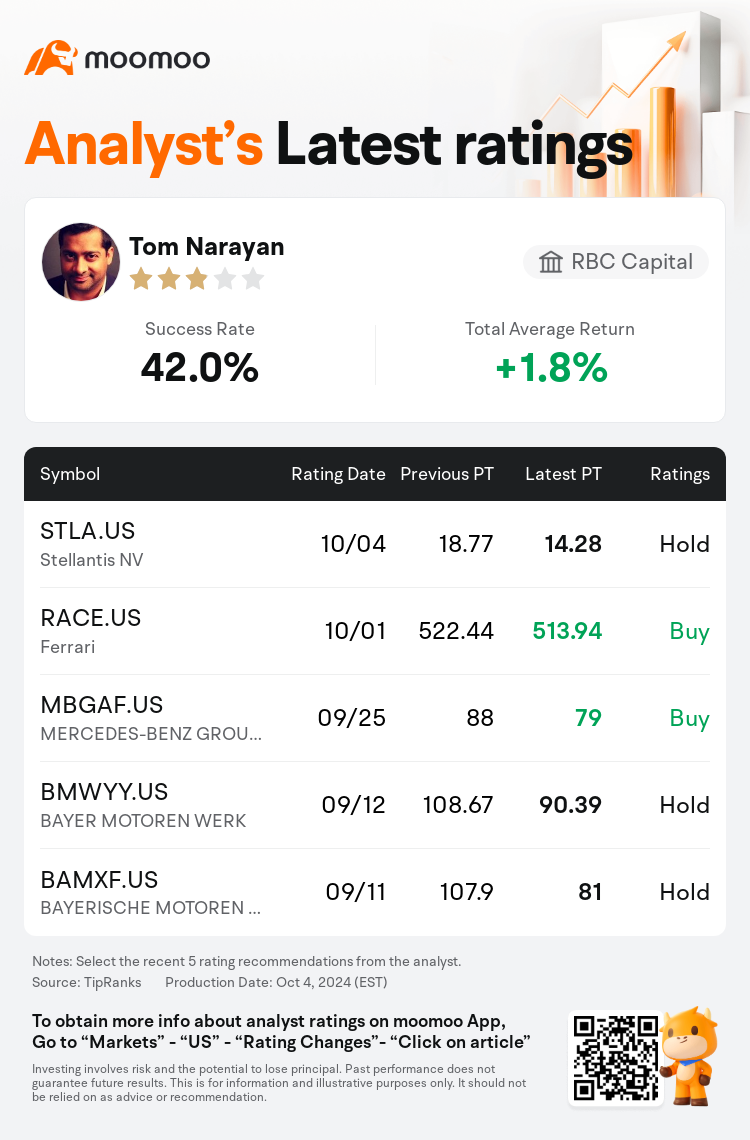

RBC Capital analyst Tom Narayan downgrades $Stellantis NV (STLA.US)$ to a hold rating, and adjusts the target price from $18.77 to $14.28.

According to TipRanks data, the analyst has a success rate of 42.0% and a total average return of 1.8% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Stellantis NV (STLA.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Stellantis NV (STLA.US)$'s main analysts recently are as follows:

Stellantis has issued a substantial profit warning, which stands out among those observed. The lack of detailed operational strategies to rejuvenate the company's sales and profitability post-2024 makes it challenging to anticipate a robust earnings recovery in 2025.

The reassessment of Stellantis' status was influenced by a delay in recognizing the company's inventory challenges in the U.S. and diminishing market shares across Europe and America. The analyst has revised EBIT estimates downwards by as much as 45% extending to the year 2026.

