74.9K |

1.0K |

1.7K |

TIGR |

看涨 |

SWEEP |

看淡 |

11/15/24 |

$2.5 |

$2.35 |

$2.35 |

8.00美元 |

$70.5K |

4.1K |

920 |

TIGR |

看涨 |

SWEEP |

看淡 |

10/18/24 |

$1.25 |

$1.2 |

$1.2 |

$10.00 |

$69.3K |

9.8千 |

6.7千 |

About UP Fintech Holding

关于向上融科控股

UP Fintech Holding Ltd is an online brokerage firm focusing on Chinese investors. Its trading platform enables investors to trade in equities and other financial instruments on multiple exchanges of stocks and other derivatives. The company offers its customers brokerage and value-added services, including trade order placement and execution, margin financing, account management, investor education, community discussion, and customer support.

向上融科控股有限公司是一家专注于中国投资者的在线券商公司。其交易平台使投资者能够在多个股票交易所和其他衍生品上交易。该公司为客户提供券商和增值服务,包括交易下单和执行、保证金融资、账户管理、投资教育、社区讨论和客户支持。

After a thorough review of the options trading surrounding UP Fintech Holding, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对向上融科控股周边期权交易进行彻底审查之后,我们开始更详细地检查该公司。这包括评估其当前市场地位和表现。

Current Position of UP Fintech Holding

向上融科控股的当前位置

Currently trading with a volume of 17,126,367, the TIGR's price is up by 12.45%, now at $9.06.

RSI readings suggest the stock is currently may be overbought.

Anticipated earnings release is in 53 days.

目前成交量为17,126,367,TIGR的价格上涨12.45%,目前为9.06美元。

RSI读数表明股票目前可能超买。

预期收益发布将在53天后。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $17.0 for UP Fintech Holding during the past quarter.