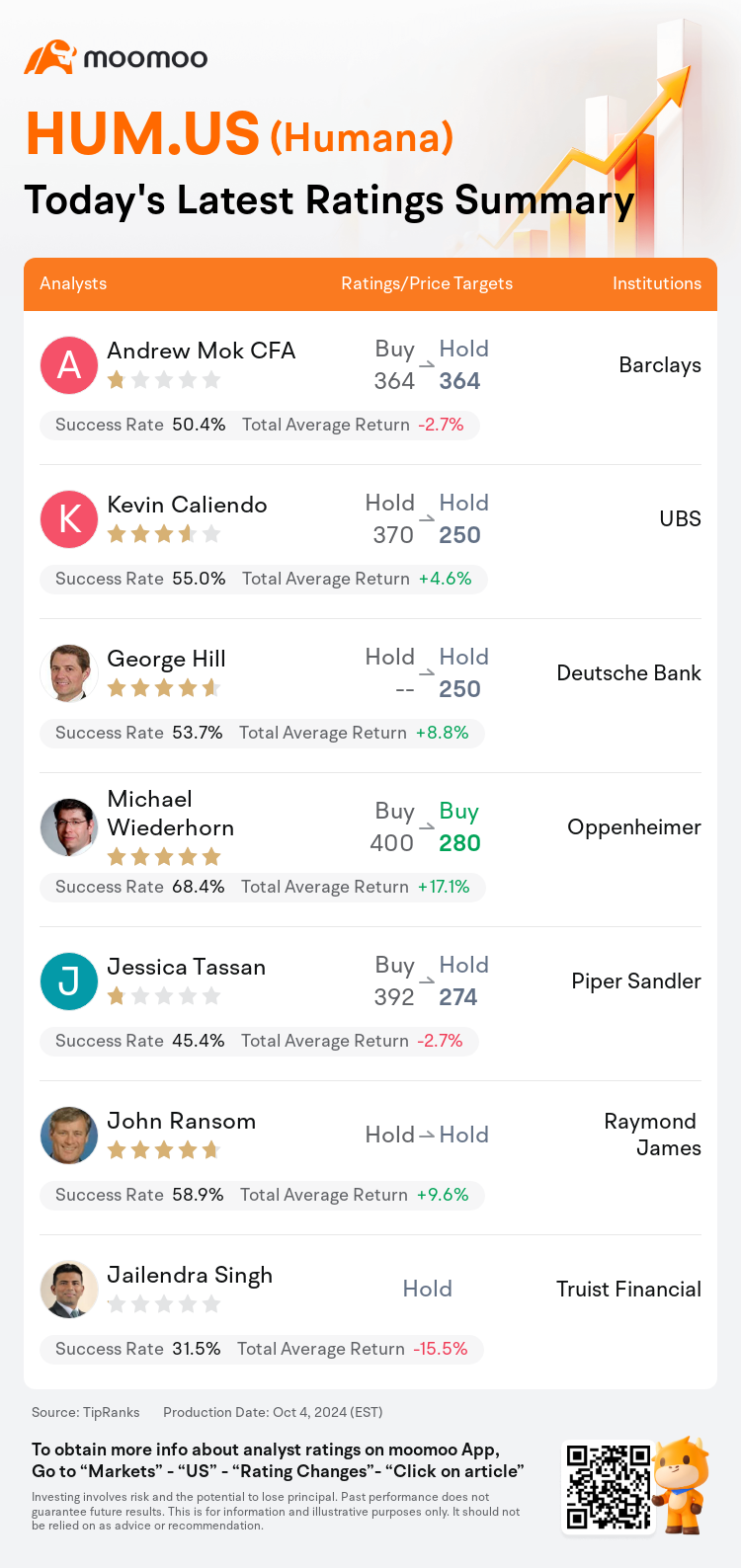

On Oct 04, major Wall Street analysts update their ratings for $Humana (HUM.US)$, with price targets ranging from $250 to $364.

Barclays analyst Andrew Mok CFA downgrades to a hold rating, and maintains the target price at $364.

UBS analyst Kevin Caliendo maintains with a hold rating, and adjusts the target price from $370 to $250.

Deutsche Bank analyst George Hill maintains with a hold rating, and sets the target price at $250.

Deutsche Bank analyst George Hill maintains with a hold rating, and sets the target price at $250.

Oppenheimer analyst Michael Wiederhorn maintains with a buy rating, and adjusts the target price from $400 to $280.

Piper Sandler analyst Jessica Tassan downgrades to a hold rating, and adjusts the target price from $392 to $274.

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

The performance of Humana is anticipated to hinge on the outcome of their appeal with CMS concerning the reported decline in the 2025 Star ratings for payment year 2026. However, it is considered 'unlikely' that a resolution will be reached before the commencement of open enrollment.

For 2025, Humana's coverage for members under bonus-qualified plans is expected to decrease to 25%, a notable reduction from the 94% coverage in 2024. This shift is seen as falling short of investor expectations and presents a considerable risk concern for the company's financial performance in 2026.

The firm has adjusted its outlook on Humana following the recent Star rating call, noting that the company is close to achieving the critical 4-Star threshold in several plans, which could be pivotal pending the outcome of an appeal. Despite potential setbacks, there's optimism around the company's ability to make a comeback next year. Humana's management is exploring various options to mitigate challenges, although it is premature to provide detailed guidance. The recent updates have cast doubt on the company's ability to meet its 3% margin goal by 2027.

Here are the latest investment ratings and price targets for $Humana (HUM.US)$ from 7 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美东时间10月4日,多家华尔街大行更新了$哈门那 (HUM.US)$的评级,目标价介于250美元至364美元。

巴克莱银行分析师Andrew Mok CFA下调至持有评级,维持目标价364美元。

瑞士银行分析师Kevin Caliendo维持持有评级,并将目标价从370美元下调至250美元。

德意志银行分析师George Hill维持持有评级,目标价250美元。

德意志银行分析师George Hill维持持有评级,目标价250美元。

奥本海默控股分析师Michael Wiederhorn维持买入评级,并将目标价从400美元下调至280美元。

派杰投资分析师Jessica Tassan下调至持有评级,并将目标价从392美元下调至274美元。

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

预计Humana的表现将取决于他们就2026年付款年度的2025年星级评级下降向CMS提出上诉的结果。但是,人们认为 “不太可能” 在公开招生开始之前达成解决方案。

到2025年,Humana对符合奖金条件的计划的会员的承保范围预计将降至25%,较2024年的94%显著下降。这种转变被认为未达到投资者的预期,并给公司2026年的财务业绩带来了相当大的风险隐患。

在最近的星级电话会议之后,该公司调整了对Humana的前景,指出该公司在多项计划中接近达到关键的四星门槛,这在上诉结果出来之前可能至关重要。尽管可能遇到挫折,但人们对该公司明年卷土重来的能力持乐观态度。Humana的管理层正在探索各种选择来缓解挑战,尽管现在提供详细指导还为时过早。最近的更新使人们对该公司到2027年实现3%的利润率目标的能力产生了怀疑。

以下为今日7位分析师对$哈门那 (HUM.US)$的最新投资评级及目标价:

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

德意志银行分析师George Hill维持持有评级,目标价250美元。

德意志银行分析师George Hill维持持有评级,目标价250美元。

Deutsche Bank analyst George Hill maintains with a hold rating, and sets the target price at $250.

Deutsche Bank analyst George Hill maintains with a hold rating, and sets the target price at $250.