Unpacking the Latest Options Trading Trends in Nu Holdings

Unpacking the Latest Options Trading Trends in Nu Holdings

High-rolling investors have positioned themselves bullish on Nu Holdings (NYSE:NU), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in NU often signals that someone has privileged information.

高额投资者已经看好Nu Holdings(纽交所:NU),对零售交易者来说,这一点非常重要。 通过Benzinga对公开可获得的期权数据的追踪,我们今天注意到了这一活动。这些投资者的身份尚不确定,但NU股票的如此重大变动通常意味着有人掌握了内幕信息。

Today, Benzinga's options scanner spotted 9 options trades for Nu Holdings. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了九笔Nu Holdings的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 55% bullish and 44% bearish. Among all the options we identified, there was one put, amounting to $107,955, and 8 calls, totaling $591,788.

这些主要交易者的情绪分化,55%看好,44%看淡。在我们识别出的所有期权中,有一笔买入,金额为$107,955,和八笔卖出,总计$591,788。

Expected Price Movements

预期价格波动

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $7.0 and $16.0 for Nu Holdings, spanning the last three months.

在评估交易量和未平仓合约后,显而易见,主要市场操纵者正在关注Nu Holdings的股价区间在$7.0和$16.0之间,跨过了过去三个月。

Analyzing Volume & Open Interest

分析成交量和未平仓合约

In terms of liquidity and interest, the mean open interest for Nu Holdings options trades today is 19492.43 with a total volume of 18,833.00.

就流动性和兴趣而言,今天Nu Holdings期权交易的平均未平仓合约为19492.43,总成交量为18,833.00。

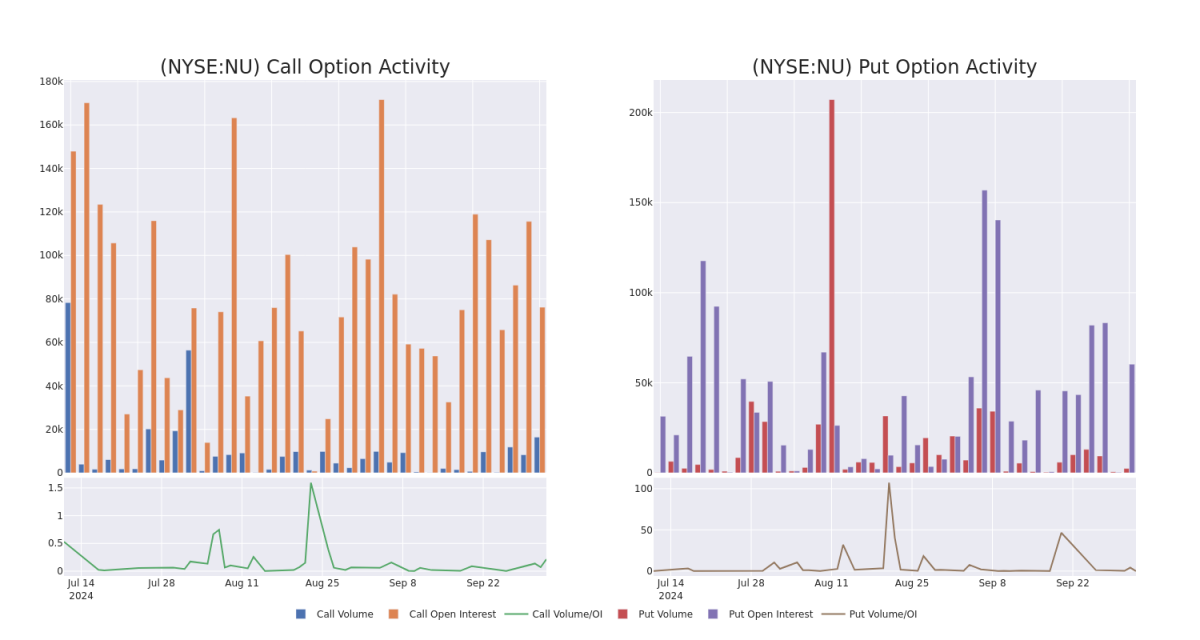

In the following chart, we are able to follow the development of volume and open interest of call and put options for Nu Holdings's big money trades within a strike price range of $7.0 to $16.0 over the last 30 days.

