Walt Disney Options Trading: A Deep Dive Into Market Sentiment

Walt Disney Options Trading: A Deep Dive Into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Walt Disney (NYSE:DIS), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DIS usually suggests something big is about to happen.

深谋远虑的投资者对迪士尼(纽交所:DIS)采取了看跌的策略,这是市场参与者不应忽视的。本财经媒体追踪公开期权记录发现了这一重大动向。这些投资者的身份尚未可知,但是DIS股票出现如此重要的变动通常意味着即将发生重大事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Walt Disney. This level of activity is out of the ordinary.

我们从今天的观察中获得了这些信息,当Benzinga的期权扫描仪突出了20个瓦特·迪士尼的非凡期权活动。这种活动水平是不同寻常的。

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 60% bearish. Among these notable options, 5 are puts, totaling $502,724, and 15 are calls, amounting to $855,609.

这些重量级投资者中普遍情绪分歧,有40%倾向于看涨,60%看淡。在这些显著的期权中,有5个看跌,总额为502,724美元,有15个看涨,总额为855,609美元。

Expected Price Movements

预期价格波动

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.

分析这些合约的成交量和未平仓量,似乎大户一直在关注瓦特·迪士尼在过去一个季度内的定价区间,即从85.0到140.0美元。

Volume & Open Interest Trends

成交量和未平仓量趋势

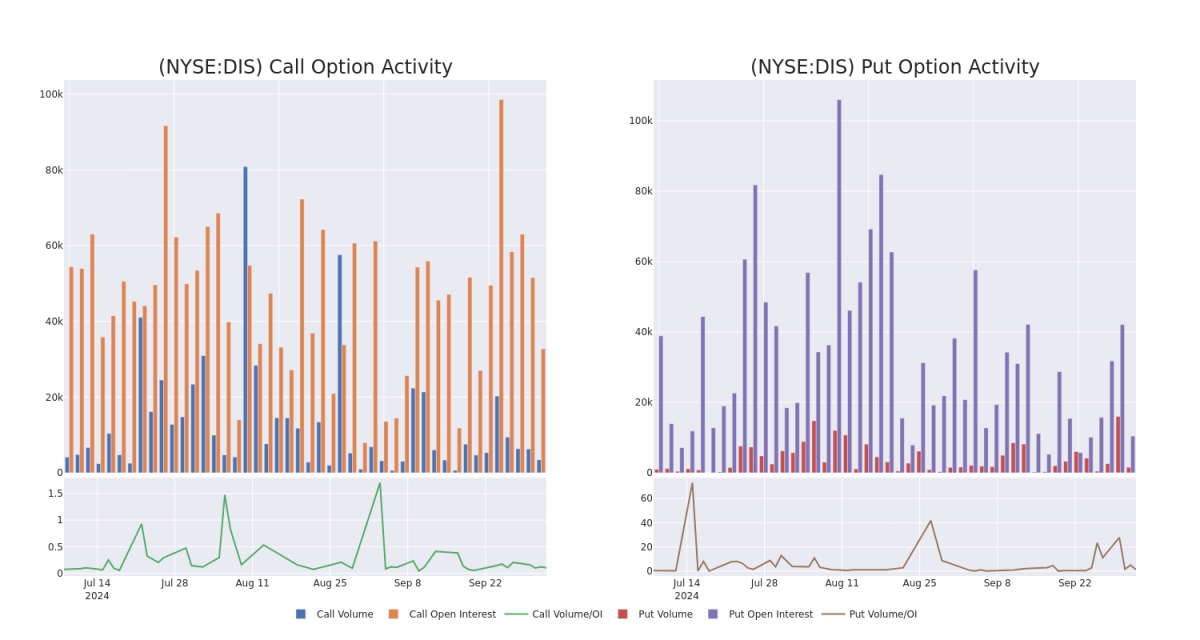

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Walt Disney's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Walt Disney's significant trades, within a strike price range of $85.0 to $140.0, over the past month.

