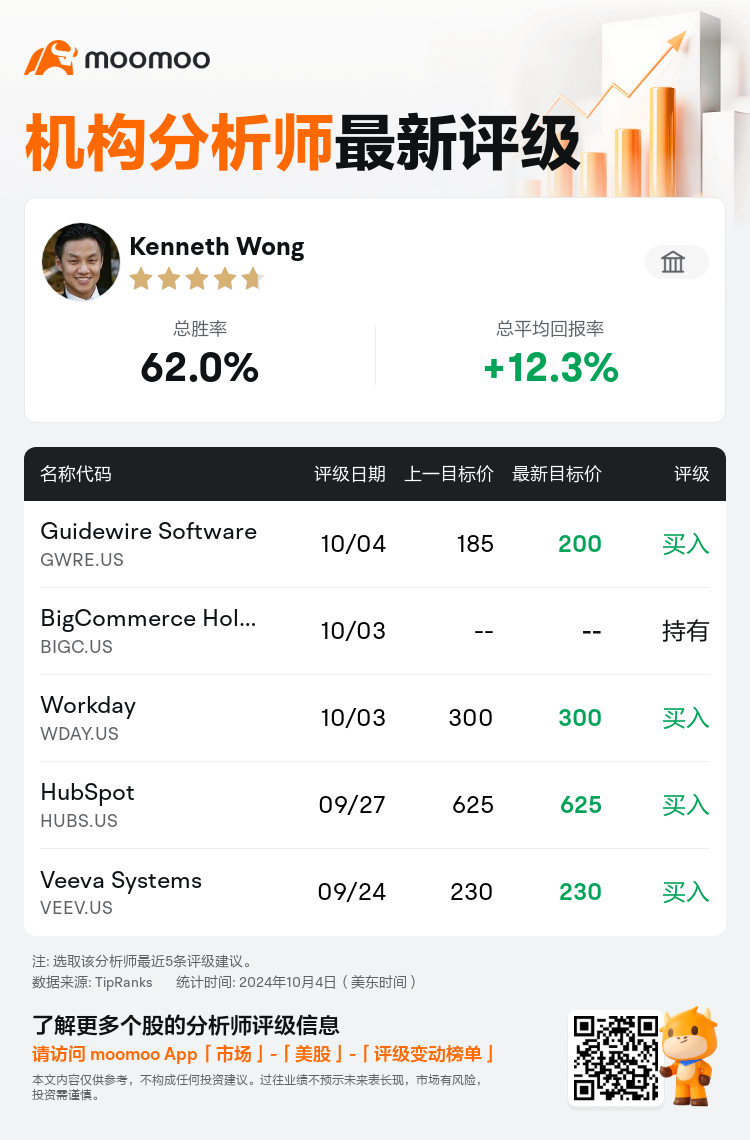

Oppenheimer analyst Kenneth Wong maintains $Guidewire Software (GWRE.US)$ with a buy rating, and adjusts the target price from $185 to $200.

According to TipRanks data, the analyst has a success rate of 62.0% and a total average return of 12.3% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Guidewire Software (GWRE.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Guidewire Software (GWRE.US)$'s main analysts recently are as follows:

The insurance industry has been categorized as 'relatively defensive' over the last year with increased premiums favorably impacting insurance software budgets. This sector is seen to benefit from both industry and company-specific tailwinds. Guidewire, in particular, is positioned to realize mid-to-high teens growth, driven by acceleration from its cloud transition and gains in market share.

In anticipation of the investor day on October 10, expectations are set for management to establish a definite timeline for achieving its annual recurring revenue goal of $1.5 billion and operating cash flow margin targets between 29% and 32%. The analyst's heightened confidence in Guidewire's long-term trajectory is cited as the rationale for the target increase.

The firm is of the opinion that Guidewire's recent analyst day may have helped outline the principal factors behind the company's recent enhancements, progress towards goals, and the long-term margin potential. This comes at a time when the investor base appears to be re-engaging. The firm also anticipates that the stock will experience a well-earned pause following the event.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

奥本海默控股分析师Kenneth Wong维持$Guidewire Software (GWRE.US)$买入评级,并将目标价从185美元上调至200美元。

根据TipRanks数据显示,该分析师近一年总胜率为62.0%,总平均回报率为12.3%。

此外,综合报道,$Guidewire Software (GWRE.US)$近期主要分析师观点如下:

此外,综合报道,$Guidewire Software (GWRE.US)$近期主要分析师观点如下:

去年,保险业被归类为 “相对防御性”,保费上涨对保险软件预算产生了有利影响。该行业被认为将受益于行业和公司特定的利好因素。特别是,在云过渡的加速和市场份额增加的推动下,Guidewire有望实现中高年龄段青少年的增长。

在10月10日投资者日的到来之际,预计管理层将制定明确的时间表,以实现其15亿美元的年度经常性收入目标和29%至32%的运营现金流利润率目标。分析师对Guidewire长期走势的信心增强,这被视为提高目标的理由。

该公司认为,Guidewire最近的分析师日可能有助于概述公司近期改进、目标进展和长期利润潜力背后的主要因素。这是在投资者基础似乎正在重新参与之际发生的。该公司还预计,该股将在事件发生后经历来之不易的暂停。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$Guidewire Software (GWRE.US)$近期主要分析师观点如下:

此外,综合报道,$Guidewire Software (GWRE.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of