在下图中,我们能够跟踪Nu Holdings的大规模交易的成交量和未平仓合约的发展,涵盖了过去30天内在$7.0至$16.0的看涨和看跌期权的执行价格范围。

Nu Holdings Call and Put Volume: 30-Day Overview

Nu Holdings 看涨和看跌成交量:30天概览

Biggest Options Spotted:

最大的期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | CALL | SWEEP | BULLISH | 12/20/24 | $0.63 | $0.6 | $0.63 | $14.00 | $150.9K | 1.2K | 5.0K |

| NU | CALL | SWEEP | BULLISH | 12/20/24 | $0.64 | $0.63 | $0.63 | $14.00 | $133.3K | 1.2K | 2.6K |

| NU | CALL | SWEEP | BEARISH | 12/20/24 | $0.4 | $0.37 | $0.37 | $15.00 | $130.8K | 462 | 5.1K |

| NU | PUT | TRADE | BEARISH | 11/15/24 | $0.45 | $0.42 | $0.45 | $12.00 | $107.9K | 60.2K | 2.4K |

| NU | CALL | SWEEP | BEARISH | 12/20/24 | $0.38 | $0.37 | $0.38 | $15.00 | $59.2K | 462 | 1.6K |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NU | 看涨 | SWEEP | 看好 | 12/20/24 | $0.63 | $0.6 | $0.63 | $14.00 | $150.9K | 1.2K | 5.0K |

| NU | 看涨 | SWEEP | 看好 | 12/20/24 | $0.64 | $0.63 | $0.63 | $14.00 | $133.3K | 1.2K | 2.6K |

| NU | 看涨 | SWEEP | 看淡 | 12/20/24 | $0.4 | $0.37 | $0.37 | 15.00美元 | $130.8K | 462 | 5.1K |

| NU | 看跌 | 交易 | 看淡 | 11/15/24 | $0.45 | $0.42 | $0.45 | 12.00美元 | $107.9K | 60.2K | 2.4K |

| NU | 看涨 | SWEEP | 看淡 | 12/20/24 | $0.38 | $0.37 | $0.38 | 15.00美元 | $59.2K | 462 | 1.6K |

About Nu Holdings

关于Nu控股

Nu Holdings Ltd is engaged in providing digital banking services. It offers several financial services such as Credit cards, Personal Account, Investments, Personal Loans, Insurance, Mobile payments, Business Accounts, and Rewards. The company earns the majority of its revenue in Brazil.

Nu Holdings有限公司从事数字银行服务。它提供多种金融服务,如信用卡、个人账户、投资、个人贷款、保险、移动支付、商务账户和奖励。该公司的大部分收入来自巴西。

Nu Holdings's Current Market Status

Nu控股的当前市场状况

- Trading volume stands at 23,957,841, with NU's price down by -0.95%, positioned at $13.1.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 41 days.

- 交易量为23,957,841,NU的价格下跌了-0.95%,位于13.1美元。

- RSI指标显示该股票可能正接近超卖。

- 盈利公告预计还有41天。

Expert Opinions on Nu Holdings

关于Nu控股的专家意见

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $15.0.

在过去的一个月里,1位行业分析师分享了对这只股票的见解,提议平均目标价为$15.0。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from B of A Securities persists with their Neutral rating on Nu Holdings, maintaining a target price of $15.

20年期权交易专家揭示了他的一行图表技术,显示何时买入和卖出。复制他的交易,这些交易平均每20天获利27%。点击这里获取更多信息。* BofA证券的分析师坚持对Nu控股保持中立评级,保持目标价为$15。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期权与仅交易股票相比是一种更具风险的资产,但它们具有更高的利润潜力。认真的期权交易者通过每日学习,进出交易,跟随多个指标并密切关注市场来管理这种风险。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $7.0 and $16.0 for Nu Holdings, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $7.0 and $16.0 for Nu Holdings, spanning the last three months.