检查成交量和未平仓量为股票研究提供了关键见解。这些信息是衡量瓦特·迪士尼在特定行权价格处的期权流动性和兴趣水平的关键。在下面,我们展示了瓦特·迪士尼在过去一个月内从85.0到140.0美元行权价格区间内看涨和看跌期权的成交量和未平仓量趋势的快照。

Walt Disney Option Activity Analysis: Last 30 Days

迪士尼期权活动分析:最近30天

Significant Options Trades Detected:

检测到重大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | SWEEP | BEARISH | 09/19/25 | $7.3 | $7.1 | $7.25 | $90.00 | $147.9K | 334 | 226 |

| DIS | PUT | SWEEP | BEARISH | 09/19/25 | $9.55 | $9.4 | $9.5 | $95.00 | $134.9K | 1.2K | 315 |

| DIS | CALL | SWEEP | BEARISH | 09/19/25 | $7.25 | $7.2 | $7.2 | $105.00 | $120.2K | 551 | 369 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $2.65 | $2.15 | $2.15 | $140.00 | $99.1K | 3.7K | 39 |

| DIS | PUT | TRADE | BEARISH | 11/15/24 | $1.34 | $1.29 | $1.32 | $85.00 | $99.0K | 8.1K | 763 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 项目8.01 | 看跌 | SWEEP | 看淡 | 09/19/25 | $7.3 | $7.1 | $7.25 | $90.00 | $147.9K | 334 | 226 |

| 项目8.01 | 看跌 | SWEEP | 看淡 | 09/19/25 | $9.55 | 9.4美元 | $9.5 | $ 95.00 | $134.9K | 1.2K | 315 |

| 项目8.01 | 看涨 | SWEEP | 看淡 | 09/19/25 | $7.25 | $7.2 | $7.2 | $105.00 | $120.2K | 551 | 369 |

| 项目8.01 | 看涨 | 交易 | 看淡 | 01/16/26 | $2.65 | $2.15 | $2.15 | $140.00 | $99.1K | 3.7K | 39 |

| 项目8.01 | 看跌 | 交易 | 看淡 | 11/15/24 | $1.34 | $1.29 | $1.32 | $85.00 | $99.0千 | 8.1千 | 763 |

About Walt Disney

关于迪士尼

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

迪士尼分为三个全球业务板块:娱乐、体育和体验。娱乐和体验都受益于公司一世纪以来创造的特许经营权和角色。娱乐包括ABC广播网络、几个有线电视网络、迪士尼+和Hulu流媒体服务。在这个板块中,迪士尼还进行电影和电视制作和分销,将内容授权给电影院、其他内容提供商,或者越来越多地在自己的流媒体平台和电视网络内使用。体育板块包括ESPN和ESPN+流媒体服务。体验包括迪士尼的主题公园和度假胜地,还受益于商品授权。

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在对迪士尼周边期权交易进行全面审查后,我们开始对公司进行更详细的评估。这包括对迪士尼当前市场地位和表现的评估。

Current Position of Walt Disney

华特迪士尼公司的当前位置

- Currently trading with a volume of 2,770,648, the DIS's price is down by -0.14%, now at $94.02.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 42 days.

- 目前成交量为2,770,648,迪士尼的价格下跌了-0.14%,目前为94.02美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计发布收益的时间为42天后。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

20年期的专业期权交易员揭示了他的单线图技巧,可以显示何时买入和卖出。复制他的交易,每20天平均盈利27%。点击这里获取更多信息。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Walt Disney options trades with real-time alerts from Benzinga Pro.

期权交易存在较高的风险和潜在回报。精明的交易员通过不断地自我教育、调整策略、监控多个因子、密切关注市场走势来管理这些风险。通过Benzinga Pro实时警报及时了解最新的华特迪士尼期权交易。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $140.0 for Walt Disney during the past quarter.