Returns On Capital Are Showing Encouraging Signs At Medprin Regenerative Medical Technologies (SZSE:301033)

Returns On Capital Are Showing Encouraging Signs At Medprin Regenerative Medical Technologies (SZSE:301033)

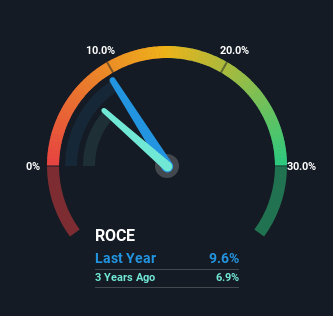

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Medprin Regenerative Medical Technologies (SZSE:301033) and its trend of ROCE, we really liked what we saw.

如果我们想要找到能够在长期内价值翻倍的股票,我们应该关注什么趋势呢?首先,我们希望看到资本回报率(ROCE)有所增长,其次,资本投入基础在扩大。这向我们表明这是一个复利机器,能够不断将其收益再投入业务并产生更高的回报。所以当我们观察了华灵生物(SZSE:301033)及其ROCE的趋势时,我们真的很喜欢我们看到的东西。

Understanding Return On Capital Employed (ROCE)

上面您可以看到蒙托克可再生能源现行ROCE与之前资本回报的比较,但过去只能知道这么多。如果您感兴趣,可以查看我们免费的蒙托克可再生能源分析师报告,了解分析师的预测。

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Medprin Regenerative Medical Technologies:

如果您不确定,ROCE是一个衡量公司在其业务中投入的资本所产生的税前收入(以百分比形式)的指标。分析师使用这个公式来计算华灵生物的ROCE:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

资产雇用回报率(ROCE)是指企业利润,即企业税前利润除以企业投入的总资本(负债加股权)。如果ROCE高于企业财务成本的承受能力,那么企业就会创造出更多的价值。

0.096 = CN¥65m ÷ (CN¥710m - CN¥35m) (Based on the trailing twelve months to June 2024).

0.096 = 6500万元人民币 ÷ (71000万元人民币 - 3500万人民币)(基于2024年6月止之过去十二个月)。

Thus, Medprin Regenerative Medical Technologies has an ROCE of 9.6%. On its own that's a low return, but compared to the average of 5.8% generated by the Medical Equipment industry, it's much better.

因此,华灵生物的ROCE为9.6%。单独看来这是一个较低的回报,但与医疗设备行业平均5.8%的回报相比,要好得多。

In the above chart we have measured Medprin Regenerative Medical Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Medprin Regenerative Medical Technologies .

在上面的图表中,我们已经测量了Medprin再生医疗技术公司以往的ROCE与其以前的业绩,但未来可能更为重要。如果您感兴趣,您可以查看我们免费的Medprin再生医疗技术公司分析师报告中的分析师预测。

So How Is Medprin Regenerative Medical Technologies' ROCE Trending?

那么Medprin再生医疗技术公司的ROCE趋势如何?

The fact that Medprin Regenerative Medical Technologies is now generating some pre-tax profits from its prior investments is very encouraging. About five years ago the company was generating losses but things have turned around because it's now earning 9.6% on its capital. Not only that, but the company is utilizing 130% more capital than before, but that's to be expected from a company trying to break into profitability. This can indicate that there's plenty of opportunities to invest capital internally and at ever higher rates, both common traits of a multi-bagger.

Medprin再生医疗技术公司现在能够从先前的投资中产生一些税前利润,这是非常令人鼓舞的。大约五年前,该公司还在亏损,但情况已经扭转,因为现在它的资本利润率达到了9.6%。不仅如此,该公司现在比以前利用的资本多了130%,但这是可以预料的,因为一家试图实现盈利的公司往往需要更多资本支持。这可能表明内部有大量投资资本的机会,并且以更高的利率投资,这都是多倍增长股的常见特征。

In Conclusion...

最后,同等资本下回报率较低的趋势通常不是我们关注创业板股票的最佳信号。由于这些发展进行良好,因此投资者不太可能表现友好。自五年前以来,该股下跌了32%。除非这些指标朝着更积极的轨迹转变,否则我们将继续寻找其他股票。

In summary, it's great to see that Medprin Regenerative Medical Technologies has managed to break into profitability and is continuing to reinvest in its business. Astute investors may have an opportunity here because the stock has declined 17% in the last three years. So researching this company further and determining whether or not these trends will continue seems justified.

总之,看到Medprin再生医疗技术公司成功实现盈利并继续在业务中进行再投资是非常好的。 精明的投资者可能在这里有机会,因为这只股票在过去三年中下跌了17%。因此,进一步研究这家公司,并确定这些趋势是否会持续似乎是合理的。

One more thing to note, we've identified 1 warning sign with Medprin Regenerative Medical Technologies and understanding this should be part of your investment process.

还有一件事需要注意,我们已经发现Medprin再生医疗技术公司有1个警示信号,了解这一点应该是您投资过程的一部分。

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

如果您想寻找财务状况良好、回报卓越的实力强企业,可以免费查看以下公司列表。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对本文有任何反馈?对内容有任何疑虑?请直接与我们联系。或者,发送电子邮件至editorial-team@simplywallst.com。

这篇文章是Simply Wall St的一般性文章。我们根据历史数据和分析师预测提供评论,只使用公正的方法论,我们的文章并不意味着提供任何金融建议。文章不构成买卖任何股票的建议,也不考虑您的目标或您的财务状况。我们的目标是带给您基本数据驱动的长期关注分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。Simply Wall St没有任何股票头寸。

0.096 = CN¥65m ÷ (CN¥710m - CN¥35m)

0.096 = CN¥65m ÷ (CN¥710m - CN¥35m)