The revision in expectations for Stellantis followed similar actions from peers, with the extent of the guidance cut being notably unexpected. Current forecasts imply a significant yield, suggesting Stellantis may have the capacity to increase its payout ratio. While this is not factored into the immediate projections, it is highlighted as a potential positive development for the future.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

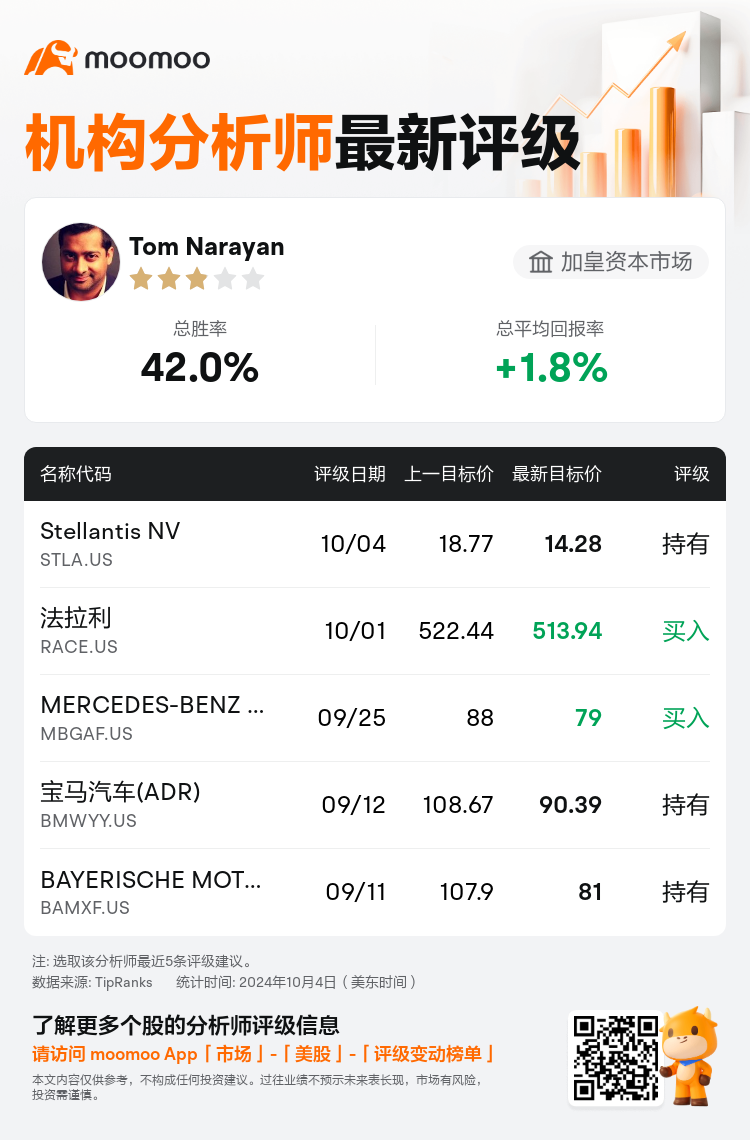

加皇资本市场分析师Tom Narayan下调$Stellantis NV (STLA.US)$至持有评级,并将目标价从18.77美元下调至14.28美元。

根据TipRanks数据显示,该分析师近一年总胜率为42.0%,总平均回报率为1.8%。

此外,综合报道,$Stellantis NV (STLA.US)$近期主要分析师观点如下:

此外,综合报道,$Stellantis NV (STLA.US)$近期主要分析师观点如下:

Stellantis已经发布了实质性的盈利警告,这在观察到的警告中尤为突出。2024年后缺乏振兴公司销售和盈利能力的详细运营战略,因此很难预测2025年盈利的强劲复苏。

对Stellantis地位的重新评估受到延迟认识该公司在美国面临的库存挑战以及欧洲和美国市场份额减少的影响。该分析师已将息税前利润估计下调了多达45%,延长至2026年。

对Stellantis的预期调整是在同行采取类似行动之后进行的,下调指引的程度明显出乎意料。目前的预测意味着收益率很高,这表明Stellantis可能有能力提高其派息率。尽管目前的预测没有考虑到这一点,但它被强调为未来潜在的积极发展。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Stellantis NV (STLA.US)$近期主要分析师观点如下:

此外,综合报道,$Stellantis NV (STLA.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of