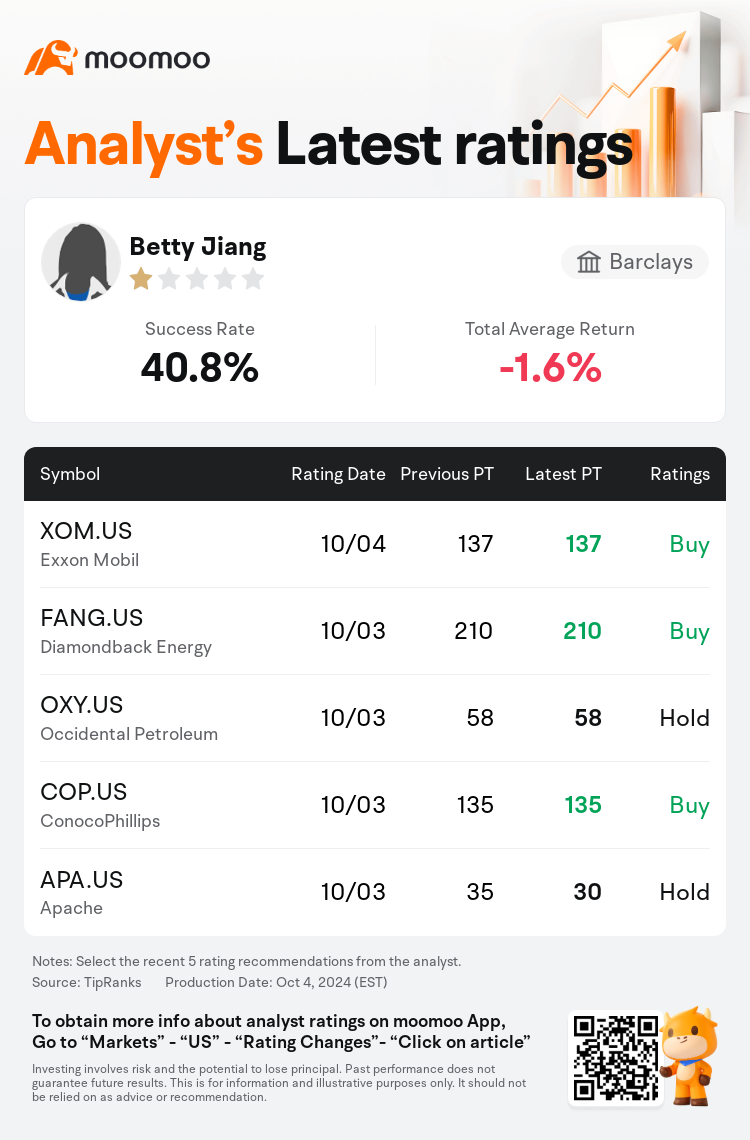

Barclays analyst Betty Jiang maintains $Diamondback Energy (FANG.US)$ with a buy rating, and maintains the target price at $210.

According to TipRanks data, the analyst has a success rate of 40.8% and a total average return of -1.6% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Diamondback Energy (FANG.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Diamondback Energy (FANG.US)$'s main analysts recently are as follows:

In a possibly challenging oil macro environment due to the anticipated reintroduction of OPEC+ barrels, Diamondback Energy is expected to perform relatively well. This outlook is based on its advantageous position at the lower end of the cost curve in the Midland Basin, which boasts dividend coverage below $45 per barrel.

Diamondback Energy is perceived to have one of the most promising sequences of positive developments in the forthcoming quarters, owing to the complete integration of Endeavor. There is an anticipation that the company will reveal a 2025 program that surpasses initial capital efficiency projections. The attractiveness of the current buying opportunity is enhanced by the stock's recent decline, which is partly attributed to the liquidity event from Endeavor sellers.

Following the completion of a significant acquisition, Diamondback Energy, alongside a major industry player, has become a leading force in the Midland Basin. This strategic move positions Diamondback as a potential long-term winner with a deep core inventory and top-tier capital efficiency. Despite a re-rating of shares, they are still considered to provide reasonable value when looking at the free cash flow yield, especially given the company's enhanced conversion rate.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

巴克莱银行分析师Betty Jiang维持$Diamondback Energy (FANG.US)$买入评级,维持目标价210美元。

根据TipRanks数据显示,该分析师近一年总胜率为40.8%,总平均回报率为-1.6%。

此外,综合报道,$Diamondback Energy (FANG.US)$近期主要分析师观点如下:

此外,综合报道,$Diamondback Energy (FANG.US)$近期主要分析师观点如下:

鉴于预期重返OPEC+产油国增加原油供应,钻石背能源有望表现相对较好。这一展望取决于其在米德兰盆地成本曲线下端拥有的优势地位,该地区的股息覆盖低于45美元每桶。

钻石背能源被认为在未来季度中有最有前途的一系列正面发展,这要归功于对恩德沃进行的完全整合。有预期称该公司将公布超出最初资本效率预期的2025计划。目前购买机会的吸引力被该股最近的下跌所增强,部分原因是恩德沃卖家的流动性事件。

完成重要收购后,钻石背能源与一家主要行业参与者一起已成为米德兰盆地的主要力量。这一战略举措使钻石背成为潜在的长期赢家,拥有丰富的核心库存和一流的资本效率。尽管股票评级有所调整,但从自由现金流产出率来看,仍然被认为提供了合理价值,尤其考虑到该公司的增强转换率。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Diamondback Energy (FANG.US)$近期主要分析师观点如下:

此外,综合报道,$Diamondback Energy (FANG.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of