Oracle Vs. Salesforce: Cloud Wars Heat Up, Stocks Take Off

Oracle Vs. Salesforce: Cloud Wars Heat Up, Stocks Take Off

The cloud battle between Oracle Corp (NYSE:ORCL) and Salesforce Inc (NYSE:CRM) is hitting new highs, and both stocks are riding the AI wave to impressive gains.

甲骨文公司(NYSE: ORCL)和赛富时公司(NYSE: CRM)之间的云市场格斗正持续升温,两家公司的股票都在人工智能浪潮中实现了令人印象深刻的涨幅。

But which one is winning? Let's dive into the numbers, recent moves, and what investors need to know.

但,哪一家公司正获胜?让我们深入了解数据、最新动向,以及投资者需要了解的信息。

Oracle's Big Play: Malaysia's Mega Cloud

甲骨文的重大举措:马来西亚的云计算巨头

Oracle has been flexing its cloud muscles, with a 20% stock jump over the past month, +61% YTD, thanks to impressive growth in its cloud infrastructure services. The latest boost?

甲骨文一直在展示其云计算实力,过去一个月股价上涨了20%,年初至今增长了61%,这要归功于其云基础服务的惊人增长。最新的助推?

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing Amazon.com Inc's $6.2 billion AWS plan. Oracle's aggressive push aims to tap into Malaysia's growing demand for AI, data, and analytics, potentially becoming one of the largest tech investments in Southeast Asia.

投资65亿美元在马来西亚建立一个公共云地域,超过了亚马逊公司的62亿美元AWS计划。甲骨文的大举推动旨在抓住马来西亚对人工智能、数据和分析日益增长的需求,有望成为东南亚最大的科技投资之一。

Read Also: Oracle Bets Big: Plans Over $6.5B Cloud Expansion In Malaysia To Fuel AI Innovation

继续阅读:甲骨文大胆押注:计划投资超过65亿美元在马来西亚扩展云计算以推动人工智能创新

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

On the charts, Oracle stock is showing solid bullish signals across the board, trading at $167.71, above its eight-day, 20-day and 50-day moving averages. However, some selling pressure indicates caution for those diving in for short-term gains.

在图表上,甲骨文股票显示出积极信号,交易价格为167.71美元,高于其8天、20天和50天的移动平均线。然而,一些卖压表明对于那些寻求短期收益的人需要谨慎。

Still, with ambitious revenue targets of $104 billion by FY2029, Oracle is playing the long game.

然而,截至2029财年,甲骨文制定了雄心勃勃的1040亿美元营业收入目标,正在进行长期规划。

Salesforce: GenAI Power Move

赛富时:GenAI 强势举措

Meanwhile, Salesforce isn't standing still. The stock is up 12.67% in the last month, powered by its new AgentForce platform, which analysts have hailed as "on par" with Microsoft Corp's GenAI.

与此同时,赛富时并未停滞不前。股价在过去一个月上涨了12.67%,得益于其新的AgentForce平台,分析师称其与微软公司的GenAI“不相上下”。

Piper Sandler even upgraded Salesforce to Outperform with a price target of $400. AgentForce, designed for sales, marketing, and service workflows, could boost Salesforce's TAM by a whopping $3.2 trillion.

派杰投资甚至将赛富时的评级提升至“表现优异”,目标价为400美元。AgentForce旨在提高销售、营销和服务工作流程,有望将赛富时的目标市场机会提升32万亿美元。

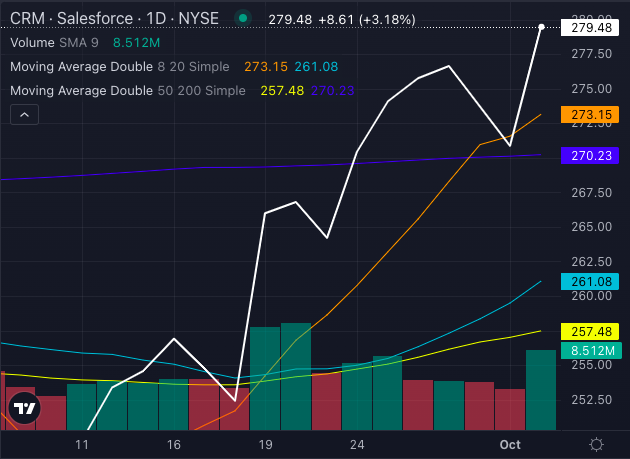

Chart created using Benzinga Pro

使用Benzinga Pro创建的图表

Salesforce stock's bullish technical signals, trading at $279.48, above its eight-day, 20-day and 50-day moving averages, confirm strong buying pressure.

赛富时股票的积极技术信号显示,交易价格为279.48美元,高于其8天、20天和50天的移动平均线,证实了强劲的买盘压力。

The Verdict?

裁决结果?

Both Oracle and Salesforce are AI-driven, cloud-hungry giants with plenty of growth potential. Oracle's bold infrastructure moves in Asia give it global reach, while Salesforce's GenAI ambitions position it to dominate in enterprise software.

Oracle和Salesforce都是以人工智能驱动、渴望云服务的巨头,拥有大量增长潜力。Oracle在亚洲大胆的制造行业举措使其具有全球影响力,而Salesforce的GenAI雄心使其有望主导企业软件领域。

Investors eyeing cloud and AI should consider both—but Oracle's international ventures and bullish long-term outlook might edge out Salesforce's innovative short-term wins.

关注云计算和人工智能的投资者应考虑两者——但Oracle的国际业务和对看好长期前景的观点可能会超过Salesforce的创新短期收获。

The real question: Who will be the ultimate king of the cloud? Let's see how the AI boom unfolds.

真正的问题是:谁将成为云端的终极之王?让我们看看人工智能繁荣如何展开。

- Oracle Surges 20% In September As AI, Cloud Strategy Flashes Bullish Signals

- 甲骨文在9月大涨20%,人工智能和云策略闪现积极信号

Photo: Shutterstock

Photo: shutterstock

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing

A $6.5 billion investment to establish a public cloud region in Malaysia—outpacing